You are visiting Finland

If this is incorrect,

12-Mar-2025

Source: Getty Images

Source: Getty Images

In 1848, Swiss-German settler John Sutter struck gold in Sacramento, California, sparking a frenzy of fortune hunters and the start of the California Gold Rush. By 1852, approximately 300,000 people, including industrialists, engineers and explorers, had migrated to California to cash in.1

Today, a similar surge of commercial interest in AI and large-language models has captivated global markets. Recent advancements in AI have been driven by huge gains in computing power, thanks to improvements in computer chips and technology. Companies around the world are racing to integrate AI into their business models to boost efficiency, reduce costs and drive innovation.

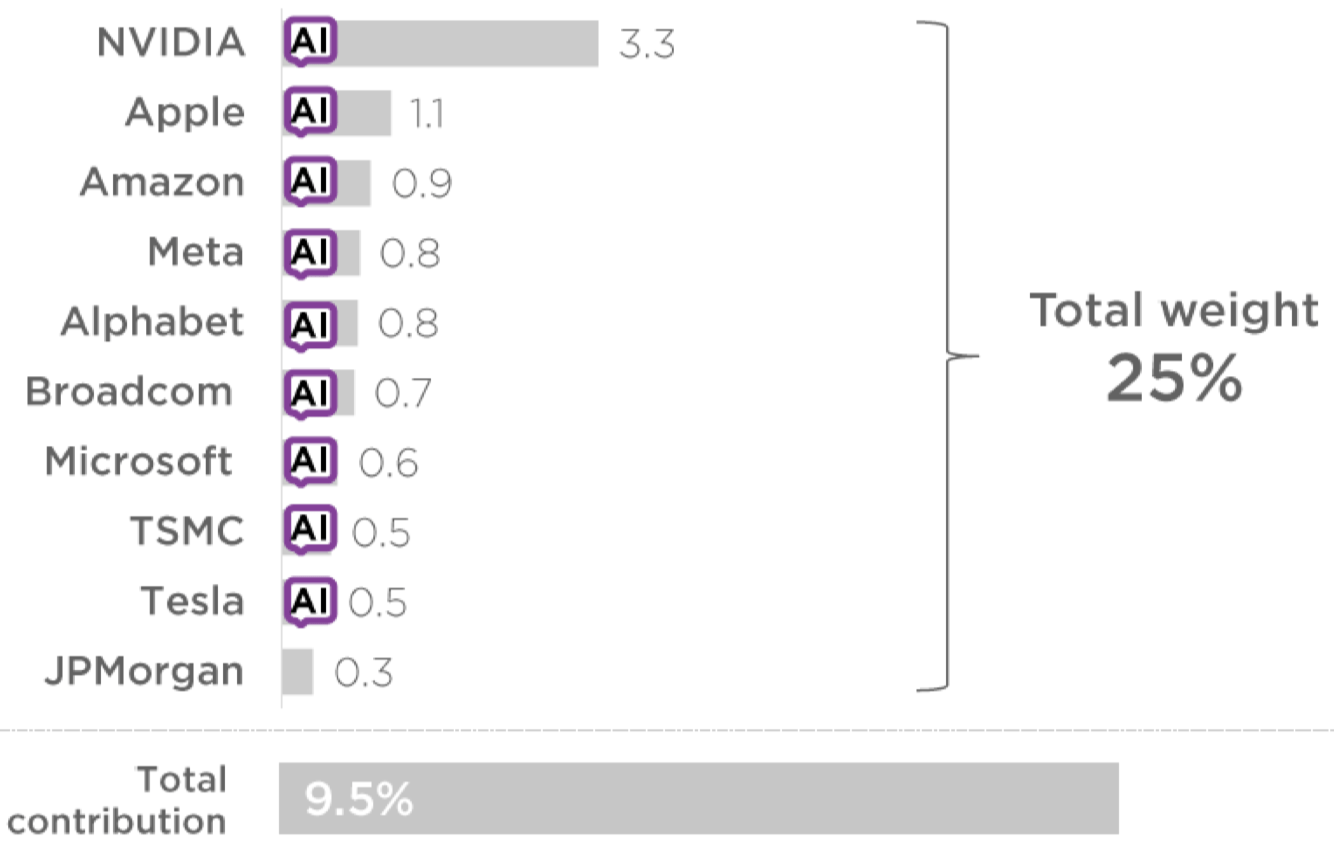

As with gold in the 19th century, AI is quickly becoming a strategic resource for companies and governments alike. Geopolitical, military and economic power is becoming more closely associated with computer chips, semiconductor manufacturing and the AI supply chain.2Investor enthusiasm for AI stocks has followed suit. In recent years, the global stock market has become increasingly concentrated in just handful of AI stocks. Eight out of the top ten contributors to the MSCI AC World Index (MSCI ACWI) in 2024 were American AI-related stocks, as shown in figure 1. As active stock pickers, Comgest believes that this concentration in AI-related stocks raises concerns about diversification and the longterm earnings potential of these leading stocks.

Source: Comgest/FactSet financial data and analytics, unless otherwise stated. Data as of 31-Dec-2024 expressed in USD.

Our Comgest Global Equity strategy focuses on identifying companies that command significant market share across a wide variety of sectors, including healthcare and critical data services. We look beyond indices and aim to construct our portfolio with companies that can potentially exhibit robust competitive advantages, formidable barriers to entry and substantial pricing power. Based on our experience, these attributes can position a company to achieve sustainable earnings growth over the long term.

The California Gold Rush and the AI boom share several similarities, both sparking waves of fear and opportunity. Oftentimes romanticised through tales of the “forty niners”, the Gold Rush saw adventurers from across the globe flock to California in search of gold. However, the true drivers of the Gold Rush—its supply chain and economies of scale, including trains, wagons, ports and hydraulic mining machines—are often overlooked.

Without essential tools like shovels and pickaxes, the Gold Rush might never have happened.

Similarly, in the AI gold rush, we believe that there has been a tendency to focus on end-products rather than the various stages of the global AI value chain (as shown in figure 2). Just as shovels and pickaxes were used to pan for gold, chip manufacturers, data centres and developers are crucial to the creation of AI models. Given this, we tend to avoid those sections of the AI value chain where companies are racing to dominate a small market segment. From our perspective, the ultimate winners in these sections of the market are unclear due to the rapid innovation and disruption across the industry. This includes foundational models, pioneered by OpenAI, and quickly followed up by start-ups like DeepSeek, Mistral and Anthropic. These companies represent only a small portion of the overall AI market. At the same time, large incumbent software companies that are investing in AI potentially risk being disrupted by these younger companies. At this stage, we believe that it’s still too early to determine whether one AI model or several will emerge as the leader in the future.

Source: Comgest

Comgest’s Global Equity strategy first invested in Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest chip manufacturer, back in 2007 as the race to create smaller, more sophisticated computer chips was picking up at a rapid pace. TSMC, since its creation in 1987, has focused on manufacturing chips designed by developers like Apple. This targeted foundry business model has enabled TSMC to establish strong ties with chip designers, cut costs, optimise their production process and gain market share.

The capital expenditure and technology required to manufacture the most-advanced generation of chips have become formidable barriers for new entrants attempting to displace TSMC's market lead. Today, TSMC manufactures most of the world’s leading-edge chips to run AI workloads, including those designed by Nvidia, Arm and Broadcom.3

Despite these escalating demands, TSMC's extensive foundry operations have consistently generated positive cash flow, which has enabled reinvestment and organic growth.

As data proliferates globally, Microsoft is positioned to provide services across the AI value chain, including supporting businesses with frontend applications and back-office infrastructure.4Microsoft’s extensive portfolio, including productivity tools, IT networks, gaming and virtual reality, has fostered long-term client relationships.5

With Azure, the company’s cloud computing platform, Microsoft provides customers with the required suite of cloud services products and network of data centres to develop and run AI applications.6The AI infrastructure space is very consolidated with three dominant hyperscalers7, including Microsoft, Amazon and Alphabet (the parent company of Google).

Microsoft has taken steps to integrate advanced models into its software and cloud services, particularly through its partnership with OpenAI.8As of January 2025, Azure achieved 31% year-over-year revenue growth, with AI services marking a 157% year-over-year increase.4Due to the substantial capital expenditures by hyperscalers in data centres, there is short-term uncertainty regarding their return on capital. However, we believe that growth and returns will potentially be significant over the long term given the industry’s high barriers to entry.

The surge in AI development has increased the demand for high-quality data, as incomplete or inaccurate data can lead to costly AI malfunctions or hallucinations.9Intuit, which specialises in tax and financial software is using AI advancements to further refine its products.10TurboTax, the company’s flagship tax preparation software, has become a staple for both retail and professional clients in the United States.11

While Intuit is not among the AI infrastructure companies featured in our strategy, the company possesses a competitive advantage in the AI gold rush: decades of quality data.12There are several startups in the software developer space, but legacy developers like Intuit have established barriers to entry rooted in long-standing customer relationships and extensive repositories of quality data.13

Comgest aims to look beyond the buzz associated with the AI gold rush. As AI technology becomes more readily available, we believe that there will be fewer distinctions between foundational models. Therefore, we aim to focus on the companies that resemble the shovels and pickaxes of the last Gold Rush: the manufacturers.

Although our Comgest Global Equity strategy includes a selection of AI stocks, we are not limited to any single theme, sector or geography. We recognise that AI is still evolving, and much of its potential has yet to be realised. Given the cyclical nature of AI investments and current stock market concentration, we prefer to invest in what we consider to be quality growth companies across a variety of sectors, such as healthcare and critical data services with visibility over the long-term. Drawing on nearly 40 years of investing experience, our objective is to construct resilient portfolios capable of delivering sustainable, long-term earnings growth, regardless of market conditions.

1 “California as I Saw It: First-Person Narratives of California’s Early Years, 1849 to 1900.” The Library of Congress. Accessed 12-Feb-2025.↩︎

2 Miller, Chirs. Chip War: The fight for the world’s most critical technology. New York, New York: Scribner, 2022.↩︎

3 TSMC 2023 Annual Report↩︎

4 Microsoft 2024 Annual Report↩︎

5 Microsoft 2024 Annual Report↩︎

6 Sweetman, Steve. “Announcing a New OpenAI Feature for Developers on Azure: Blog Azure: Microsoft Azure.”Blog Azure, 7-Aug-2024.↩︎

7 Hyperscalers are large-scale data centres, supported by leading technology companies, that provide customers with access to cloud computing services and infrastructure.↩︎

8 Microsoft 2024 Annual Report↩︎

9 Weise, Karen, and Cade Metz. “When A.I. Chatbots Hallucinate.” The New York Times, 1-May-2023.↩︎

10 “Our Strategy.” Intuit. Accessed 7-Mar-2025.↩︎

11 Yuk, Pan Kwan. “AI Boom Can Even Work on Your Taxes.” Financial Times, 22-Apr-2024.↩︎

12 Peel, Michael. “The Problem of ‘Model Collapse’: How a Lack of Human Data Limits AI Progress.” Financial Times, 24-Jul-2024.↩︎

13 Melendez, Steven. “In the AI Era, Data Is Gold. and These Companies Are Striking It Rich.” Fast Company, 1-Jul-2024.↩︎

This document has been prepared for professional/qualified investors only and may only be used by these investors.

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon.

No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance is not a reliable indicator of future results. Forward looking statements, data or forecasts may not be realised.

MSCI data may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information.

MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.mscibarra.com).

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest’s prior written consent.

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Its registered office is at 46 St. Stephen’s Green, Dublin 2, Ireland.

Comgest US L.L.C is registered as an Investment Adviser with the U.S. Securities and Exchange Commission.

Comgest Singapore Pte Ltd, is a Licensed Fund Management Company & Exempt Financial Advisor (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

The investment professionals listed in this document are employed either by Comgest S.A., Comgest Asset Management International Limited, Comgest Far East Limited, Comgest Asset Management Japan Ltd. or Comgest Singapore Pte. Ltd.

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).