White papers

COMGEST: LES BIENFAITS DU PARTENARIAT ET DE LA QUALITE CROISSANCE

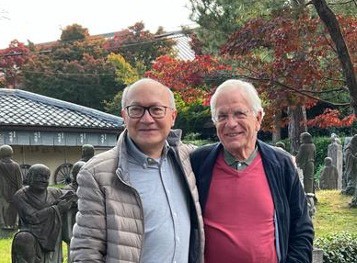

Par Wedig von Gaudecker et Jean-François Canton, fondateurs de Comgest - 21/07/2025

De nombreuses start-up naissent d’un mélange d’idéalisme, d’esprit entrepreneurial, d’un désir d’indépendance, d’un appétit pour la rentabilité et d’une volonté de bousculer le statu quo. Pour les fondateurs de Comgest, Jean-François Canton et Wedig von Gaudecker, cette combinaison a été le catalyseur d’une véritable révolution dans le paysage français de la gestion de portefeuille : éviter la bureaucratie, promouvoir une approche long terme et bâtir un modèle de partenariat exceptionnel.

« Nous voulions éviter la bureaucratie, promouvoir une approche long terme et bâtir un modèle de partenariat exceptionnel. »

Au milieu des années 1980, ces gestionnaires de portefeuille chevronnés travaillaient à Paris, à la Banque Indosuez, où ils géraient des portefeuilles d'actions asiatiques (Jean-François) et européennes (Wedig). Les deux hommes ont développé une solide camaraderie en débattant des meilleures stratégies qui leur permettraient de surpasser la moyenne du marché à long terme. La clé de leur énigme boursière leur est apparue lorsque Wedig, originaire d'Allemagne, est tombé sur un article du magazine Fortune expliquant que la plupart des gestionnaires de portefeuille, quelles que soient leurs compétences analytiques, ne pouvaient jamais faire mieux que les indices boursiers.

Au lieu de se concentrer sur cette sombre prédiction concernant sa profession, il fut intrigué par les références de l’article à quelques gérants de portefeuille actions qui avaient effectivement réussi à battre les indices. Les noms qui ressortaient étaient celui de « l’Oracle d’Omaha », Warren Buffett de Berkshire Hathaway, et son bras droit, Charlie Munger. Tous deux avaient étudié l’analyse financière auprès de Benjamin Graham, le « père de l’investissement value »1. Après s’être plongé dans les rapports annuels et les lettres aux actionnaires de Berkshire, Wedig releva l’importance accordée par la société à un partenariat avec ses actionnaires, liant le succès de l’investissement aux perspectives de la société.

Le succès est déterminé par une position dominante sur le marché, un management solide et des bases financières saines – autant d'atouts difficiles à imiter pour les concurrents

Leur concept affirmait que le succès est déterminé par une position dominante sur le marché, telle qu’une marque, des brevets, un produit indispensable, un service unique – autant d'atouts difficiles à imiter pour les concurrents – ainsi qu’un management solide, le tout reposant sur des bases financières saines. Cette stratégie, baptisée Qualité Croissance, se concentrait sur des entreprises bien positionnées, capables de prévoir et d’actualiser de manière fiable leurs bénéfices futurs. Mais un tel style pouvait-il réussir en Europe ?

EMPRUNTER UNE VOIE PEU FRÉQUENTÉE

À l’époque, l’approche Qualité Croissance était pratiquement inconnue sur le continent, ce qui offrait à Wedig une opportunité de se différencier – même s’il lui fallut quelques années pour s’engager pleinement.

À l'époque, l'approche Qualité Croissance était pratiquement inconnue sur le continent.

En 1985, Jean-François et lui quittèrent leurs postes – un choix audacieux pour des gérants de portefeuille français à l’époque. Tandis que Wedig rejoignait une autre banque française, Jean-François acquit une coquille juridique portant le nom plutôt fade de « Comsam Gestion ». Lorsque l’opérateur télécom local estima le nom trop long pour une ligne télex, « Comgest » vit le jour.

Deux ans plus tard, Jean-François parvint finalement à convaincre Wedig de le rejoindre chez Comgest pour l’aider à mettre en œuvre une approche bottom-up fondée sur l’approche Qualité Croissance dans les actions européennes et asiatiques.

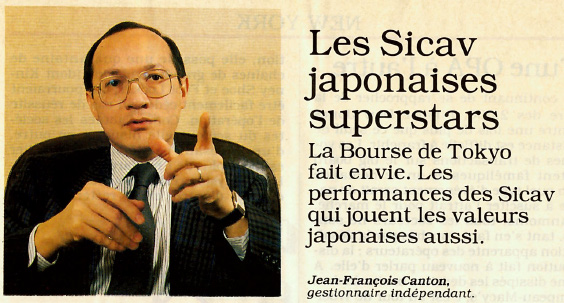

La vie française, avril 1988.

La vie française, avril 1988.

Cependant, au-delà des idées et des ambitions, les start-up prospères nécessitent également des investissements importants, un emplacement stratégique, des autorisations réglementaires, le recrutement de collaborateurs et des clients, ainsi qu’une part de chance. Au cœur de ce parcours se trouve l’ambition de proposer un produit unique et indispensable. Pour Jean-François et Wedig, les banques – y compris leurs anciens employeurs – se montraient méfiantes à l’égard des portefeuilles concentrés, de la faible rotation et des coûts élevés liés à une analyse approfondie des sociétés, faisant écho aux défis auxquels ils avaient été confrontés par le passé.

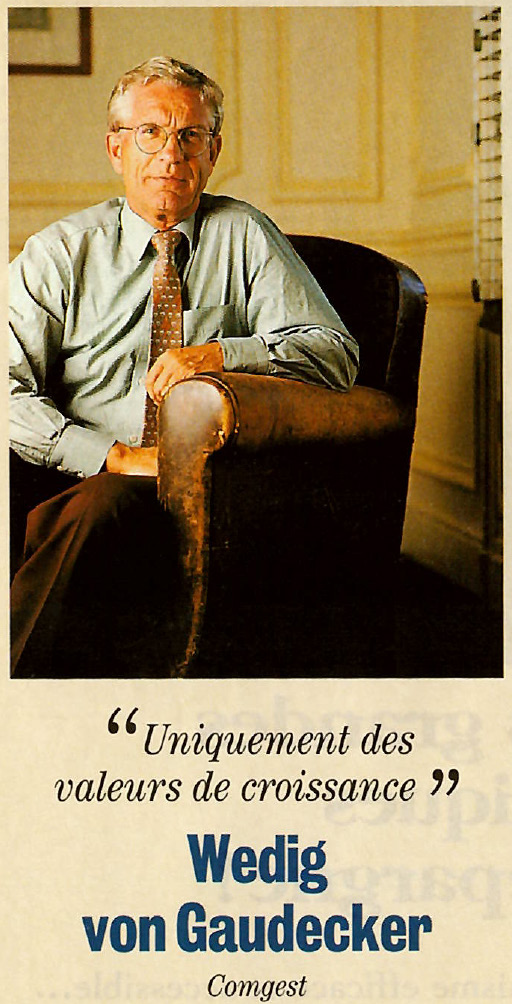

Illustration : Investir magazine, octobre 1998

Illustration : Investir magazine, octobre 1998

Dès le départ, les ressources étaient limitées. Le capital initial se composait de leur expertise commune, enrichie de contacts issus de leurs précédentes expériences professionnelles. Leur lieu d’implantation, niché dans une petite rue adjacente à l’Opéra Garnier à Paris, était connu pour son passé sulfureux dans l’ancien quartier rouge, immortalisé par le peintre français Toulouse-Lautrec. Payer le loyer mensuel devenait une sorte de jeu du chat et de la souris pour savoir qui aurait la tâche d’apporter le chèque, car la concierge de l’immeuble, peut-être en écho à l’histoire du quartier, avait souvent pour habitude de traîner en peignoir. Dans cette ambiance éclectique, les bureaux de Comgest occupaient une modeste mezzanine, coincée entre un commissariat de police et le siège d’un journal d’extrême droite.

Pour Wedig, Jean-François s'est également révélé être un mentor dans les méandres de l'administration française et un interprète de ses expressions françaises approximatives. Ils durent surmonter des obstacles de taille, notamment l’obtention des autorisations réglementaires, les statuts de société de gestion n’existant pas encore en France. Les deux investisseurs intrépides durent ainsi participer à la rédaction des textes réglementaires. L’ambiguïté quant à la tutelle de Comgest – relevant-elle de l’autorité de l’AMF ou l’équivalent aujourd’hui de l’autorité de contrôle prudentiel ? – ajoutait à l’incertitude. En conséquence, le duo a d'abord dû travailler comme « remisiers» (équivalent d’un courtier ou conseiller financier), un statut qui leur donnait accès à la Bourse et leur permettait de percevoir des commissions.

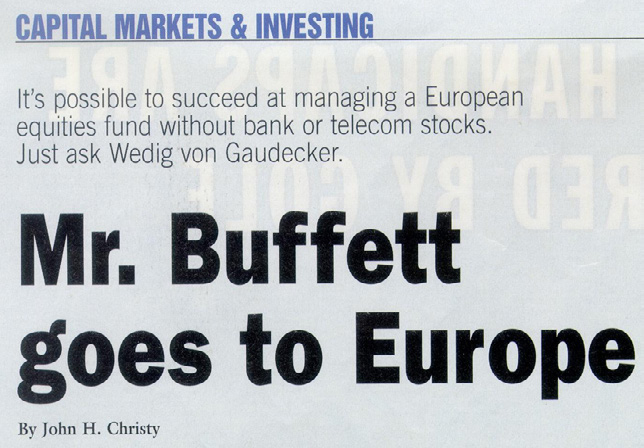

Magazine Forbes, février 2000

Magazine Forbes, février 2000

Au fur et à mesure qu’ils développaient leur bureau, Jean-François et Wedig cherchaient à constituer une équipe d’égaux – non à recruter des génies. Ils adhéraient à la conviction selon laquelle « le travail d’équipe est le carburant qui permet aux gens ordinaires d’accomplir des choses extraordinaires », comme l’a formulé Andrew Carnegie. Cette approche a favorisé une combinaison riche de personnalités et de compétences, qui allait renforcer l’équipe d’investissement. En 1991, Laurent Dobler, qui avait débuté sa carrière à Genève, a rejoint l’équipe en tant que gérant de portefeuille et a joué un rôle déterminant dans l’expansion de la stratégie européenne de la société.

L’équipe a dû faire face à un obstacle commercial majeur : l’impossibilité de conserver les clients provenant de leurs précédentes fonctions.

Cependant, lorsque l'ancien employeur de Wedig lui a confié une mission à Genève, ils ont pu mettre un pied sur le marché suisse. Dans le même temps, Jean-François a mis à profit son héritage franco-vietnamien et son expertise des marchés asiatiques et de la complexité des « Tigres » en gérant un portefeuille asiatique pour une autre banque française, ce qui lui a ouvert les portes d'institutions majeures peu familières avec la région.

Si ces premiers mandats et leurs relations personnelles leur ont apporté un certain soutien, l'équipe a rapidement pris conscience de la nécessité urgente de disposer d'un produit solide. Leur plus grand défi était l'absence de fonds leur permettant d'appliquer ce qui allait devenir l'approche bottom-up axée sur la Qualité Croissance, qui fait aujourd'hui la renommée de Comgest.

LE HASARD A BIEN FAIT LES CHOSES

La chance sourira pour la première fois à Comgest lorsque l'ancien employeur de Wedig, pour lequel il gérait le mandat suisse, connaîtra des difficultés financières. Cela permettra à Wedig d’élargir son réseau, ce qui le mènera à faire la connaissance d’une société qui testait avec succès des gérants de portefeuille basés aux États-Unis (et découvrait notamment des figures comme Georges Soros et Michael Steinhardt). Après avoir obtenu une place dans la nouvelle structure de la société, un léger problème de communication avec Wedig concernant la disponibilité des fonds a entraîné un retard fortuit de deux semaines, lui permettant de tirer parti d'un repli du marché pour acheter à bas prix, ce qui a procuré à Comgest un avantage significatif et une augmentation des actifs à gérer.

Afin de préserver les ressources financières limitées de la société, Wedig rédigea lui-même le prospectus en anglais et en allemand en une seule nuit.

Cependant, les années 1992 et 1993 s'avèrent difficiles, Comgest perdant plusieurs mandats. En réponse, les deux fondateurs prennent une décision audacieuse : réduire leurs salaires au minimum légal en France pendant plusieurs mois, tout en garantissant la stabilité des rémunérations de leurs employés. Malgré ces temps difficiles, Wedig réussit un redressement remarquable qui redéfinira l'avenir de Comgest. En 1992, il a lancé un fonds libellé en francs suisses et basé au Luxembourg, baptisé Comgest Europe. Afin de préserver les ressources financières limitées de la société, Wedig rédigea lui-même le prospectus en anglais et en allemand en une seule nuit.

L’année suivante marqua une nouvelle étape pour la société avec le lancement de Comgest Asia, également basé au Luxembourg. Ce tournant fut déterminant : il transforma Comgest, qui jusque-là se contentait de conseiller des portefeuilles créés par d’autres banques, en gérant actif à la recherche d’investisseurs dans toute l’Europe.

Par la suite, Comgest a poursuivi son développement : en 1993, une succursale a été ouverte à Hong Kong et, en février 1997, moins de dix ans après sa création, Comgest dépassait le seuil d’un milliard d’euros d’actifs sous gestion.

Cette dynamique a été soutenue par la couverture médiatique, notamment un article paru en octobre 1990 dans Manager Magazin, intitulé « We Are Different », qui attira l’attention du marché allemand. Comgest capitalisa sur cette notoriété grâce à des actions ciblées, notamment celles menées par Jan-Peter Dolff, aujourd’hui CEO de Comgest, qui fonda la succursale allemande de la société à Düsseldorf.

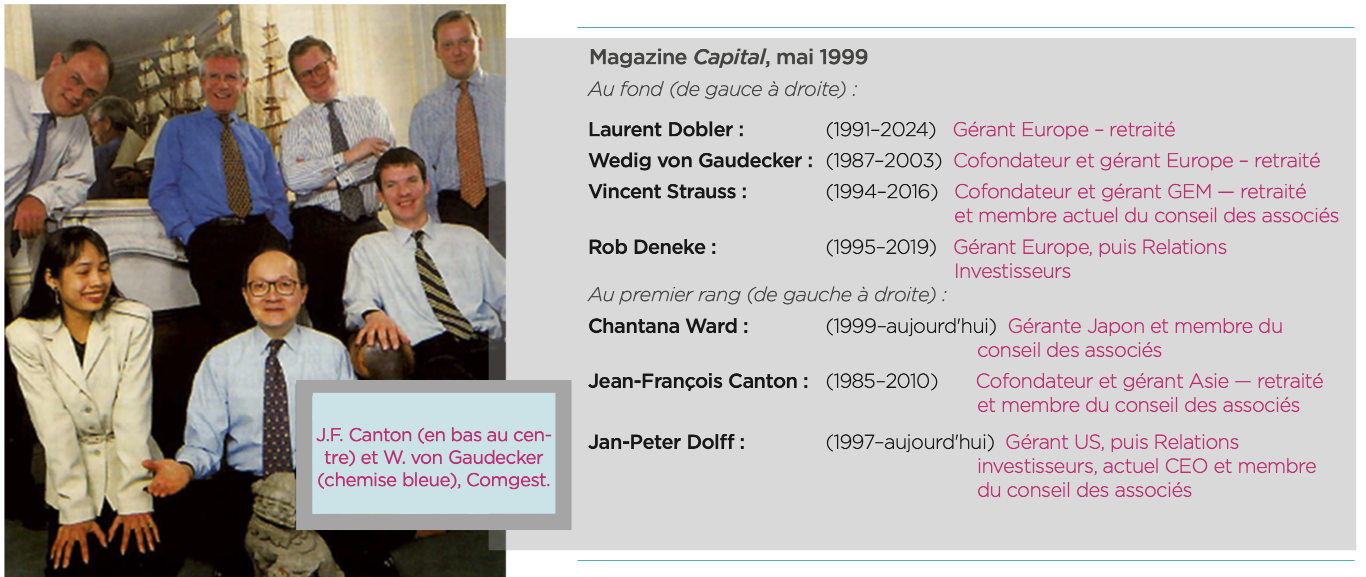

Illustration : Magazine Capital , mai 1999

Illustration : Magazine Capital , mai 1999

Un autre événement marquant a renforcé la notoriété de la société dans le monde anglo-saxon : en février 2000, un journaliste du magazine Forbes a sollicité une interview. S’interrogeant sur l’approche de Comgest et ses figures de référence, Wedig cita Buffett et Munger, ainsi que Phil Fisher, dont la philosophie exposée dans Common Stocks and Uncommon Profits avait profondément influencé Munger. Compte tenu de la renommée de Buffett dans le secteur, la chance sourit à Comgest lorsque l’article fut publié sous le titre : « Mr. Buffett Goes to Europe ».

Peu de temps après, cependant, Wedig réalisa deux erreurs dans sa façon de penser : qu’un bon produit pouvait se vendre tout seul, et que les dépenses marketing étaient superflues. Lui et ses collègues entreprirent alors d’importants efforts pour obtenir une couverture médiatique, des interviews, des classements et une participation à des événements du secteur afin de mettre en valeur les atouts de Comgest.

TRANSFORMER LES OBSTACLES EN OPPORTUNITÉS

Au début des années 90, Comgest avait réussi à obtenir la gestion de deux mandats lancés par une banque privée française bien connue, l'un axé sur les actions européennes et l'autre sur les marchés émergents.

Lorsque cette banque a fait faillite en 1995, le liquidateur a vendu les portefeuilles à une grande banque française. Cependant, grâce à son expertise juridique, Jean-François savait que seuls les administrateurs des portefeuilles avaient le pouvoir de choisir un gestionnaire. Saisissant l'occasion, il a convoqué une réunion extraordinaire des conseils d'administration, au cours de laquelle une décision décisive a été prise : Comgest s'est vu réattribuer les portefeuilles. Ce fut un tournant historique – non seulement pour Comgest, mais aussi pour la France – marquant la première fois qu’une petite société de gestion indépendante se voyait attribuer l’entière responsabilité d’un véhicule d’investissement collectif français.

Wedig a ensuite eu l'occasion de transformer le portefeuille d'actions européennes, en lui donnant le style Qualité Croissance qui caractérise aujourd'hui Comgest. En ce qui concerne le portefeuille des marchés émergents, Jean-François conseillait déjà l'équipe pour l'Asie, tandis qu'un ami de longue date, Vincent Strauss, s'occupait de l'Amérique du Sud.

Après la reprise des deux sicav, Vincent a rejoint Comgest, une décision qui a marqué un tournant décisif puisqu'il a pris la responsabilité du portefeuille et posé les bases de la stratégie de Comgest sur les marchés émergents. Sous son impulsion, le portefeuille s'est hissé au premier plan et est devenu le cœur des actifs sous gestion de Comgest pendant plus de deux décennies. L'expertise de Vincent a renforcé la crédibilité et l'approche d'investissement singulière de Comgest, lui valant d'être surnommé le « troisième fondateur » de la société.

Vint ensuite la crise financière de 2008, qui déclencha une vague de panique généralisée à l'échelle mondiale. Rétrospectivement, Comgest a démontré la résilience de son modèle grâce à l'absence de dette, à des coûts fixes minimaux et à une solide assise financière. Ses investissements étaient solides et n'ont pas été affectés par la crise des subprimes. Malgré le climat apocalyptique qui régnait, la clientèle de Comgest est restée intacte, voire s'est élargie. La performance constante de la société, en retrait lors des périodes d’euphorie boursière en raison de la priorité donnée à la qualité, mais bien moins exposée en période de crise, lui valut le surnom de « gérant pour temps de crise ».

UN PARTENARIAT AVANT-GARDISTE

En 2000, Comgest comptait déjà un effectif de 34 personnes, soudées, dont 14 membres de l’équipe de gestion, tout en continuant de fonctionner sans structure hiérarchique classique. Ce n’est qu’en 2010 que Comgest nomma officiellement un CEO, Vincent succédant alors à Jean-François, parti à la retraite. Il conserva le style de management informel des fondateurs, basé sur la discussion en marchant (walk-and-talk), favorisant la communication et la résolution proactive des conflits. Cependant, malgré la croissance de l'entreprise, les fondateurs n'ont jamais trouvé de structure organisationnelle parfaite à imiter.

Illustration : "Alors que nous nous sommes retirés de l’entreprise et avons cédé les rênes, l’idée a toujours été de préparer le passage à la génération suivante, tant en matière de planification de la succession que d’adaptation aux besoins en constante évolution.

Illustration : "Alors que nous nous sommes retirés de l’entreprise et avons cédé les rênes, l’idée a toujours été de préparer le passage à la génération suivante, tant en matière de planification de la succession que d’adaptation aux besoins en constante évolution.

Les fondateurs ont dès le départ décidé de faire de tous les employés des associés. À l'instar des premières initiatives de Jean-François et Wedig chez Comgest, cette décision était également rare en France à l'époque. Les fondateurs ont adopté une structure de partenariat étendue pour incarner la philosophie de la société, favorisant ainsi des relations solides avec les employés, les clients, les sociétés dans lesquelles ils investissaient et leurs pairs du secteur. Ancrée dans un esprit d’association et de collaboration sur un pied d’égalité pour atteindre un objectif commun, cette approche a motivé les collaborateurs et a ainsi contribué à générer à la fois une performance absolue plus régulière et de la surperformance.

Les fondateurs ont choisi une structure de partenariat étendue pour incarner la philosophie de la société.

Chaque mardi matin, des réunions mettaient à plat tous les aspects de l'activité : répartition des tâches, organisation des bureaux, structures de rémunération, protocoles d'embauche, accords de participation aux bénéfices, etc. La transparence était essentielle : pas de secrets internes, pas de structures hiérarchiques, et uniquement des intitulés de poste imposés par la loi. Cette approche collaborative se poursuit aujourd'hui, les réunions du mardi étant désormais organisées à l'échelle mondiale et en ligne depuis la pandémie de Covid. Si l’approche de Comgest présente un revers, c’est que la conduite d’un navire requiert des leaders capables de trancher, ce qui bouscule la posture antihiérarchique de l’entreprise.

Malgré des divergences occasionnelles, la culture de partenariat étendue de Comgest inculque à ses employés la nécessité d'agir toujours dans l'intérêt des clients de l'entreprise et du partenariat.

SEMER LES GRAINES DE L'AVENIR

Le développement de Comgest n’a pas entravé la communication ouverte entre les associés ni le sens des responsabilités partagées.

"En tant que fondateurs, nous pouvons affirmer que Comgest a largement dépassé nos attentes”

Aujourd’hui, les femmes représentent 49 % des effectifs et 35 % des gérants de portefeuille au sein de l’équipe de gestion2 – une évolution qui reflète l’influence continue d’une culture fondée sur la collaboration.

Avec le temps, et au gré des évolutions économiques et sociales, même les entreprises les plus solides peuvent être confrontées à des défis – qu’il s’agisse de la volatilité des marchés ou des risques liés à l’immobilisme, à la bureaucratie ou à l’excès de confiance.

La structure de partenariat connait aujourd’hui sa quatrième génération.

Quarante ans plus tard, Comgest a largement dépassé le cadre entrepreneurial de ses débuts, porté par ce partenariat fondateur et cette culture d’entreprise forte. Son approche Qualité Croissance continue de raisonner auprès des investisseurs de long terme à la recherche d'un style d'investissement durable. Cet héritage des fondateurs – l’approche Qualité Croissance et le partenariat qui connait aujourd’hui sa quatrième génération – constitue l’ADN de la société, où chacun est encouragé à s’exprimer librement. Le soutien des fondateurs a contribué à ancrer ces valeurs au sein de la société, assurant leur transmission aux nouvelles générations.

"Alors que nous nous sommes retirés de l’entreprise et avons cédé les rênes, l’idée a toujours été de préparer le passage à la génération suivante, tant en matière de planification de la succession que d’adaptation aux besoins en constante évolution.

"Alors que nous nous sommes retirés de l’entreprise et avons cédé les rênes, l’idée a toujours été de préparer le passage à la génération suivante, tant en matière de planification de la succession que d’adaptation aux besoins en constante évolution.

L’objectif a été de faciliter le transfert du capital et des responsabilités à la jeune génération, tout en cultivant la cohésion d’équipe – un élément essentiel, mais souvent négligé."

Les souvenirs personnels exprimés ici reflètent le point de vue des auteurs.

RÉFÉRENCES

1 Graham, Benjamin, 1894-1976. The Intelligent Investor: A Book of Practical Counsel. New York ; Harper, 1959. Illustration : La vie française, avril 1988.↩︎

2 Au 30 juin 2025.↩︎