White papers

THE FAIR-VALUE FOLLY: THE DANGER OF VALUATION-CENTRIC PORTFOLIO CONSTRUCTION

ARCHIVED - 08-Jan-2015

It must be human nature: everyone loves to discover a great bargain! Whether we pass by a shop closing down, try to spot limited offers on eBay, or of course during end-of-season sales, we often find ourselves switching into hunting mode: the focus sharpens, the pulse quickens, we rush to identify an attractive deal before anyone else does, doing our best to stimulate the economy in the process.

This approach may work for most types of products. However, if you plan to wait to find a Hermes tie or a Rolex watch on sale, you may be in for a long wait. Certain items are rarely found at bargain prices. It simply does not make sense to look at the price as the first and most important criterion. Probably not many consumers enter Galeries Lafayette, Harrods or Macy’s looking for the cheapest handbag: most will already have in mind a certain brand. Likewise, who would screen Auto Trader or similar second-hand car magazines simply for the cheapest car? It is very possible that during end-of-season sales the consumers hunting for bargains actually end up buying and spending more than they would in a well-considered and targeted purchase. Only looking at the purchase price of a product is pretty short-sighted. When investing, companies take into consideration the total cost of ownership and re-sale value. Likewise in private life: a Porsche may cost more than a cheap-and-cheerful car when you buy it, but at least you can sell it at a reasonable (or even a collector’s) price later on and you do not need to pay someone to take it off you at scrap value.

Discussions about stocks often remain limited to their valuation

Bargain hunting is not only typical consumer behaviour; it is often considered best practice in financial markets: everyone competes to outsmart the rest, trying to buy securities cheaper than anyone else and below fair value. However, this preponderant focus on price, often at the expense of other considerations such as quality or risk, may lead to unpleasant consequences like a corporate profit warning or even a financial crisis such as we experienced in 2008/2009. Nevertheless, discussions about the attractiveness of particular stocks often start with, or even remain limited to, their valuation.

Valuation matters, but cannot be the only factor to be considered

When picking stocks and constructing a portfolio, valuation does matter: yet, it cannot be the only factor to take into consideration. The beauty of a valuation method such as the widely used price-earnings multiple is its simplicity: both the share price and consensus earnings estimates are readily available. We at Comgest, on the other hand, argue that valuation should not even be the most important factor in investors’ minds; particularly for investors with a longer-term horizon, earnings become the increasingly dominant factor as the holding period lengthens. After all, by investing in a company, one buys a future stream of income (dividends), whereby the size and growth of future dividends strongly rely on the underlying earnings development1.

Valuation needs to take into account the visibility and duration of growth

Instead of looking at the price-earnings multiple, a more appropriate method of valuing a stock should therefore take into consideration not just the likely earnings growth over the next twelve months, but rather the next five years, and also include both the visibility and duration of that growth beyond those five years.

That is exactly what we do at Comgest, the ‘quality-growth’ investors: we apply a long-term-oriented investment approach, which relies on companies’ fundamental value creation, i.e., earnings development, as the determinant share-price driver. A ‘quality-growth’ company is one that delivers superior, long-term earnings growth with below-average risk.

Comgest’s valuation method reflects our quality-growth investment style

Comgest has developed a proprietary valuation method which reflects our quality-growth investment style: it is based on long-term earnings growth forecasts as well as the visibility and duration of that growth, with the latter two determining the price-earnings multiple on terminalyear earnings as well as the discount factor for annual dividends and terminal value. The Comgest valuation tool is simple, stable, conservative and employed together with a range of other conventional valuation measures.

Forecasting earnings many years ahead is always fraught with difficulties and uncertainties: we never have absolute certainty about any security, not even after the most intensive research efforts, meetings with management, competitors, experts et cetera, and after having fully integrated in our analysis environmental, social and governance aspects. A certain level of uncertainty or risk will always remain, even though that risk should be more limited with an investment philosophy such as the one practised at Comgest for more than twenty years, where we avoid unpredictable, risky and heavily cyclical stocks, and apply strict quality criteria.

The importance of the changing nature of risk...

Put simply, quality is defined by the probability of earnings forecasts being consistently achieved. Of course, life is not black-and-white and companies cannot simply be divided into ‘quality’ or ‘not quality’. Within Comgest’s universe of selectively chosen quality-growth stocks, each company operates in different product and geographical markets, and faces different competitors and internal challenges. Hence, each of them displays a different risk profile. This risk profile is subject to variations, explained by structural changes in a company’s business model or industry, but also by temporary factors such as the launch of an important new product with uncertain success, the need for FDA approval for a new drug, the expansion of a retailer into a new geography, or a significant acquisition that needs to be integrated, to name just a few.

... is difficult to capture in valuation models

At Comgest, analysts strongly focus on establishing a clear view of each company’s risk profile and on identifying any variations within. Furthermore, the Comgest valuation model reflects our risk-averse investment style by ascribing discount factors to individual companies, which are always above and sometimes well in excess of that for the overall market, despite these companies’ favourable quality characteristics. At the same time, a discount factor only reflects the risk inherent in a company’s business model, but fails to capture the ongoing, shorter-term variations in the risk profile as described above. Even if a valuation model attempts to integrate risk, it can never do so fully. That is, no valuation model, not even the most risk averse, can possibly cover all risks so that portfolio decisions may be taken with no further caution, in the belief that the consideration of risk has already been dealt with by the model.

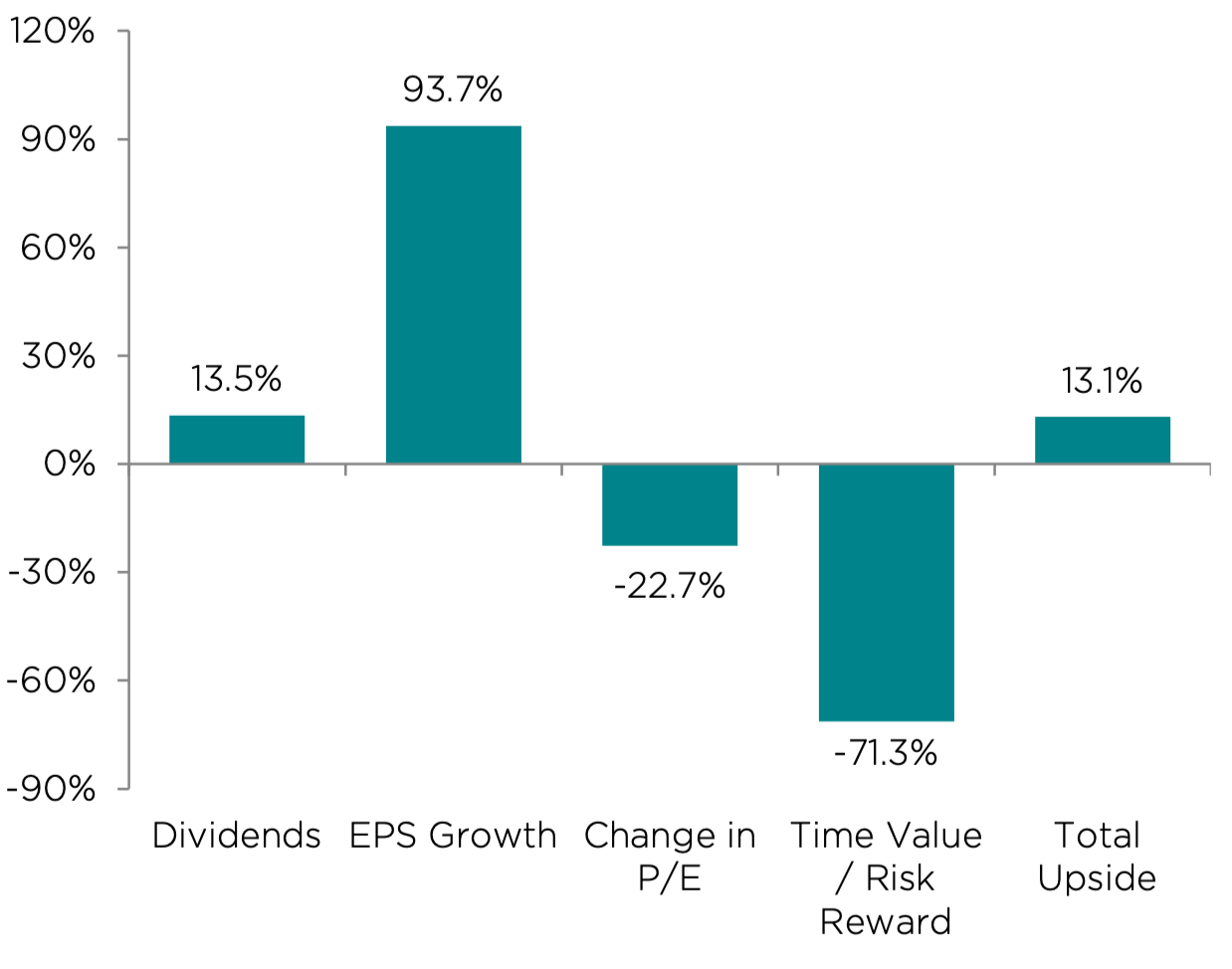

The following graph (Figure 1) shows how the valuation of a company or indeed an entire portfolio may be broken down into its different components. In this example the company’s share price stands 13.1% below its appropriate valuation as calculated by the model, based on five-year forecasts. What is more notable is the relative importance of the components resulting in this upside potential.

Source: Factset / Comgest Data as at 30/06/2015

At Comgest, our investment style is to invest in dynamic and sustainablegrowth companies. We regard earnings growth as the dominant driver of expected performance. In this example, earnings growth contributes an upside of 93.7%, while dividends contribute an upside of 13.5%. The second most important, albeit negative, component is a combination of time value and risk reward, i.e., the negative impact from discounting back terminal value and dividends paid out over the following five years. The importance of time value and risk reward may be surprising and we will return to it below. As expected from a cautious investor, at Comgest we refrain from speculating on revaluation; rather, we assume that the price-earnings multiple declines over five years. Earnings growth may remain dynamic, but it is prudent to assume some slowdown, as competitive advantages may weaken and visibility diminish. In the example above, multiple contractions reduce the upside by 22.7%.

The cardinal, long-term shareprice driver is earnings growth

Earnings growth is key, much more so than the price-earnings multiple, particularly since the latter relies entirely on earnings to match expectations. In case of a profit warning, the target price falls pretty quickly. In fact, the correlation between earnings and target price may be even stronger than that: if earnings disappoint or simply grow more slowly than expected, often the valuation multiple also contracts, as investors are disappointed and take a more critical view of the company’s future perspectives. The cardinal, long-term share-price driver is earnings growth: therefore analysts and portfolio managers should develop a clear vision and strong conviction about a company’s future earnings trajectory and the risks associated with it, before even beginning to look at valuation parameters. The output of any valuation model is only as good as its input. For this reason, Comgest’s analysts focus their research efforts on those companies with a highly attractive growth profile, always in combination with a low level of risk2. The assessment of growth perspectives and risk necessitates ongoing, in-depth fundamental research and an intimate knowledge of each company as well as experience developed over many years.

Valuation in Context

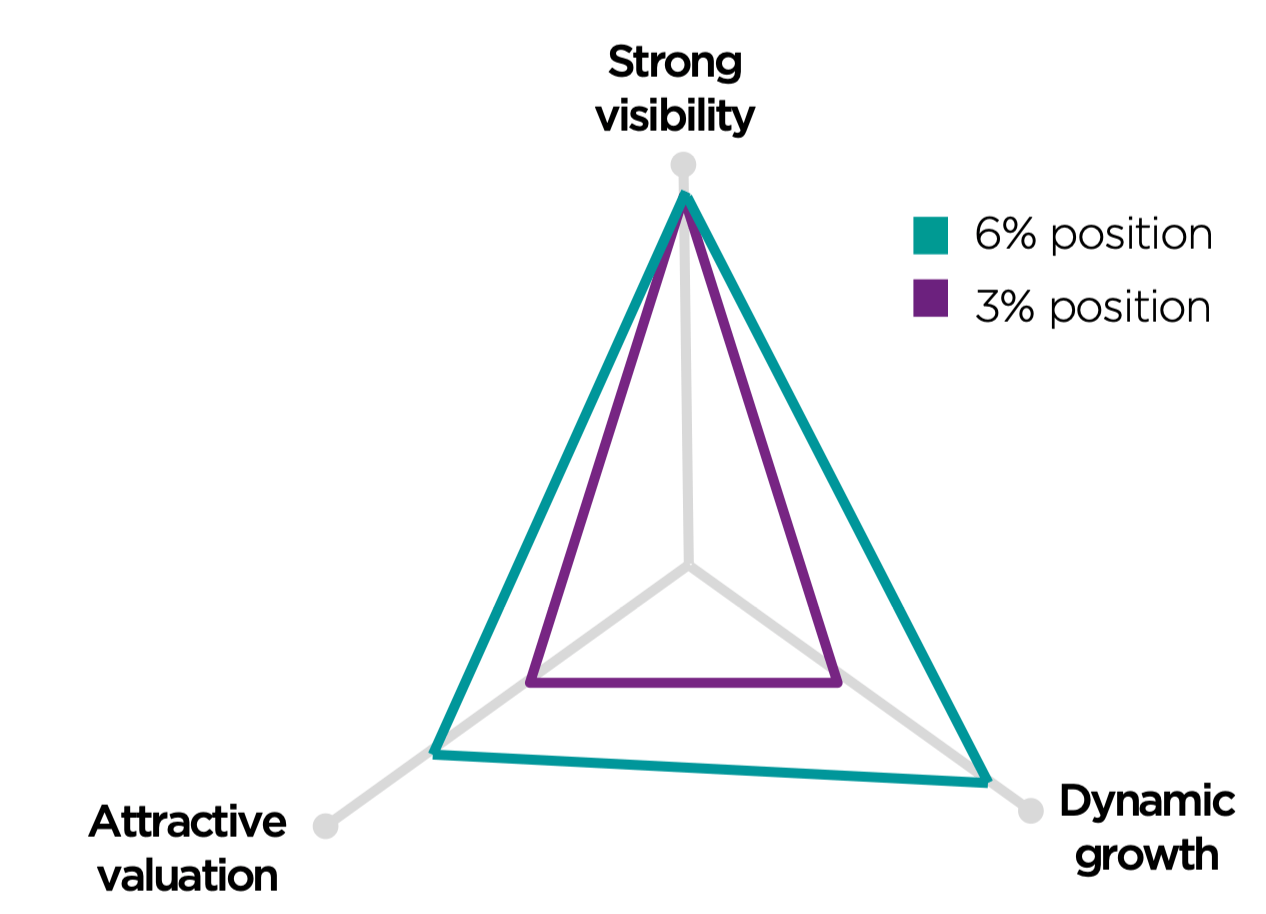

Source: Comgest

Each company is characterised by a unique mix of the variables growth, risk and valuation. When taking portfolio-construction decisions, a portfolio manager looks for the most compelling mix of these variables. Valuation merits close attention, but cannot be looked at in isolation.

Selling an entire portfolio position as soon as it reaches its target valuation may be as unwise a decision as simply buying those stocks which present the most valuation upside. Likewise, not selling at fair value does not necessarily indicate lack of selling discipline. Particularly when managing a fully-invested portfolio, selling a stock for valuation reasons requires it be replaced by a more attractively valued stock. All other things being equal, the decision is obvious, but this is a theoretical scenario, remote from reality. If the argument for selling is based purely on valuation and implies replacing a high-growth, low-risk stock with a lower-growth, higher-risk one, then a myopic interpretation of target price and valuation discipline may sooner or later lead to poorer performance for the portfolio.

A myopic interpretation of valuation discipline may be detrimental to performance

Any valuation model and method have weaknesses and limits, and should therefore be handled with care. Let us return to the typical valuation components appearing in the first of the above graphs. Even though the total upside is only 13.1%, a time value and risk reward of -71.3% mean nothing less than 71.3% absolute return for holding the stock for a period of 5 years and taking on the uncertainties associated with that investment. Particularly in today’s low-yield times, this is a significant number, explained by the cautious use of discount factors. At Comgest we invest in quality growth companies with resilient business models: stocks with a risk profile below market average and a higher likelihood of achieving their earnings forecasts. Yet, we consider each of these companies riskier than the market, by discounting their dividends and terminal value at higher discount rates than for the market. This factor of caution with regard to the future is not based on past experience; Comgest’s European flagship portfolio3, for example, shows a portfolio beta of only 0.63x and a standard deviation 25% lower than the market. This portfolio has historically been much less risky than the market, yet we use a higher risk factor, reducing target prices as a result. Lowering company-specific discount rates to levels consistent with the portfolios’ risk characteristics would result in significantly less negative time value and risk reward and provide a major boost to target valuations.

Another shortcoming of most valuation models is that they only take into consideration a limited number of future years. Typical discounted cash-flow models assume a short period of strong growth, followed by a period of slowing growth and, finally, terminal growth close to GDP growth. In reality, some companies succeed in maintaining their dynamic growth over a large number of years.

Most valuation models fail to reflect the duration of a company’s growth

These companies may be relatively rare, but they do exist, and many a portfolio position in Comgest’s strategies is testimony to that. These rare, long-term growth companies typically trade at a meaningful valuation premium to their markets, which is why they tend to get short-changed; for most valuation models fail to properly reflect a company’s duration of growth4.

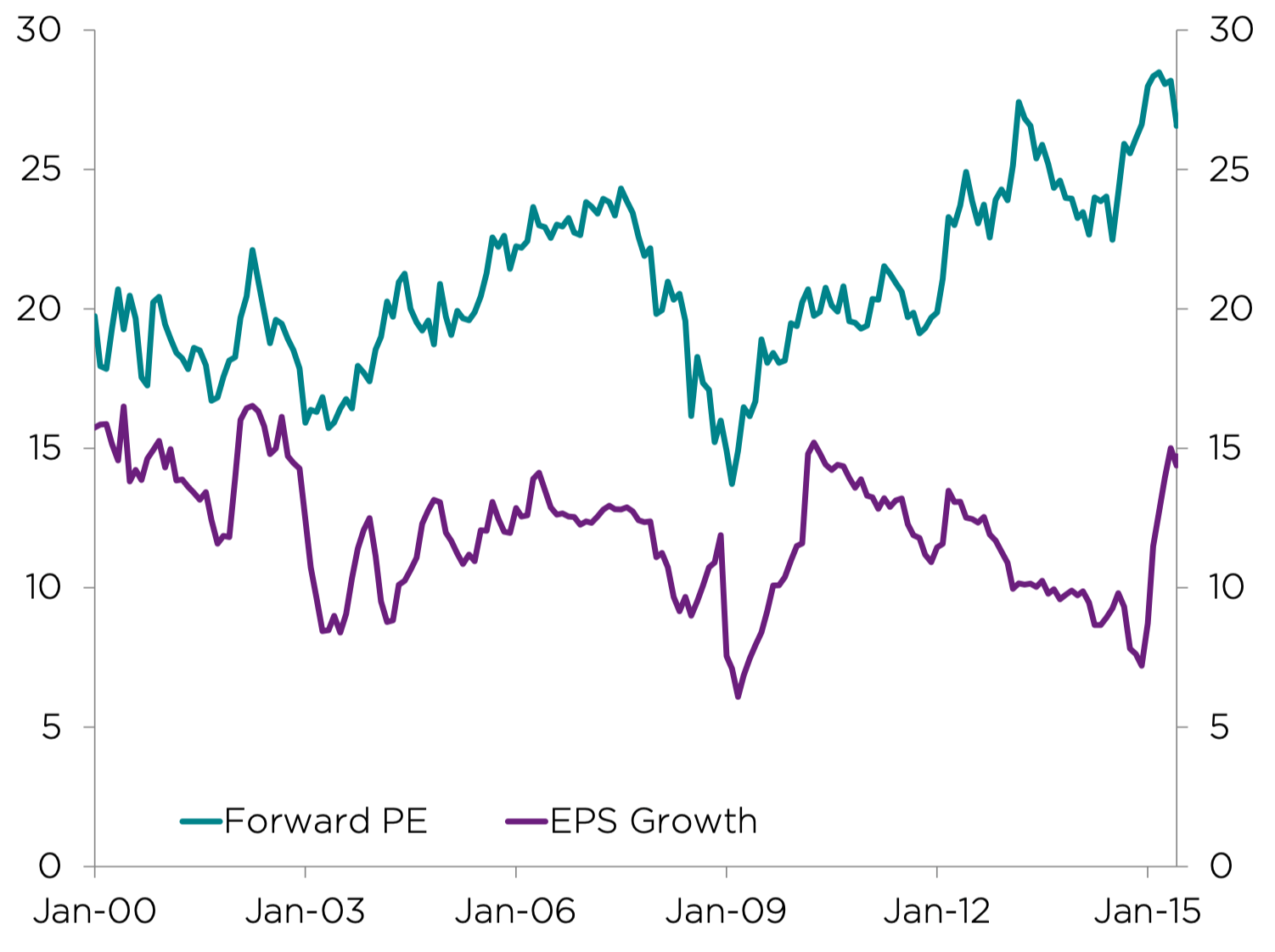

Source: Factset

Data as at 30/06/2015

Over the past 15 years, Essilor’s 14.6% p.a. earnings growth (CAGR) was rewarded with a price-earnings multiple which was, on average, 63% above that of the CAC 40 index. Essilor’s shares rose 609%, compared to a 18% decline for the CAC 40 index.

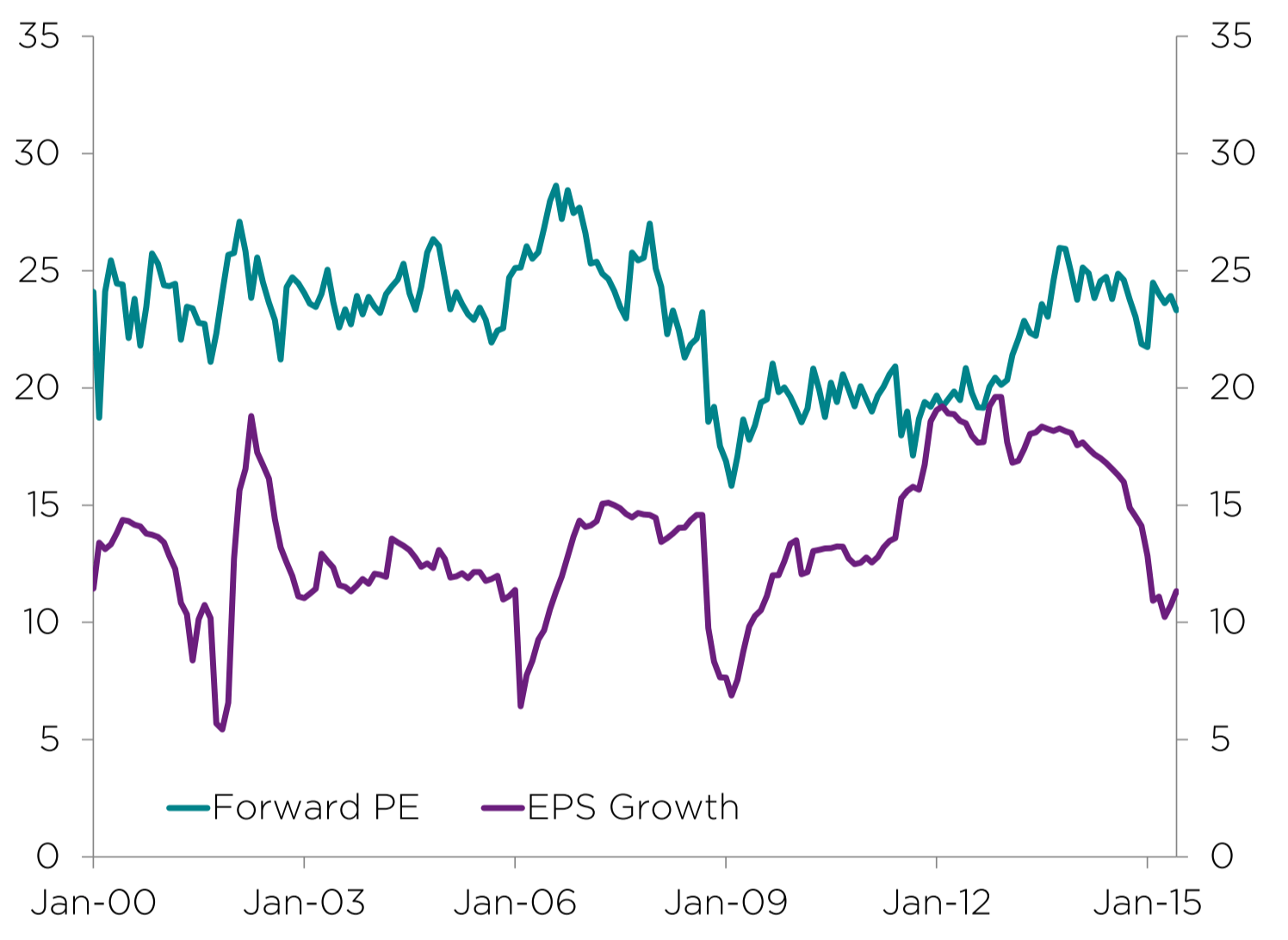

Source: Factset

Data as at 30/06/2015

Ecolab’s 12.7% p.a. earnings growth (CAGR) over the past 15 years resulted in a share price performance of +477%, ahead of the S&P 500 index (+41%), despite its price-earnings multiple trading at an average premium of 45%.

In-depth, fundamental research, may lead to an intimate conviction about a company’s qualities and growth profile

Valuation models and target prices are highly useful, but they need to be properly understood with all their characteristics and shortcomings; they also need to be carefully applied. Valuation discipline is more than a mere numbers game and must not dictate portfolio decisions one-dimensionally. Instead, valuation should be looked at in the context of each company’s growth expectations, and structural and temporary risk characteristics. In-depth, fundamental research, conducted over many years may lead to an intimate conviction about a company’s qualities and growth profile, both in terms of the dynamics and the longevity of that growth, even though the risk and longevity of growth may be difficult to quantify. Albert Einstein is known for having said: ‘compound interest is the greatest mathematical discovery of all time. He who understands it, earns it…he who doesn’t…pays it’. Anyone can have a view on valuation; but at Comgest we strongly believe that we can add value for our investors by identifying companies with a smooth and yet dynamic development of earnings over the long-term.

REFERENCES

1 This paper uses earnings growth as the key measure of a company’s successful development merely for the sake of simplicity. A more complete discussion of the aspects of ‘quality growth’ such as RoCE and the generation of free-cash flow may be found in the following Comgest white papers:↩︎

“Deconstructing the Comgest Quality Growth Approach” (April 2015) and “Cash Is King and There’s No Heir to the Throne” (January 2015), which are available upon request.

2 Comgest’s white paper “Growth Investing: It All Starts with the Top Line” (October 2013) highlights the importance of dynamic and regular sales growth among the many other factors driving earnings growth and is available upon request.↩︎

3 Source: FactSet/Comgest, data as at 29/05/2015 for Comgest’s Pan-European Equity Representative Account, a pooled investment vehicle which has been managed in accordance with the strategy discussed since inception of the strategy. Past performance is no guarantee of future results.↩︎

4 For a discussion of the importance of the duration of growth, please see Comgest’s white paper, “The Long-Term Growth Conundrum” (September 2014), available upon request.↩︎

FOR PROFESSIONAL/QUALIFIED INVESTORS ONLY

Data in this document is as at 30 June 2015, unless otherwise stated.

This document has been prepared for Professional/Qualified Investors and may only be used by these investors. This document and the information herein may not be reproduced (in whole or in part), distributed or transmitted to any other person without the prior written consent of Comgest.

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

The information and any opinions have been obtained from or are based on information from sources believed to be reliable, but accuracy cannot be guaranteed. All opinions and estimates constitute our judgment as of the date of this document and are subject to change without notice.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The securities discussed herein may not be held in the portfolio at the time you receive this document. The contents of this document should not be treated as advice in relation to any potential investment.

Past investment results are not indicative of future investment results. The value of all investments and the income derived therefrom can decrease as well as increase. This may be partly due to exchange rate fluctuations in investments that have an exposure to currencies other than the base currency of the fund.

Investing involves risk including possible loss of principal. Forward looking statements may not be realised. Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners.

Reference to market indices or other measures of relative market performance over a specified period of time are provided for your information only. Reference to an index does not imply that the portfolio will achieve returns, volatility or other results similar to the index. The composition of the index will not reflect the manner in which a portfolio is constructed.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

Before making any investment decision, investors are advised to check the investment horizon and risk category of the fund in relation to any objectives or constraints they may have. Investors must read the latest fund prospectus, key investor information document and financial statements available at our offices and on our website www.comgest.com.