THE EIGHTH WONDER OF THE WORLD?

COMPOUNDERS – THE POWER OF TIME AND QUALITY

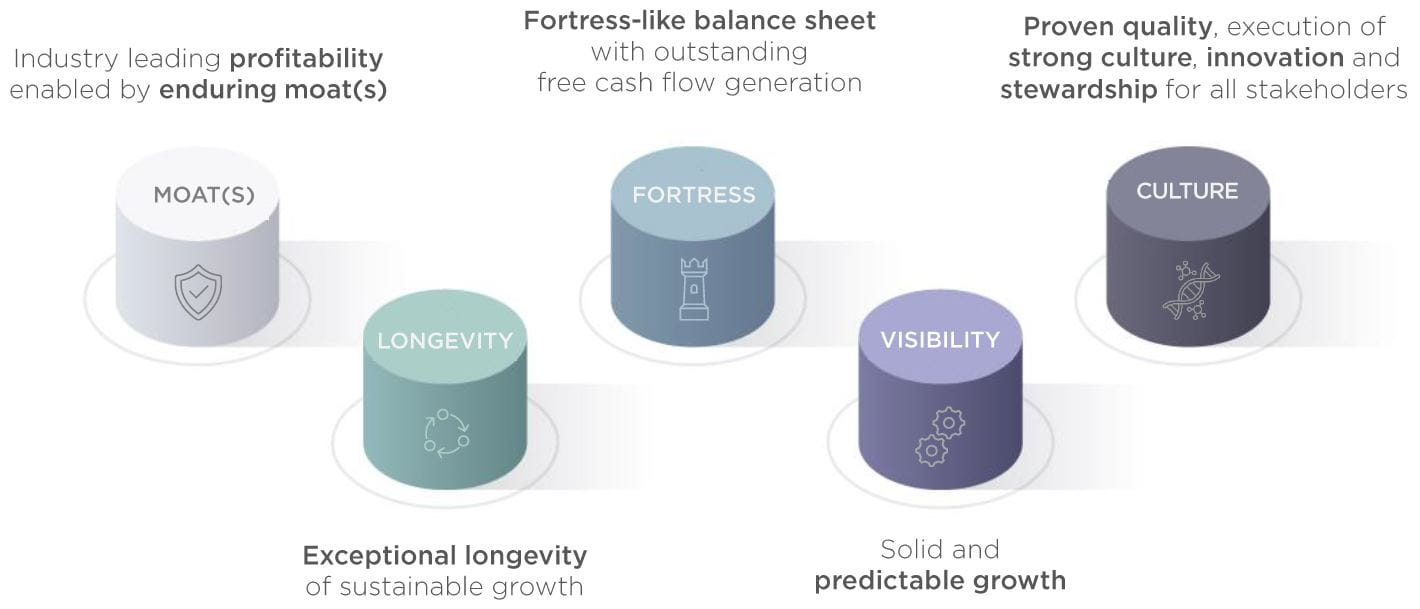

Albert Einstein once described compounding as the eighth wonder of the world. The longer the investment horizon, the greater its effect. This also applies to equity returns when high-quality companies grow sustainably over the long term. As a Quality Growth investor, our approach has been guided for decades by the belief that time can work in an investor’s favour. When analysing quality companies for inclusion in our Comgest Compounders equity strategies, we seek:

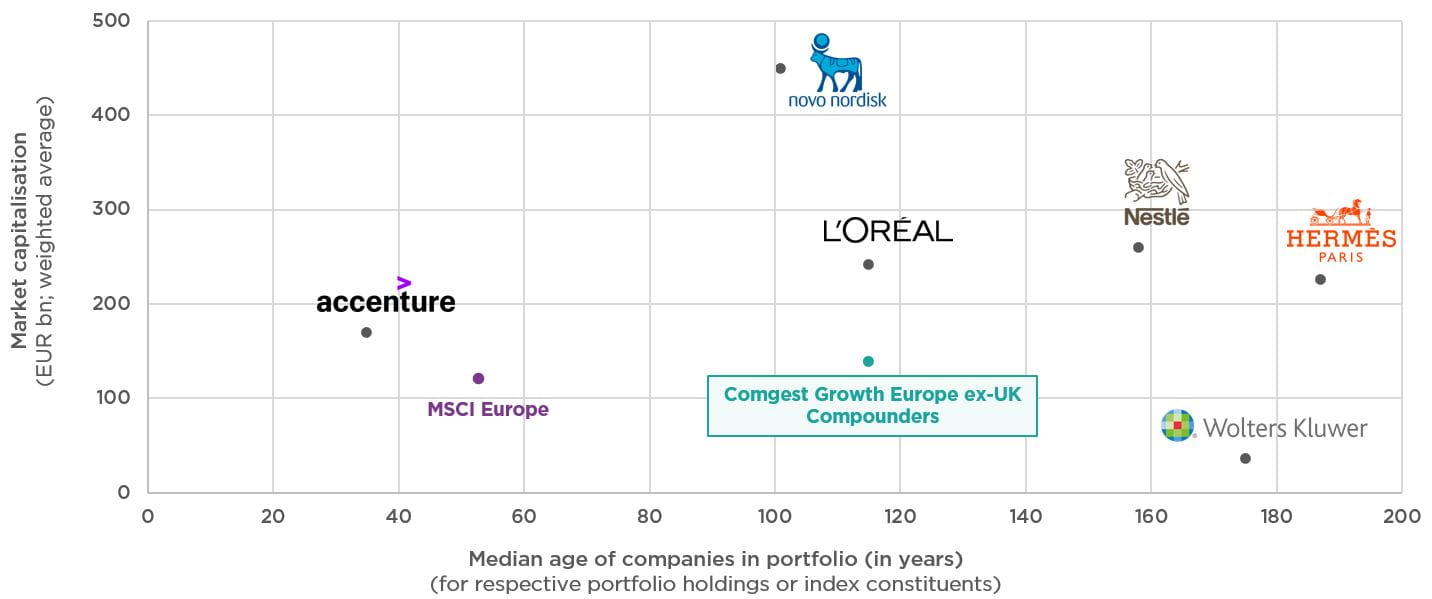

WISDOM AND SUCCESS COME WITH AGE

Past performance does not predict future returns.

Source: Comgest / FactSet financial data and analytics, unless otherwise stated. Data as of 31-Mar-2023 expressed in EUR. The MSCI Europe Large Cap, MSCI Europe Mid Cap and MSCI Europe Small Cap indices are used for comparative purposes only and the funds do not seek to replicate the indices.

WHAT ARE COMPOUNDERS EQUITIES?

Comgest’s Compounders Equity strategies are portfolios comprised of companies that demonstrate high visibility, consistency, longevity of growth and strong ESG credentials.

Europe Equities - Withstanding the winds of change

These days the world seems to be changing faster than ever. Rising geopolitical tensions and technological advancements, such as artificial intelligence, are increasing volatility in the global economy.

UNCOVERING THE QUALITIES THAT SET COMPOUNDERS APART

How does M&A factor into the growth of compounders companies? Being a “marathon runner” requires more than just a venerable age (an average of 126 years in our portfolio). Over time, these companies have used their resilience and built up competitive moats yielding exceptional free cash and healthy balance sheets. By leveraging these elements, compounders seize on M&A opportunities to fuel future organic growth.

COMGEST EX UK COMPOUNDERS STRATEGY

Interested in knowing more about our Europe ex UK Compounders equity strategy? Click below to discover more.

Comgest Growth Europe Ex UK Compounders

THE ADVANTAGES OF COMPOUNDERS STRATEGIES

MAIN RISKS

This strategy has the following core inherent risks (non-exhaustive list):

- Investing involves risk including possible loss of principal

- The value of all investments and the income derived therefrom can decrease as well as increase

- There is no assurance that the investment objective will be achieved

COMGEST TEAM APPROACH

EUROPEAN EXPERTS

-

William Bohn

Analyst / PM

-

Quentin Borie

Analyst

-

Denis Callioni

Analyst / PM

-

Bassel Choughari

Analyst / PM

-

Eva Fornadi

Analyst / PM

-

James Hanford

Analyst / PM

-

Connor Middleton

Analyst

-

Mark Schumann

Analyst / PM

-

Franz Weis

CIO - PM

ESG

-

Petra Daroczi

ESG Analyst / PM

AVERAGE INDUSTRY EXPERIENCE IS 15 YEARS

Contact Details

Tom Culhane

Investor Relations

Tel: +44 78 1729 6522

Email: tculhane@comgest.com

Ian Lewis

HEAD OF INVESTOR RELATIONS

Millie Mather

Investor Relations

Tel: +44 77 7545 2242

Email: mmather@comgest.com

Hannah Rosley

Investor Relations

Tel: +44 77 8669 1831

Email: hrosley@comgest.com