Investment letters

Japan Equities - Paddling against the value current

18-Dec-2025

KEY TAKEAWAYS

- The sharp depreciation of the Japanese yen against the US dollar in recent years has boosted Japanese value stocks.1

- At Comgest, we have consistently warned that Japan’s value rally rests on fragile, cyclical drivers that could reverse quickly and leave investors exposed to downside risk.2

- From our perspective, quality growth companies armed with strong balance sheets, disciplined management, steady profit growth and a long-term vision should outlast this short-term rally.

GOING AGAINST THE VALUE FLOW

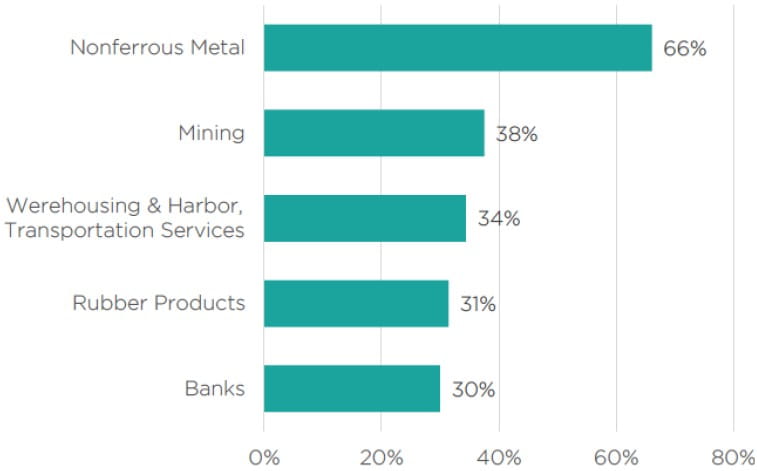

Since mid-2021, Japan’s equity market has been propelled by cyclical sectors—automobiles, commodities and banks—amid a backdrop of macroeconomic uncertainty (as shown in Figure 1). A weaker yen, coupled with escalating Sino-American geopolitical tensions, has set the stage for a rally in value stocks.3 Foreign investors, seeking both currency arbitrage and to hedge against perceived China risk, have funnelled record capital into Japanese equities, distorting traditional valuations.4

Past performance does not predict future returns. Returns may increase or decrease as a result of currency fluctuations. Source: Factset. Data as of 30-Sep-2025 expressed in local currency. Indices: Topix Growth, Topix Value, Topix. Indices are used for comparative purposes only and the Fund does not seek to replicate the indices.

Meanwhile, Japanese retail investors and institutional institutions, such as the Government Pension Investment Fund (GPIF), have abstained from this value stock surge.5 In our view, the absence of domestic investors underscores that much of the value trade is a transient phenomenon, rooted in opportunistic plays instead of thorough stock analysis. Comgest’s Japanese equities investment team deliberately refers to these companies so-called value stocks because we challenge whether they offer any value to investors. Evidence suggests that Japan’s value rally has been driven more by timing and liquidity tied to the cyclical nature of these stocks, rather than the underlying company fundamentals.6 Comgest views Japan’s value rally as a distraction from what truly matters: the competitive advantages that underpin sustainable long-term growth. Our focus is on quality companies with robust balance sheets, disciplined management, inspiring leadership teams and a historical record of consistent earnings growth. These businesses share a long-term vision and should benefit from secular trends such as productivity gains, demographic shifts and digitalisation.

RACING UPSTREAM

One clear example of quality growth in action is taking place in the sportswear industry’s race to create the world’s fastest running shoe. Since Nike’s 2017 launch of the Vaporfly 4%, a carbon-fibre plate shoe designed to maximise energy return, rivals have scrambled to match the company’s performance edge.7 Japan’s Asics, long respected for its innovation, has entered the “super shoe” race with designs aimed at shaving precious seconds off marathon times.8

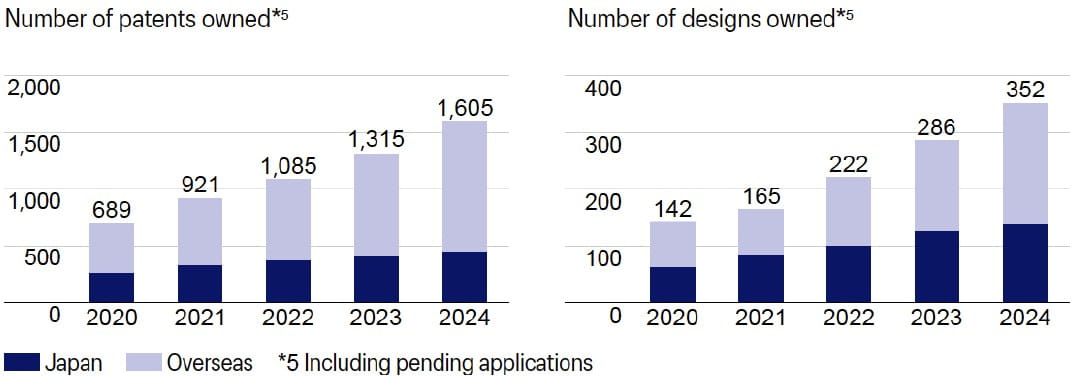

Founded in 1946 in Kobe, the company has pioneered several distance running breakthroughs, including its GEL and FlyteFoam cushioning systems.9 Today, the company is leveraging decades of research and athlete partnerships to close the gap against its sportswear rivals in the performance running category—which accounts for 60% of the Asics’s revenues.10 The company’s latest super shoe model, the Metaspeed Ray—weighing a feathery light 4.5 ounces—powered John Korir to victory at the 2025 Boston Marathon.11 As long-term growth investors, Comgest seeks innovative companies like Asics that we believe can adapt and capitalise on shifting market dynamics. Since the launch of its first “super shoe” in 2021, Asics has steadily grown its patent and design trademarks (as seen in Figure 2), underscoring how the company’s research is translating into innovation.

Source:Asics Integrated Report 2024, 18-Jul-2025

Elite success fuelling strong consumer demand has been amplified by the post-pandemic running boom. Applications for the 2026 London Marathon jumped 31% year-over-year, while the New York City Marathon reported a 22% rise over the same period.12

With the Metaspeed Ray priced at $300 and daily trainers like the Novablast and Nimbus retailing between $165 and $225, we believe that Asics should be well-positioned to sustain pricing power against smaller new market entrants.13 Beyond running, the brand has strengthened its tennis category through sponsorships with stars such as Novak Djokovic14, while its Onitsuka Tiger line taps into demand for what Comgest defines as “cool Japan”—premium lifestyle products blending heritage and style.

RIDING THE WAVE OF CHANGE

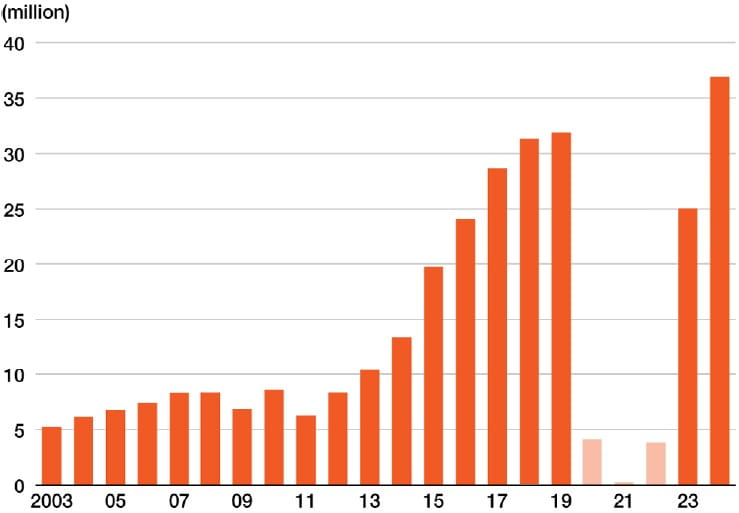

Source:Nippon and Japan National Tourism Organizaton, 16-Jan-2025.

As consumer brands like Asics become synonymous with style and innovation, international tourism has also surged in Japan. In 2024, the country welcomed a record 36.9 million visitors, up 47.1% on the previous year and eclipsing the pre-pandemic peak of 31.9 million in 2019 (as shown by Figure 3). Travellers often leave with suitcases full of Japanese staples and souvenirs, from matcha tea and puffer jackets to sake and limited-edition snacks.15

Among the most coveted tourist retail stops is Don Quijote, a discount chain offering a wide product selection spanning fresh produce, yoga mats, electronics, and sporting goods—all at competitive prices. For many tourists, Don Quijote is not just a shop, it’s a retail experience.16 Music loops on repeat, bright signs shout bargain prices and customers weave slowly through a maze of aisles packed tight with products. Don Quijote’s carnival-like atmosphere offers a unique shopping experience to all.

The brand has expanded beyond Japan into Malaysia, Taiwan and Singapore and the United States, where it operates three retail locations in Hawaii. In August 2025, it announced plans to open 250 new stores by 2035 to tap into Japan’s record-level tourism rates.17 Based on our experience, quality growth companies often sustain compounding by entering new geographies or adjacent markets18—a strategy that Pan Pacific International Holdings (PPIH), Don Quijote’s parent company has executed with patience and discipline.

Past performance does not predict future returns. Data as of 30-Sep-2025 in local currency. Base 100 = 31-Dec-2008. Source: Factset. The security discussed above is provided for information only, is subject to change and is not a recommendation to buy or sell the security.

PPIH has posted 35 consecutive years of sales and operating profit growth.19 Since December 2012, both its share price and forward 12-month EPS have trended steadily higher (see Figure 4), underscoring strong fundamentals and sustained investor confidence. For long-term investors like Comgest, that resilience over time stands out. Unlike value stocks that swing with market cycles, PPIH has delivered consistent growth for more than three decades.

DIGITALISATION: THE OAR POWERING US FORWARD

Japan’s semiconductor revival has been decades in the making. The recent surge in cloud computing and artificial intelligence has unleashed a global boom in data centres, fuelling demand for semiconductor chips. In the 1980s, Japan briefly eclipsed the US as the dominant force in chip manufacturing, with companies like NEC, Toshiba and Fujitsu leading the world in dynamic random-access memory (DRAM) chip production.20 But by the 1990s, Japanese chipmakers misjudged the rise of personal computers, clinging to legacy DRAM memory chips. Intel and other US rivals seized the moment, pivoting decisively into the microprocessors and effectively displacing Japan’s chipmakers overnight.21

Today, Japan has shifted from chip manufacturing into critical niches within the semiconductor market. Based on our research, among the most influential companies is Lasertec, a Yokohama-based specialist in inspection systems designed to safeguard the integrity of chip patterns. In an industry where microscopic defects can cost millions, Lasertec’s machines play an essential role in protecting against costly mistakes.

Founded in 1960 as Tokyo ITV Laboratory, the company shifted toward semiconductor inspection in the mid-1970s.22 In 2017, Lasertec unveiled the world’s first inspection system for extreme ultraviolet (EUV) lithography, a breakthrough that has helped the company secure a near-monopoly over this market segment. Lasertec’s machines have become indispensable to many leading chipmakers, including TSMC, to verify that their chips are fit for use.23

Lasertec typically channels 5–10% of annual revenue into R&D and counts roughly 70% of its workforce as engineers.24 At Comgest, we consider this type of reinvestment strategy to be a hallmark of the compounding companies that we seek to include in our portfolios.25 Rather than aiming for short-term gains, quality growth companies typically focus on long-term ambition. We favour businesses that treat innovation as an engine for sustainable growth. By reinvesting earnings into innovation, we believe that quality growth companies like Lasertec should stay ahead of new market entrants, widen their competitive advantages over rivals and adapt to changing market conditions.

IS THE TIDE FINALLY TURNING TO GROWTH STOCKS?

The election of Japan’s new prime minister, Sanae Takaichi, has revived debate over whether growth companies are set to reclaim leadership from the so-called value stocks. Takaichi, an Abenomics disciple—favouring ultra-low interest rates, fiscal stimulus and corporate governance reforms26—has already triggered a sharp market response. In the final two weeks of October, foreign investors poured ¥384bn (US$2.5bn) into Japanese equities, betting that Takaichi policies could reignite growth-oriented stocks after years of value dominance.27

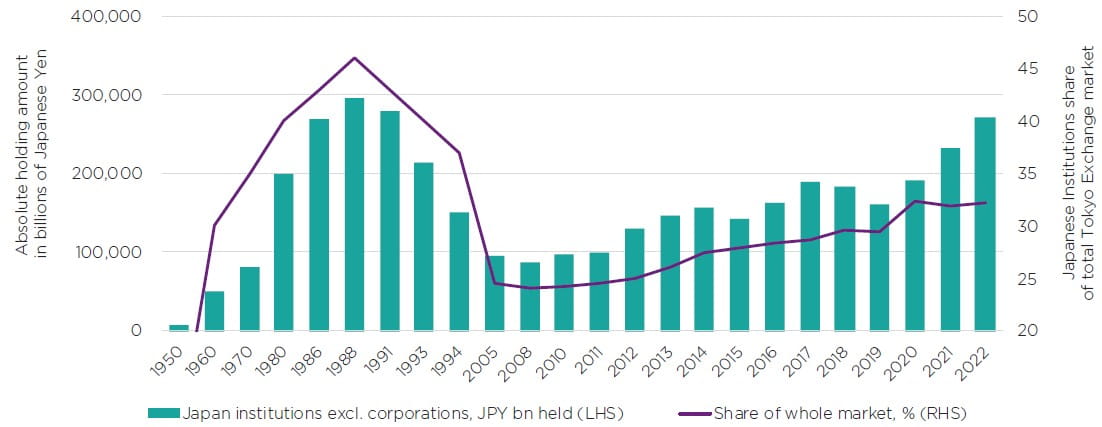

At Comgest, we avoid making these types of macro-driven investment decisions. Our focus is on fundamentals and what’s happening on the ground in Japan. More significant than Takaichi’s win, in our view, is the resurgence of Japanese domestic investors. As shown in Figure 5, Japanese financial institutions have steadily returned to the domestic market in recent years, now accounting for nearly 40% of the Tokyo Stock Exchange’s market share—signalling, in our view, renewed confidence. Based on our experience, local investors tend to favour businesses with durable returns over cyclical plays.

Source: Tokyo Stock Exchange

Our Japan Equities team is split between Paris and Tokyo, combining both global and local insights to identify quality-growth companies. We believe firms exposed to long-term structural themes, such as productivity enhancements, digitalisation, and Japan’s changing —are best placed for sustained earnings. Asics, Pan Pacific International Holdings and Lasertec exemplify our investment approach. These companies are grounded in fundamentals rather than short-term factors like the price of oil, interest rates and other short-term metrics that typically drive value stocks.

The following are the main risks relevant to the fund discussed in this presentation:

- Investing involves risk including possible loss of principal

- The value of all investments and the income derived therefrom can decrease as well as increase

- Changes in exchange rates can negatively impact both the value of your investment and the level of income received

- Emerging markets may be more volatile and less liquid than more developed markets and therefore may involve greater risks

- The portfolio invests in limited number of securities and may therefore entail higher risks than those which hold a very broad spread of investments

- A more detailed description of the risk factors that apply to the fund is set out in the prospectus

REFERENCES

1 Hunter, Gregor. “Japanese Investors Are Leaving the Reflation Trade to Foreigners.” Reuters, 3-Sep-2025.↩︎

2 For more information, read “Looking beyond Japan’s value rally” by Richard Kaye and Chantana Ward (Comgest; 2025). Please visit the “Our Thinking” page of your local Comgest website for access to this paper.↩︎

3 Riley, Brigid. “Soaring Japanese Equities Offer Investors Cozy Distance from Troubled China.” Reuters, 27-Feb-2024. ↩︎

4 Dogra, Gaurav. “Foreigners Turn Net Sellers of Japan Stocks for First Week in 12 .” Reuters, 26-Jun-2025.↩︎

5 “Japan’s $1.7 Trillion GPIF to Keep Portfolio Composition Unchanged.” CNA, 31-Mar-2025. ↩︎

6 Tan, Huileng. “Japan’s Market Surge Is Still Gaining Speed - Here’s What’s Driving It Higher.” Business Insider, 12-Sept-2025. ↩︎

7 Germano, Sara, Sam Joiner, Dan Clark, and Irene de la Torre Arenas. “Inside the Race to Make the World’s Fastest Running Shoes.” Financial Times, 30-Jul-2024. ↩︎

8 Rosen, Jonathan W. “Supershoes Are Reshaping Distance Running.” MIT Technology Review, 12-Nov-2025. ↩︎

9 “What Is FLYTEFOAMTM? Learn about the Key Technology.” ASICS. Accessed 17-Nov-2025. ↩︎

10 Asics Integrated Report 2024, 18-Jul-2025↩︎

11 Ball, Ali. “Asics Unleashes Its Lightest Carbon Shoe yet — the All-New Metaspeed Ray.” Runner’s World, 2-May-2025. ↩︎

12 Stacey, Stephanie. “Strava Plots Wall Street Debut as Running Boom Boosts Fitness App.” Financial Times, 13-Oct-2025. ↩︎

13 Asics retail website, 17-Dec-2025↩︎

14 “Asics Honors Novak Djokovic as He Achieves the Career Golden Slam.” ASICS Global, 5-Aug-2024.↩︎

15 Alphonso, Sharon. “Things to Buy in Japan: GO Shopping like a Local in the Land of the Rising Sun.” Souvenir Shopping in Japan? Don’t Miss These Winter Must-Buys,” 9-Oct-2025. ↩︎

16 Kazuki, Tanigashira. “Donki Devotion: How Don Quijote Stores Became Such a Hit with Visitors to Japan.” Nippon, 8-Jul-2025. ↩︎

17 “Don Quijote Operator Plans 250 New Stores in Tourism Bet.” The Japan Times, 19-Aug-2025. ↩︎

18 Fickus, Wolfgang. “How marathon runners can go the distance,” 1-Apr-2025.↩︎

19 Pan Pacific International Holdings. Pan Pacific International Holdings Corporation Results for FY24, 16-Aug-2024.↩︎

20 Echter, Adam, Bhavin Manjee, and Rohit Mathew. “The 1980s – Global Expansion and the Rise of Strategic Pricing.” Simon Kucher, 25-Apr-2025. ↩︎

21 Miller, Chris. Chip War: The Fight for the World’s Most Critical Technology. New York, N.Y: Simon & Schuster, 2022.↩︎

22 Lasertec Corporation. “Lasertec - Milestones.” Lasertec Corporation. Accessed16-Nov-2025. ↩︎

23 Negishi, Mayumi. “Lasertec Shares Jump After Nvidia Fuels AI Chip Spending Hopes.” Bloomberg, 31-Oct-2025. ↩︎

24 “Corporate Strategy.” Lasertec Corporation. Accessed 16-Nov-2025.↩︎

25 For more information, read “How Marathon Runners Can Go the Distance” by Wolfgang Fickus (Comgest; 2025). Please visit the “Our Thinking” page of your local Comgest website for access to this paper.↩︎↩︎

26 “Abenomics: How Shinzo Abe Aimed to Revitalise Japan’s Economy.” BBC News, 8-Jul-2022. ↩︎

27 “US Investors Flock to Japanese Equities amid Nikkei’s Outsized Returns.” South China Morning Post, 10-Nov-2025.↩︎

FOR PROFESSIONAL INVESTORS ONLY

Important Information

This document has been prepared solely for professional/qualified investors and may be used only by such persons.

Not investment advice

This commentary is for informational purposes only and does not constitute investment advice or a solicitation to buy or sell any security. It does not take into account any investor’s specific investment objectives, strategies, tax status, or investment horizon, and should be read in conjunction with an oral briefing provided by Comgest representatives.

Not an investment recommendation

Any discussion of specific companies does not constitute a recommendation to buy or sell any particular security or investment. The companies mentioned do not represent all past investments, and it should not be assumed that any discussed investments were or will be profitable.

Comgest does not provide tax or legal advice to its clients, and all investors should consult their own tax or legal advisors regarding any potential investment.

Not investment research

The information contained in this communication does not constitute ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MiFID II. This means that (a) it has not been prepared in accordance with the legal requirements designed to promote the independence of investment research, and (b) it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Performance disclaimer

Past performance is not a reliable indicator of future results. Forward-looking statements, data or forecasts are based on assumptions and judgments by Comgest and the Strategy regarding future economic and market conditions, which are inherently uncertain and beyond the control of Comgest or the Strategy. Actual outcomes may differ materially, and unforeseen events may significantly affect performance. Accordingly, no reliance should be placed on such statements as a guarantee that the Strategy will achieve its objectives or plans.

Trademark and index disclaimer

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners.

S&P Dow Jones Indices LLC ("SPDJI"). S&P is a registered trademark of S&P Global ("S&P"); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones"). These trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Comgest. Comgest's fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones and S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in the fund nor do they have any liability for any errors, omissions, or interruptions of the index.

Information provided subject to change without notice

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

Restrictions on use of information

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest's prior written consent.

Limitation of Liability

Certain information contained in this commentary has been obtained from sources believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Comgest accepts no liability for any errors or omissions in the information provided.

Legal entity disclosure

Comgest S.A. is regulated by the Autorité des Marchés Financiers (AMF). Comgest Asset Management International Limited is regulated by the Central Bank of Ireland and the U.S. Securities and Exchange Commission (SEC). Comgest US LLC is regulated by the SEC. Regulation by the SEC does not imply a certain level of skill or training. Comgest Asset Management Japan Ltd. is regulated by the Financial Services Agency of Japan (registered with the Kanto Local Finance Bureau, No. Kinsho 1696). Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission. Comgest Singapore Pte. Ltd. is a Licensed Fund Management Company and Exempt Financial Adviser (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

For UK only:

This commentary has not been approved under section 21 of the Financial Services and Markets Act 2000 (FSMA) by an person authorised. It is directed only at investment professionals as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). Investments are available only to to such persons, and any related agreement will be made solely with them. Persons who are not investment professionals should not rely or act upon this commentary. Recipients must observe all applicable restrictions and must not publish, distribute or share this commentary in whole or in part.