Investment letters

Why attention matters in the age of distraction

12-Jan-2026

Key Takeaways

- In our view, attention scarcity has reshaped both society and markets, eroding deep thinking while driving investors toward shorter horizons, herd behaviour and concentration risk.

- Based on our experience, long-term investing demands resisting noise and anchoring decisions in fundamentals, which is why Comgest grounds its approach in bottom-up research, historical earnings and resilient moats.

- In an age of distraction, we believe that Comgest’s culture of curiosity, candour and long-term focus remains our defining advantage, enabling sustained conviction in quality growth.

WHEN ATTENTION BECOMES SCARCE

“In today's information-flooded world, the scarcest resource is not ideas or even talent: it's attention.”

– Thomas Davenport and John C. Beck (2001).1

When was the last time you read something all the way through without checking your phone? In a world saturated with information, that question has become harder to answer in recent years. Research suggests that global attention spans are shrinking rapidly.2 Professor Gloria Mark of the University of California, Irvine estimates that people spend an average of forty-seven seconds staring at a given screen today, compared to two and a half minutes in 2004.3 Smartphones, social media algorithms, artificial intelligence (AI) and the constant availability of information online have diminished our ability to concentrate, and ultimately, to think.

Back in 2001, business school professors Thomas Davenport and John C. Beck coined the term “attention economy” to capture the relationship between the availability of information and an organisation’s capacity to focus on essential tasks. In an information-flooded world, they argued, “the scarcest resource is not ideas or even talent: it's attention.” Two decades later, the “attention economy” has been reshaped by social media platforms and algorithms that prize brevity and visual aesthetics over accuracy and analysis. Today, the battle for attention is being waged in eight-second bursts on applications like Instagram and TikTok—designed for endless scrolling.

Sadly, it seems these days that anything outside of these parameters (yes, even this investment letter) is less likely to capture the attention of people. Contrary to popular belief, this phenomenon is not something limited to our children or the next generation. Average literacy and numeracy proficiency among adults has stagnated or declined across major developed economies, according to the Organisation for Economic Cooperation and Development.4 Besides ageing populations and rising immigration, Andreas Schleicher, director for education and skills at the OECD, believes that technology, especially short-form social media posts, has weakened the advanced literary skills needed to judge evidence, handle ambiguity and distinguish fact from opinion.5

How does this relate to investing? We think the growing attention deficit has bubbled into financial markets and investor decision-making. For instance, the average holding period for stocks has declined from eight years in 1960 to just six months in 2025.6 This stands in stark contrast to Comgest’s approach, where our average holding period is above five years and our preference is to hold our stocks forever.

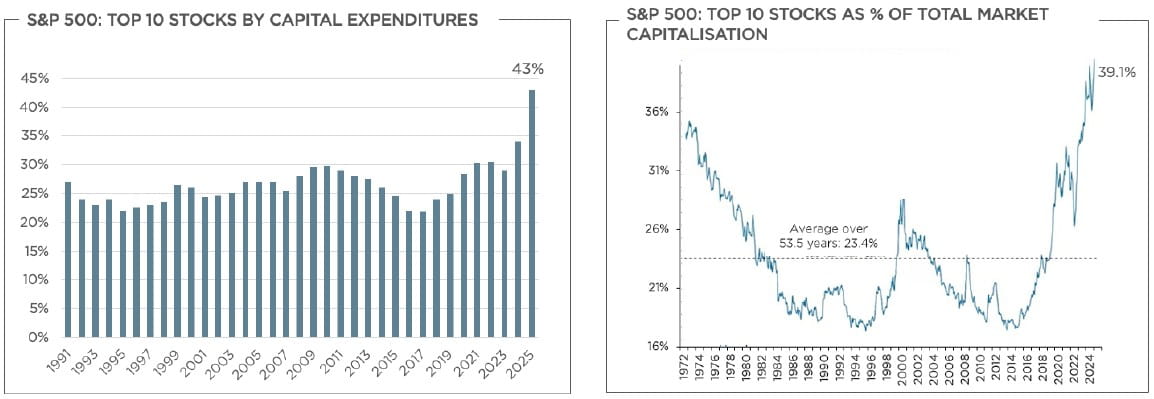

In our view, the prevalence of this short-term mindset has tilted markets towards a narrow set of stocks, especially the S&P 500, which is experiencing concentration levels not seen in over a half century (as shown in Figure 1).7 From our perspective, there is an excessive focus in the asset management industry to meet short-term performance targets and outperform benchmarks over a quarterly and annual basis at the cost of true long-term investment.

Meanwhile, retail investing flows have surged by around 50% between 2023 and 2025, reshaping markets and fuelling phenomena such as meme stocks.8 We believe that this behaviour reflects short-term momentum chasing and herd behaviour rather than patient, long-term value creation. From our perspective, the parallel expansion of passive investing—from 1% of assets in the early 1990s to over 50% today—has also contributed to market concentration and inflated valuations by ignoring company fundamentals.9 Together, we believe these forces have reinforced a short-term, momentum-driven cycle that stands in contrast to our active focus on identifying high-quality businesses that we believe have the potential to deliver sustainable long-term growth for clients.

Source: Left: Comgest, BAIRD, Bloomberg, as of 30-Jun-2025; Right: Ned Davis Research, FT as of 30-Jun-2025.

At Comgest, we seek to avoid sweeping conclusions, particularly when it comes to AI. In today’s markets, however, it’s hard to miss the current euphoria. Companies across almost every sector are issuing press releases and communications trumpeting “AI-powered” innovation, from German breweries to pet facial recognition software companies and almost everything in between. According to FactSet, AI was mentioned on 306 earnings calls during Q4 2025 across the S&P 500.10

This exuberance has helped propel parts of the US technology sector to record valuations.11 In such an environment, it is tempting to treat all AI-related companies as part of the same trade. Some investors appear convinced that AI will transform every industry, while others treat it as a trend built on shaky foundations. Meanwhile, the increasing concentration within global indices has encouraged both passive and retail flows into a small number of large-cap winners (especially US tech stocks), which has reinforced momentum behind the biggest contributors.

Despite the enthusiasm and excitement surrounding AI, our investment philosophy and approach to company research remains unchanged. As active investors, we do not paint all AI-related developments with the same brush. Instead, we focus on bottom-up, fundamental analysis to discern between AI-related offerings that can sustain long-term earnings growth and those more likely to fade once the excitement subsides. As with any new addition to our investment universe, we aim to see how a company aligns with our quality growth investment approach.

Aside from AI exuberance, higher yields, increased liquidity and currency moves have served as a tailwind for lower-quality and value stocks. Commodities and financial companies have largely benefitted from this value rally. From our perspective, this has created an opportunity for quality growth stocks which have become more attractively valued over the same period.12 Given their predictable earnings growth and low debt levels, we believe that quality growth companies can offer investors stable returns over the long term, regardless of what happens with AI or market cycles.

CLARITY THROUGH FUNDAMENTALS

At Comgest, we are not luddites suspicious of technological progress, nor monks stashed away in towers far removed from society when it comes to investing. We use technology daily: communicating via smartphones, building financial models, applying AI to support our investment research process and staying abreast of market developments. However, the engine that drives our investment philosophy is—and always has been—fundamental company research. For years, our investment team has taken quiet pride in working in offices without televisions blaring the latest Bloomberg market update or CNN newsflash. In an age of relentless connectivity, this may seem antiquated.

Instead, we would rather be the friend who leaves a message on read13 than the one who rushes with an immediate reply. It’s not that we have nothing to say, nor that we are avoiding your message. Our pause is deliberate. We take the time to consider our options carefully before acting. We believe that thoughtful investment demands patience, reflection and a rigorous evaluation of alternatives. Markets can be swayed by sentiment, but we prefer to focus on what can be assessed. In our view, high-quality companies with sound fundamentals and visible earnings often prove more resilient across cycles.

We analyse investment opportunities on an individual company basis. Our bottom-up research targets companies with durable, visible earnings streams—supported by strong fundamentals, structural growth drivers and the ability to sustain returns above the cost of capital—rather than sector or market forecasts.

For us, the name of the game is a company's ability to maintain high levels of profitability and predictable earnings across multiple cycles, often based on recurring revenue streams or long-term contracts. We search for moats or competitive advantages that can sustain excess returns far beyond typical market expectations (as shown in figure 2). We identify such businesses through high barriers to entry, such as brand positioning, patents and high switching costs. We also look for strong balance sheets, high free cash flow conversion and conservative capital allocation. Based on our experience, market inefficiencies, like horizon myopia and narrative-driven trades, often leave long-duration growth mispriced.

A TALE AS OLD AS TIME

Mark Twain’s adage that “history doesn’t repeat itself, but it rhymes” is probably one of the most cited by investors for good reason. Today’s market concentration in AI has evoked comparisons with past speculative bubbles—from the Dutch Tulip Mania in the 17th century to the dot-com bubble in the early 2000s. As long-term investors, we take a balanced view when it comes to AI.

We believe that the ultimate AI winners remain unclear due to the rapid pace of innovation and disruption taking place across the industry. The competition among foundational models illustrates this uncertainty. Since OpenAI’s release of ChatGPT, a wave of challengers, including DeepSeek, Mistral and Anthropic, has arrived on the scene with each seeking to establish a foothold. Together these models account for only a small share of the broader AI ecosystem, yet their fast-moving progress makes it challenging to predict who will dominate the market in five to ten years. At the same time, large incumbent software companies that are investing in AI potentially risk being disrupted by these younger new entrants. Therefore, at this stage, we believe it’s too early to determine whether AI leadership will ultimately rest with a single model or be shared by several models.

More broadly, our expectations for the AI market’s trajectory remain measured. While rising data-centre investment, soaring demand for computing power and widening use cases suggest AI’s momentum may endure, potential limitations—overcapacity, reduced funding, slower adoption and technological setbacks—could just as easily cool today’s expectations and optimism.

The renewed focus on market concentration has revived old debates around diversification and time horizons. For Comgest, we believe that past episodes of exuberance merely underscore the merits of owning companies with durable earnings power and defensible moats. Having successfully navigated through past cycles, such as the dot-com bubble and the COVID-19 pandemic, we prefer to back the enablers of technological shifts rather than more speculative frontrunners.

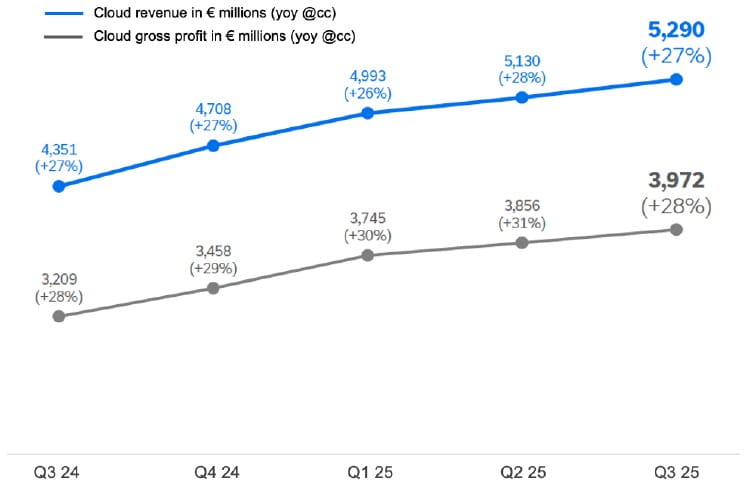

In the age of AI, that means that we prefer to back companies like TSMC, a linchpin of the global semiconductor supply chain, and SAP, whose deeply embedded enterprise resource planning (ERP) systems generate reliable cash flows and provide access to deep pools of operational data—a crucial ingredient for the next wave of AI-powered optimisation. The results speak for themselves. In 2024, SAP’s cloud revenue rose 25% year-on-year, driven by a 33% increase in ERP contributions.14 That trajectory has remained strong into 2025, with Q3 results showing a 22% rise in overall cloud revenue and a 23% increase in cloud backlog, now totalling €18.8 billion (see figure 3).15

Source: SAP, Third Quarter 2025 results, 22-Oct-2025.

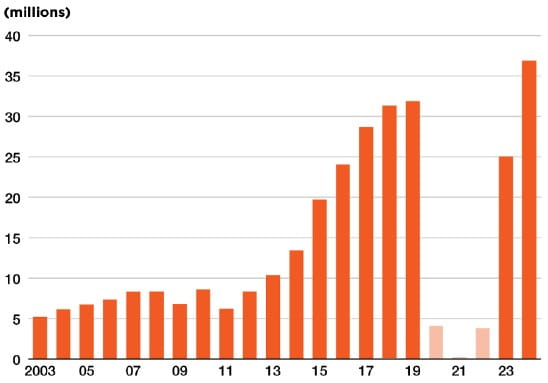

Structural and company-specific growth drivers and fundamentals matter more to us than sector labels. Quality growth is not confined to technology giants but can be found in sometimes overlooked corners of the global economy. For instance, Japan’s Pan Pacific International Holdings (PPIH), operator of the Don Quijote discount chain, has delivered more than three decades of uninterrupted sales and operating profit growth. PPIH’s growth trajectory has been supported by rising inbound Japanese tourism (see figure 4) and a retail format that blends low prices with a uniquely immersive shopping experience.16 PPIH’s gradual expansion into new geographies and adjacent markets illustrates the compounding potential that we seek. As long-term investors, businesses prove their resilience to us through consistent execution over time—not cyclical rebounds.

In Brazil, engine maker WEG offers a similar blueprint for growth. What began as a small electric-motor manufacturer has evolved into a global industrial champion. Over the years, WEG has been aided by vertical integration and a disciplined programme of bolt-on acquisitions across energy generation, transmission, storage, and electric vehicle infrastructure. By converting the weaknesses of Brazil’s supply chain into a competitive advantage, WEG has built a diversified platform that now derives most of its growth from international markets.

Source:Nippon and Japan National Tourism Organizaton, 16-Jan-2025.

Within the United States, but far from the shadow of Silicon Valley, we have found several companies that fit our quality growth investment framework. One such business is Cintas, a century-old, Cincinnati-based group, whose origins lie in the reselling of cleaned industrial towels following the Great Depression, that has since evolved into the US market leader in uniform rental services, with an approximately 40% market share.17 Over the years, Cintas has expanded into adjacent areas such as facility services and safety products. We believe the company’s scale, dense distribution network and decentralised operating model constitute durable competitive advantages. Together, these support structurally attractive margins, resilient cash generation and continued market share gains.

For Comgest, these companies underscore a truth that is often lost during periods of market concentration: enduring value is created not by chasing fashionable short-term trends but by staying focused on businesses capable of compounding earnings over decades. Whether in technology, healthcare, construction or software, our goal is to identify companies with durable, visible long-term earnings growth. Anything less would distract us from what truly matters: delivering long-term value to our clients.

DARE TO BE DISCIPLINED AND STAY THE COURSE

If you’re still reading, you have made it to the section that matters most: our culture. Persistency pays off to those who stay the course and discover what others miss.

In a world that increasingly rewards instant reactions over deliberation, we believe our unrelenting focus on quality growth is an increasingly scarce asset. This essential ingredient is woven into Comgest’s partnership and company culture, and as shown throughout this article, it underpins our disciplined investment approach that helps us resist the constant noise of news cycles.

Long-term investing is rarely suited to analysts who seek applause in real time, nor is Comgest a home for those angling for airtime to opine on the Fed’s latest policy shift. Policies change, rates can spike, ballots are counted and natural disasters upend expectations. Each of these developments can provoke headlines and bouts of short-term panic that contrast with our investment philosophy.

This is why our investment team spends years conducting bottom-up research to understand the durable growth potential of prospective holdings. From research trips to sharing conversations with company management, our work is collaborative and inquisitive.We aim to uncover the fundamental forces shaping businesses on the ground, rather than relying on the market’s view from afar. As active managers, we believe these in-person interactions can reveal qualitative aspects of a business, such as culture, that are essential components of visibility.

At Comgest, titles matter less than curiosity and sustained attention on what matters most: identifying quality growth companies and delivering on our clients’ long-term objectives. Every member of the investment team is, first and foremost, an analyst. We value dissent, encourage candid debate and reward intellectual honesty over the consensus on the street. In our team-based environment, a first-year analyst and a portfolio manager with three decades of experience are equally expected to put their best investment ideas forward. This is possible because we share a common focus on the long term. Our competitive edge lies in our ability to maintain an unwavering commitment to quality growth, while many seem to jump from one distraction to another. It is this discipline that sustains our conviction as we seek to capture the benefits of compounding for our clients.

REFERENCES

1 Davenport, Thomas H., and John C. Beck. The Attention Economy: Understanding the New Currency of Business. Boston: Harvard Business School Press, 2001.↩︎

2 Ducharme, Jamie. “Why Our Attention Spans Seem to Be Getting Shorter.” Time, 10-Aug-2023.↩︎

3 “Speaking of Psychology: Why Our Attention Spans Are Shrinking, with Gloria Mark, PhD.” American Psychological Association, Feb-2023. ↩︎

4 “Adult Skills in Literacy and Numeracy Declining or Stagnating in Most OECD Countries.” OECD, 10-Dec-2024.↩︎

5 O’Connor, Sarah. “Are We Becoming a Post-Literate Society?” Financial Times, 26-Dec-2024.↩︎

6 NYSE↩︎

7 Pauley, Bill. “Market Concentration and Lost Decades.” CFA Institute, 2-Apr-2025.↩︎

8 Wheat, Chris, and George Eckerd. “A Decade in the Market: How Retail Investing Behavior Has Shifted since 2015.” JPMorgan Chase & Co., 27-Aug-2025.↩︎

9 Vayanos, Dimitri. “Passive Investing and the Rise of Mega-Firms.” London School of Economics and Political Science. Accessed 5-Jan-2026.↩︎

10 Butters, John. “Highest Number of S&P 500 Earnings Calls Citing ‘Ai’ over the Past 10 Years.” FactSet, 8-Dec-2025.↩︎

11 Pitcher, Jack. “U.S. Stocks Are Now Pricier Than They Were in the Dot-Com Era.” Wall Street Journal, 31-Aug-2025.↩︎

12 Sharma, Ruchir. “The Best Time to Buy Quality Stocks Is Now.” Financial Times, 1-Dec-2025.↩︎

13 “The English We Speak / Left On Read.” BBC Learning English, 10-Dec-2025.↩︎

14 SAP Integrated Report 2024↩︎

15 “Q3 2025 Results.” SAP, 22-Oct-2025.↩︎

16 Nippon and Japan National Tourism Organizaton, 16-Jan-2025.↩︎

17 Comgest research note↩︎

FOR PROFESSIONAL INVESTORS ONLY

Important Information

This document has been prepared solely for professional/qualified investors and may be used only by such persons.

Not investment advice

This commentary is for informational purposes only and does not constitute investment advice or a solicitation to buy or sell any security. It does not take into account any investor’s specific investment objectives, strategies, tax status, or investment horizon, and should be read in conjunction with an oral briefing provided by Comgest representatives.

Not an investment recommendation

Any discussion of specific companies does not constitute a recommendation to buy or sell any particular security or investment. The companies mentioned do not represent all past investments, and it should not be assumed that any discussed investments were or will be profitable.

Comgest does not provide tax or legal advice to its clients, and all investors should consult their own tax or legal advisors regarding any potential investment.

Not investment research

The information contained in this communication does not constitute ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MiFID II. This means that (a) it has not been prepared in accordance with the legal requirements designed to promote the independence of investment research, and (b) it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Performance disclaimer

Past performance is not a reliable indicator of future results. Forward-looking statements, data or forecasts are based on assumptions and judgments by Comgest and the Strategy regarding future economic and market conditions, which are inherently uncertain and beyond the control of Comgest or the Strategy. Actual outcomes may differ materially, and unforeseen events may significantly affect performance. Accordingly, no reliance should be placed on such statements as a guarantee that the Strategy will achieve its objectives or plans.

Trademark and index disclaimer

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners.

S&P Dow Jones Indices LLC ("SPDJI"). S&P is a registered trademark of S&P Global ("S&P"); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones"). These trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Comgest. Comgest's fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones and S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in the fund nor do they have any liability for any errors, omissions, or interruptions of the index.

Information provided subject to change without notice

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

Restrictions on use of information

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest's prior written consent.

Limitation of Liability

Certain information contained in this commentary has been obtained from sources believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Comgest accepts no liability for any errors or omissions in the information provided.

Legal entity disclosure

Comgest S.A. is regulated by the Autorité des Marchés Financiers (AMF). Comgest Asset Management International Limited is regulated by the Central Bank of Ireland and the U.S. Securities and Exchange Commission (SEC). Comgest US LLC is regulated by the SEC. Regulation by the SEC does not imply a certain level of skill or training. Comgest Asset Management Japan Ltd. is regulated by the Financial Services Agency of Japan (registered with the Kanto Local Finance Bureau, No. Kinsho 1696). Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission. Comgest Singapore Pte. Ltd. is a Licensed Fund Management Company and Exempt Financial Adviser (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

For UK only:

This commentary has not been approved under section 21 of the Financial Services and Markets Act 2000 (FSMA) by an authorised person. It is directed only at investment professionals as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). Investments are available only to such persons, and any related agreement will be made solely with them. Persons who are not investment professionals should not rely or act upon this commentary. Recipients must observe all applicable restrictions and must not publish, distribute or share this commentary in whole or in part.