You are visiting Sweden

If this is incorrect,

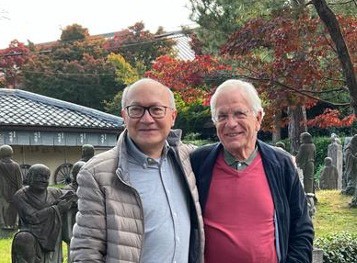

By: Wedig von Gaudecker and Jean-François Canton, founders of Comgest - 21-Jul-2025

Many start-ups are born from a fusion of idealism, entrepreneurial drive, a pursuit of independence, a hunger for profitability and a desire to challenge the status quo. For Comgest founders, Wedig von Gaudecker and Jean-François Canton, this combination was the catalyst that helped them spark a revolution in France’s portfolio management landscape – breaking down bureaucratic barriers, championing long-term quality growth and building an exceptional partnership model.

"We wanted to break down bureaucratic barriers, champion long-term quality growth and build an exceptional partnership."

In the mid-1980s, the veteran portfolio managers worked in Paris at France’s Banque Indosuez where they managed European (Wedig) and Asian (Jean-François) equity portfolios. The two developed a strong camaraderie while debating the best strategies that would enable them to beat market averages over the long term. The key to their market conundrum came when German-native Wedig stumbled upon a Fortune magazine article discussing how most portfolio managers, regardless of their analytical prowess, could never do better than market indices.

Instead of focusing on the dire prediction for his profession, he was intrigued by the story’s references to a few equity portfolio managers who had actually managed to beat the indices. The names that stood out were the “Oracle of Omaha”, Warren Buffett of Berkshire Hathaway and his right-hand man, Charlie Munger. Both had studied financial analysis under Benjamin Graham, the “father of value investing”.1After diving into Berkshire’s annual reports and letters to shareholders, Wedig took note of the company’s emphasis on a shareholder partnership, tying investment success to the company's prospects.

Success is determined by a protected market position, strong management and sound finances – qualities that competitors can’t easily replicate.

Their concept asserted that success is determined by having a protected market position, such as brand, patents, an indispensable product, a unique service – attributes that are difficult for competitors to imitate – along with strong management, all based on sound finances. This strategy, dubbed “Quality Growth”, focused on companies with favourable positions that were capable of reliably forecasting and discounting future earnings. But could such a style succeed in Europe?

A quality growth approach was then virtually unknown on the continent.

A quality growth approach was then virtually unknown on the continent, which presented Wedig a path to differentiate himself – even if it took him a couple of years to fully commit. In 1985, both he and Jean-François left their positions – a bold move for French portfolio managers at the time. While Wedig moved to another French bank, Jean-François acquired a shell company with the rather bland name of “Comsam Gestion”. When the local telecom company found the name too long for a telex line, “Comgest” was born. After two years, Jean-François finally lured Wedig to Comgest to help him implement a bottom-up, quality growth investment style in European and Asian equities.

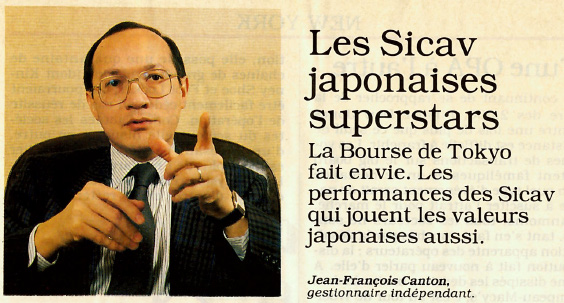

La vie française magazine; April 1988

La vie française magazine; April 1988

However, beyond ideas and aspirations, successful start-ups also require substantial investment, a strategic location, regulatory approvals, the recruitment of employees and clients, as well as a bit of luck. Central to this journey is the ambition to deliver a unique and indispensable product. For Wedig and Jean-François, banks (including their former employers) were wary of concentrated portfolios, low turnover and the high costs associated with in-depth company analysis, echoing their past challenges.

La vie française magazine; April 1988

La vie française magazine; April 1988

From the outset, resources were scarce. The initial capital consisted of their collective expertise, bolstered by contacts from their prior professional lives. Their chosen location, nestled off a Parisian side street adjacent to the famed Opera Garnier, was known for its lurid past in the former red-light district and immortalised by the French painter Toulouse-Lautrec. When paying the monthly rent, it became a game of tag to decide who had to deliver the rent cheque as the building’s concierge, perhaps leaning into the area’s history, would frequently lounge in her bathrobe. Amid the eclectic ambiance, Comgest’s offices were in a modest mezzanine space, sandwiched between a police station and an ultra-right newspaper.

For Wedig, Jean-François also proved to be a mentor in the mysterious ways of French administration and an interpreter of his butchered French expressions. There were significant hurdles that included obtaining regulatory approvals, since asset management company statutes were non-existent in France, leading the two intrepid investors to become involved in drafting the regulations. Ambiguity surrounding Comgest’s supervisory jurisdiction – whether by France’s stock market exchange authority or the central bank – added to the uncertainty. As a result, the duo initially had to work as “remisiers” (equivalent to a stockbroker or financial advisor), which granted them access to the stock exchange and commission-earning opportunities.

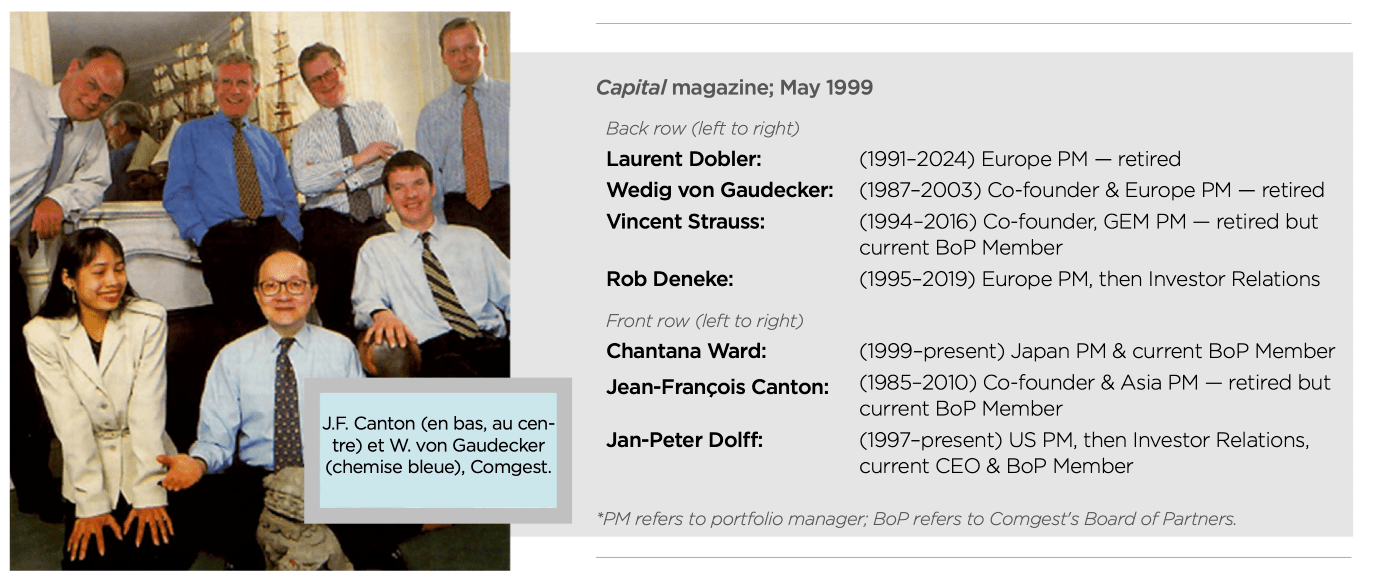

As they built up the office, Wedig and Jean-François aimed to create a team of equals – not hire geniuses. They embraced the belief that “teamwork is the fuel that allows common people to attain uncommon things”, as stated by Andrew Carnegie. This approach fostered a diverse blend of personalities and expertise that would strengthen the investment team. In 1991, Laurent Dobler, who had begun his career in Geneva, became the next portfolio manager to join them and played a crucial role in expanding the company’s European strategy.

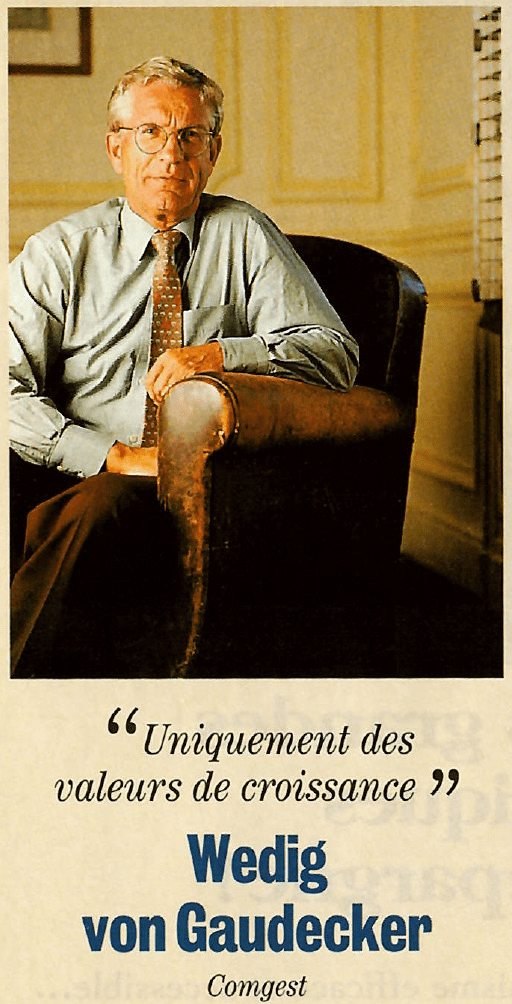

Investir magazine; October 1998

Investir magazine; October 1998

One of the team’s commercial hurdles was the inability to secure clients from their prior roles. However, when Wedig’s former employer granted him a mandate in Geneva, they gained a foothold in the Swiss market. At the same time, Jean-François leveraged his French-Vietnamese heritage with his expertise in Asian markets and the complexities of the “Tigers” by managing an Asian portfolio for another French bank, which opened doors to major institutions unfamiliar with the region.

While these initial banking mandates and personal connections provided some support, the team recognised the urgent need for a robust product. Their biggest challenge was the lack of a mandate to apply what would become Comgest’s signature bottom-up, quality growth approach.

Comgest’s first stroke of luck came when Wedig’s former employer – for which he oversaw the Swiss mandate – faced business difficulties. This offered Wedig the opportunity to network, leading to introductions with a firm that was successfully testing US-based portfolio managers (and discovering the likes of financial gurus Georges Soros and Michael Steinhardt). After securing a place in the firm’s new portfolio structure, a slight hiccup in communication to Wedig on the availability of funds led to a fortuitous two-week lapse, allowing him to capitalise on a market downturn by buying cheaply, earning Comgest a significant advantage and an increase in assets to be managed.

To conserve the company’s limited financial resources, Wedig drafted the prospectus himself in English and German in just one night.

However, 1992 and 1993 proved challenging, with Comgest losing a few portfolios. In response, the two founders took a bold step: slashing their salaries to the legal minimum in France for several months, while ensuring that their employees' pay remained stable. Amid these trying times, Wedig engineered a remarkable rebound that would redefine Comgest’s future. In 1992, he launched a Swiss franc-denominated, Luxembourg-based pooled investment vehicle, aptly named Comgest Europe. To conserve the company’s limited financial resources, he drafted the prospectus himself in English and German in just one night.

The following year marked another company milestone with the introduction of Comgest Asia, also based in Luxembourg. This shift was a gamechanger – transforming Comgest from mere advisors on portfolios created by other banks and brokers into active managers seeking investors all over Europe.

Thereafter, Comgest’s growth continued to expand: in 1993, a Hong Kong branch was established and by February 1997, within a decade of inception, Comgest had surpassed one billion euros in assets under management. This upswing was aided by the media, notably through a feature in “Manager Magazin” in October 1990, entitled “We Are Different”, which garnered the attention of the German market. Comgest leveraged this brand recognition through strategic public relations initiatives, including those led by Jan-Peter Dolff, now Comgest’s CEO, who set up the company’s German branch office in Düsseldorf.

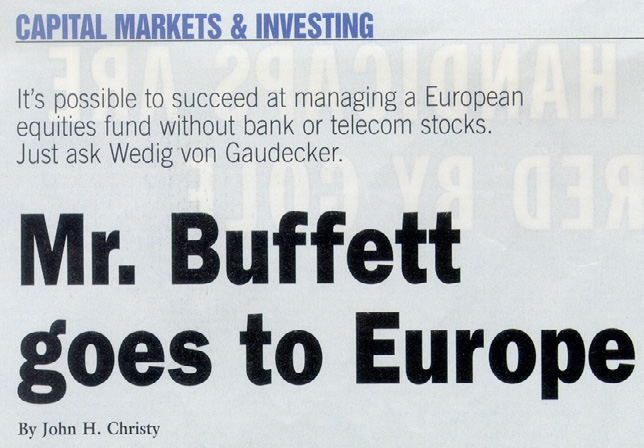

Forbes magazine; February 2000

Forbes magazine; February 2000

A further breakthrough raised the company’s stature in the Anglo-Saxon world: in February 2000, a journalist from Forbes magazine reached out for an interview. Inquiring about Comgest’s approach and role models, Wedig referenced Buffett and Munger as well as Phil Fisher, whose philosophy “Common Stocks and Uncommon Profits” had greatly influenced Munger. Given Buffett’s renown in the industry, fortune was in Comgest’s favour when the article was published as “Mr. Buffett Goes to Europe”.

Soon after, however, Wedig realised a couple of errors in his thinking: that a good product could sell itself and marketing expenses were wasteful. He and his colleagues then made significant efforts to secure press coverage, interviews, rankings, and participation in industry events to showcase Comgest’s strengths.

By the early '90s, Comgest had successfully secured management of two well-known French pooled-vehicle mandates launched by a private bank – one focused on European equities and the other on Emerging Markets. When that bank went bankrupt in 1995, the liquidator sold the portfolios to a prominent French bank. However, thanks to Jean-François’s legal expertise, he knew that only the directors of the portfolios had the power to choose a manager. Seizing the moment, he called for an extraordinary meeting of the Boards, where in a momentous decision, Comgest was re-awarded the portfolios. It was historical – not just for Comgest, but for France – marking the first time an independent, small asset manager was given full responsibility over a French pooled vehicle.

Wedig then had the opportunity to transform the European equities portfolio, crafting it into Comgest’s now-signature quality growth style. In terms of the Emerging Markets portfolio, Jean-François was already advising on the portfolio for Asia, while a long-time acquaintance, Vincent Strauss, advised on South America. Post-acquisition, Vincent joined Comgest – a move that signalled a pivotal moment as he took charge of the portfolio and laid the foundation for Comgest’s Emerging Markets strategy. His guidance propelled the portfolio to prominence, where it became the core of Comgest’s assets under management for over two decades. Vincent’s expertise cemented Comgest’s credibility and distinctive investment approach, earning him the honour of being called the company’s “third founder”.

Then came the 2008 financial crisis, which triggered a global wave of widespread fear. In retrospect, Comgest showed the strength of its resilience thanks to having no debt, minimal fixed costs and ample equity. Its investments were solid, untouched by subprime woes. Despite the doomsday sentiment, Comgest’s client base remained intact, even expanding. The company’s consistent performance, lagging in times of market euphoria due to prioritising quality and reasonable valuations and losing far less in moments of crisis, earned it the industry moniker, “asset managers for bad weather funds”.

By 2000, Comgest’s close-knit staff had swelled to 34, including 14 investment team members, but still operated without a typical hierarchical leadership. Notably, it was only in 2010 that Comgest named an official CEO, with Vincent stepping in to replace a retiring Jean-François. He maintained the founders’ informal “walk-and-talk” management style aimed at promoting communication and proactively addressing any conflicts. Still, as the company grew, the founders never found a perfect business structure to emulate.

The founders embraced a broad-based partnership structure as a symbol of the company’s ethos.

Legal constraints, however, necessitated a transition to a corporate structure. As a result, the founders decided from the start to make all employees shareholders. Similar to Wedig and Jean-Francois’s earliest Comgest endeavours, this was also a rarity in France at the time. The founders embraced a broad-based partnership structure as a symbol of the company's ethos – fostering robust relationships with employees, clients, investee companies, and industry peers alike. Rooted in an ownership mindset and collective accountability, this approach nurtured a dynamic work culture – with their goal to fuel employees’ motivation and drive remarkable portfolio outperformance. Crafting a business plan from scratch, they navigated the intricacies of salary distribution, bonus allocation and share allocation.

Weekly Tuesday morning town hall-style meetings laid bare every aspect of operations: task distribution, office setups, compensation structures, hiring protocols, and profit-sharing arrangements, etc. Transparency was key – no internal secrets, no hierarchical structures and only titles mandated by law. This collaborative approach continues to this day, with the Tuesday meetings now being global and online following the Covid pandemic. If there is a drawback to Comgest’s approach, it is that ships demand decisive leaders, which challenges the company’s antihierarchical stance. Despite occasional differences, Comgest’s culture of a broad-based partnership instils in employees the need to always act in the best interests of the company’s clients and the partnership.

“As founders, it’s fair to say that Comgest has exceeded our expectations.”

Even as the company has expanded, the ethos of open communication and shared responsibility endures. Over time, that spirit has helped shape a team that is more balanced and representative. Today, women make up 49% of Comgest's global workforce and 35% of the investment team's portfolio managers2—an evolution that reflects not just intention, but the steady influence of a collaborative culture.

Now, four decades on, Comgest has evolved far beyond its entrepreneurial beginnings. With time, and shifting economic and social dynamics, even the strongest of companies can face challenges—from volatile markets to the risks of complacency, bureaucracy or overconfidence.

Comgest’s partnership structure is now in its fourth generation.

As the Covid-19 pandemic proved, Comgest’s investment approach has endured through market highs and lows. The company’s steadfast bottom-up, quality growth approach, which has been further refined over the years to take into account the environmental, social and governance credentials of Comgest’s portfolio companies, still resonates with long-term investors seeking a responsible investment style. Comgest’s partnership structure is now in its fourth generation. The founders’ legacy of quality growth and partnership is integrated into the company’s DNA, where individuals are empowered to freely express themselves.Educated risks are taken in the interests of Comgest’s clients, but balanced with experience and responsibility.

Ultimately, Comgest’s longevity is rooted in its partnership structure, dedication to clients and the quality of relationships. The founders' enduring support has helped embed these values across the firm, ensuring continuity as new generations take the lead. With a forwardlooking, long-term mindset woven into the company's DNA, Comgest is well-positioned to remain resilient, successful and ready to meet the challenges and opportunities ahead.

As we have transitioned out of the business and relinquished control, the idea was always to prepare for the shift to the next generation in terms of succession planning and adapting to evolving needs. The aim has been to facilitate the transfer of capital and responsibility to the younger generation while nurturing team cohesion – an essential yet often overlooked detail.

As we have transitioned out of the business and relinquished control, the idea was always to prepare for the shift to the next generation in terms of succession planning and adapting to evolving needs. The aim has been to facilitate the transfer of capital and responsibility to the younger generation while nurturing team cohesion – an essential yet often overlooked detail.

The personal recollections expressed here reflect the authors’ perspectives.

1 Graham, Benjamin, 1894-1976. The Intelligent Investor: A Book of Practical Counsel. New York; Harper, 1959.↩︎

2 As of 30-Jun-2025.↩︎