Investment letters

JAPAN EQUITIES: DAWN OF A NEW GOLDEN ERA?

04-Sep-2024

Over the past three years, Japan’s so-called value stocks have benefitted from the rise in inflation and interest rates. At Comgest, we believe that our consistent, long-term growth investment style will outlast these short-term developments.

A GROWING GARDEN OF QUALITY INVESTMENTS

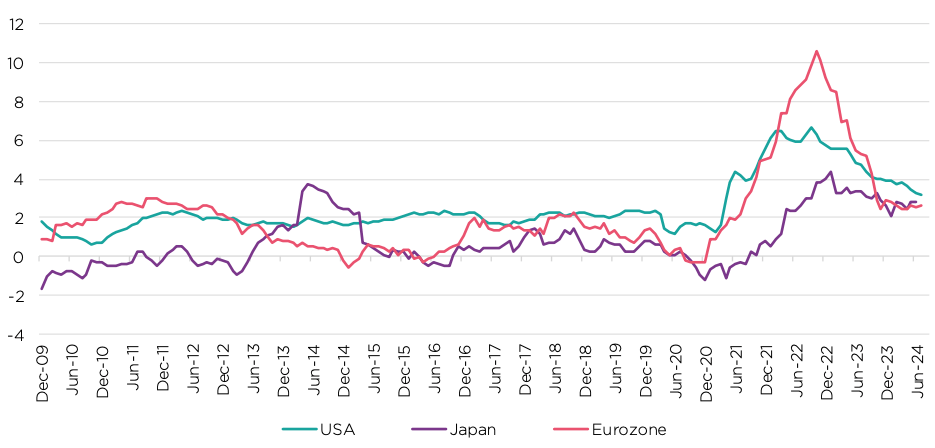

In Japan, the debate between value and growth investing has been heating up in recent years. Following the COVID-19 pandemic and Russia’s invasion of Ukraine, there was a worldwide resurgence of inflation and a resulting rise in interest rates, especially in the United States. Since 2021, while most developed economies followed the lead of the US and raised their interest rates to combat inflation, Japan stood out as an exception by deciding not to raise its interest rate.1 Japanese inflation peaked at just 4% in 2021, and its interest rate remained at zero until a surprise rate hike in July 2024, as shown in figure 1.

Source: Comgest/Factset as of 19-Aug-2024.

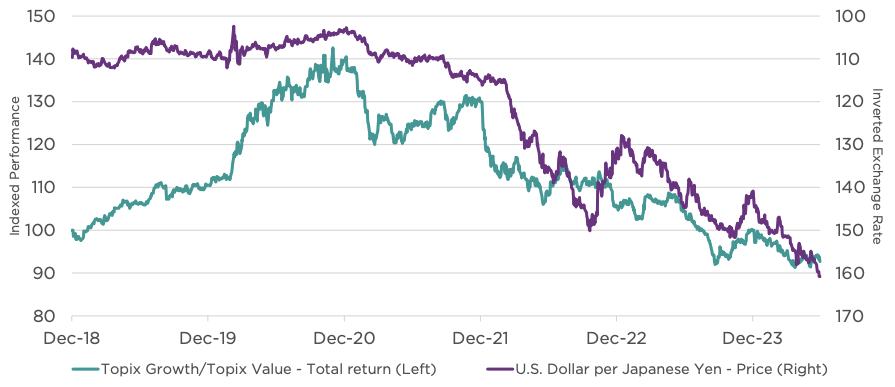

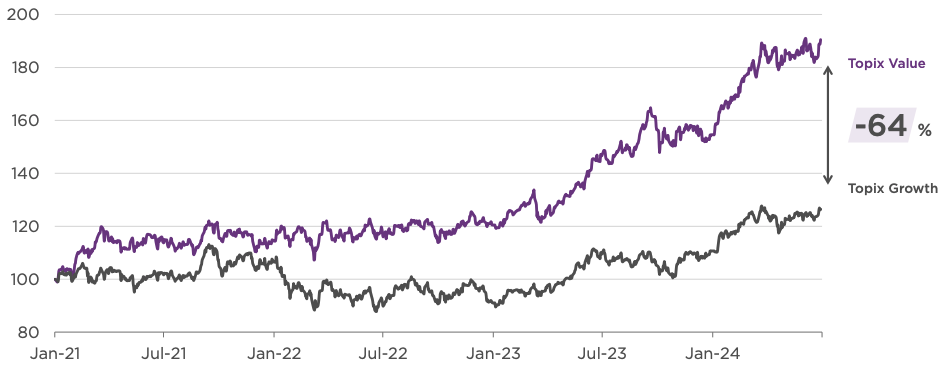

Over the past three years, many investors have flocked to Japan’s so-called value stocks, such as banks and commodity companies, due to rising interest rates and the historic weakness of the Japanese yen against the US dollar, as demonstrated in figure 2. Growth stocks, meanwhile, have underperformed value stocks over the same period. Since December 2020, the TOPIX Value Index has outperformed the TOPIX Growth Index by 73% (as seen in figure 3). During the same timeframe, our Comgest Japan Equities strategy, which seeks quality growth companies with track records of above-average, double-digit earnings growth and strong environmental, social and governance (ESG) credentials, also underperformed.

Past performance does not predict future returns. Returns may increase or decrease as a result of currency fluctuations. Source: Factset. Data as of 30-Jun-2024 in local currency. Indexes used are for comparative purposes only and none of the portfolios discussed seek to replicate an index.

In our view, value stocks have artificially propped up the overall performance of the Japanese stock market. As the interest rate gap between the United States and Japan narrows, we believe that the value trend of the past three years will come to an end and that growth will come back into favour, which long-term investors will appreciate.

Source: Comgest / FactSet financial data and analytics, unless otherwise stated. Data as of 30-Jun-2024 expressed in JPY. Indices : Topix Growth – Total Return and Topix Value -Total Return. Indices are used for comparative purposes only and the Strategy does not seek to replicate the indices.

PLANTING THE SEEDS OF A NEW GOLDEN ERA

In our perspective, there have been several long-term quality companies hiding in plain sight while investors were absorbed by the value stock rally. Small- and medium-sized companies (“SMID caps”), for instance, have largely underperformed in the Japanese stock market over the past three years as investors became blinded by the higher liquidity associated with value stocks.

As a result, we believe that the reduced value of several high-quality SMID caps2 offers investors a potential opportunity to find undervalued “gems” that could experience better performance once the Japanese market “normalises” and ends its decades-long policy of extremely low interest rates.3 Japanese companies are also demonstrating improved earnings per share growth and margins. For example, Comgest’s Japan strategy price-to-earnings growth ratio (PEG) – a metric that accesses growth – is at an all-time low of 1.4x.

We also believe that the yen’s volatility and sector rotation in response to macroeconomic developments over the past three years, especially US inflation data, underscores the strength of a long-term quality approach to stock selection. Since inception, the Comgest Japan Equities strategy has focused on identifying companies with competitive advantages, high barriers to entry and pricing power that we believe makes them capable of sustainably growing their earnings. From our perspective, long-term quality growth companies are less susceptible to macro-economic developments than value stocks, like banks and commodity companies, due to their company-specific drivers of growth.

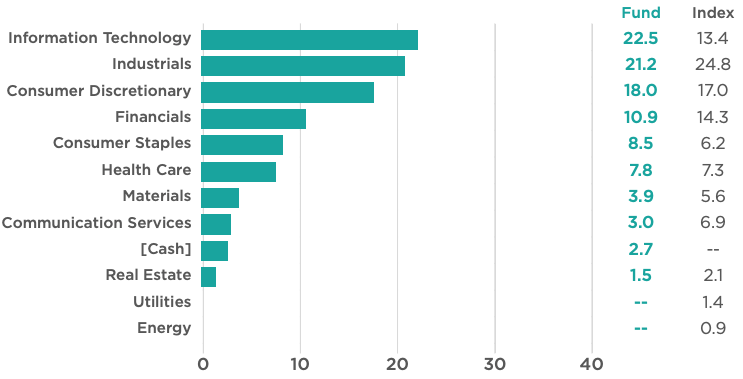

Source: Comgest / FactSet financial data and analytics, unless otherwise stated. Data as of 31-Jul-2024. Due to rounding difference, figures may not add up to 100%. Index: Topix - Net Return. The index is used for comparative purposes only and the Strategy does not seek to replicate the index. Breakdowns based on Comgest data, GICS sector and MSCI country classifications.

Our strategy avoids cyclical sectors and instead focuses on sectors with long-term secular growth trends, such as Japan’s ageing society, digitisation, Asia’s growing market and productivity enhancers. During our engagements with Japanese companies, we typically discuss digital transformation and recovering consumer demand following the COVID-19 pandemic. The sector allocation of our Japanese equities strategy reflects these insights and trends, as shown in figure 4.

We believe Japan’s emergence from two decades of deflation will likely benefit both companies and consumers in these sectors. Already, business investments in software and research and development (R&D) rose by 12.8% (after adjusting for inflation) in 2023 compared to the previous year. 4Increased R&D spending is a key factor in how our quality growth companies reinforce their competitive advantages and cement their innovation leads over rivals.

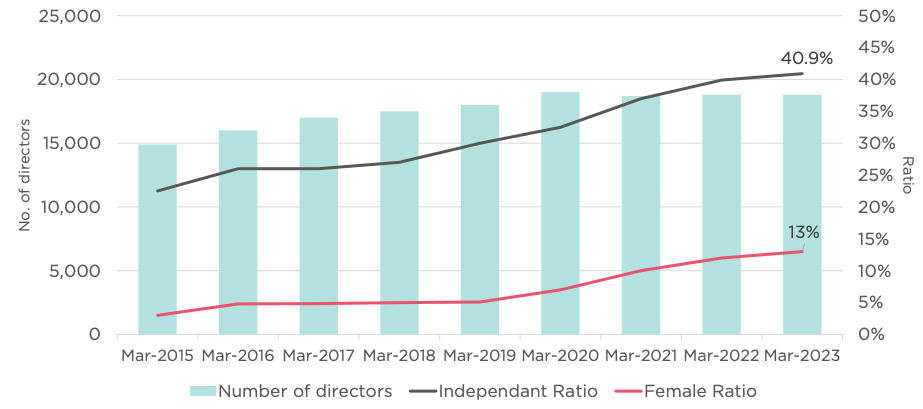

Corporate governance reform is another development that is starting to bear fruit in Japan as more and more Japanese companies are adopting strategic and targeted strategies. The introduction of Japan’s Corporate Governance Code in 2015 has resulted in the appointment of more independent directors (as seen in figure 5), increased shareholder activism and improved return on invested capital (ROIC).5 While regulatory changes have helped, we also believe that many Japanese companies understand that good governance is in their own interest. As long-term quality growth investors, we believe that this enables deeper engagement with Japanese companies.

Source: Bloomberg Finance L.P., JP Morgan as of 31-Dec-2023. Universe is TOPIX companies.

In our view, Japan’s corporate governance reforms, combined with low debt and substantial cash reserves, will open new avenues for capital expenditures and increase mergers and acquisitions, share buybacks and dividends. As Japan’s economic outlook improves, we believe that many companies in Japan will be able to increase their capital expenditure and M&A activity, which when done properly can lead to stronger business growth and improved returns for investors.

NURTURING ROOTS TO CULTIVATE THE FUTURE

One sign of Japan’s new golden era could be its family-owned companies. Japan is home to many of the world’s oldest companies and has one of the highest concentrations of large family-owned businesses. In Japan, one-third of all listed companies maintain some type of family control. Many of these businesses have been around for centuries and have survived previous periods of uncertainty, including wars, pandemics, natural disasters and volatile markets.

Investors tend to avoid family businesses altogether because they assume that professionally managed public companies can better raise capital, retain talent and implement succession plans. Although we recognise these limitations, our 17-years of on-the-ground experience in Japan has shown us examples of family businesses that are well-aligned with shareholder values and have established long-term strategies for success.

Based on our experience, family businesses value long-term relationships with stakeholders and are predisposed to preserve their performance as a means of protecting their family’s heritage, values and image in society. As long-term quality growth investors, we value companies that possess a combination of unique culture and resilience that will keep them growing in good and bad times.

Family businesses tend to prioritise structures that improve adaptability and strengthen resilience, which enables them to survive market downturns, according to a study published by McKinsey & Company.6 The same study found that founder- and family-owned businesses help foster a sense of trust, loyalty and ownership among employees. We believe that the purpose-driven mindset founder and family owners can help perpetuate a strong corporate culture that would likely take an externally recruited CEO years to create.

COMPANY EXAMPLES

The power of an employee-first culture

Obic, a leading family-owned Japanese business software provider that Comgest first met in 2005, exemplifies the type of high-quality companies that could contribute to Japan’s new era of growth. Founded in 1968 by Masahiro Noda – who remains Chair of the Board and a 23% shareholder – Obic has focused providing Japanese small- and medium-sized companies with enterprise resource planning technology.7 OBIC delivered 6.36% sales growth (year-on-year) and reported an increase in operating income for the 30th consecutive year, according to the company’s latest full-year earnings report.8 In our view, the company is strategically positioned to benefit from our portfolio’s “Changing Japan” growth trend, i.e., the adoption of more efficient ways of work. As more Japanese businesses digitise processes and move services to the cloud, including accounting and inventory control, Obic is poised to reap the rewards of this sustained growth.

We believe that the Obic’s employee-first culture, which has been maintained by the founding Chair’s leadership, offers another long-term competitive advantage over potential new entrants. “The driving force behind Obic’s growth is employee growth,” wrote Chair Masahiro Noda and President Shoichi Tachibana as part of the company’s 2023 Annual Report. Based on our experience, a key indicator of a quality growth company is a corporate culture that invests in the development and well-being of its employees. As OBIC’s employees note, “We are like the Chair’s children”.9 In our view, this defining corporate culture boosts employee morale and has contributed to one of Japan’s most reliable software solution companies. Unlike value stocks, we believe that the attributes of quality companies, such as Obic, can stand the test of time.

Execution is key

Another Japanese family-owned company that exemplifies how company fundamentals can result in consistent, long-term returns for investors is Keyence, the manufacturer of industrial automation equipment. Since 1974, the company’s founder and current Chair Takemitsu Takizaki has built a knowledge-based company that uses its workforce as consultants for factory automation. From our perspective, the company benefits from our portfolio’s long-term growth driver of solutions for an ageing population. The company has consistently delivered high operating profit margins – the percentage of revenue left after paying operating costs – for the past several decades, as evidenced by its reported 51.1% operating profit margin in 2023.10 As Japan’s workforce continues to age, we believe that Keyence is well-placed to provide customers with solutions to keep their factories running.

Over the years, the company has earned a reputation for maintaining a meritocratic culture that compensates its employees well and allows qualified engineers to conduct their own research. Keyence outsources its production process to a network of suppliers and assemblers. This “fabless” structure has incentivised Keyence to prioritise relationships with its supplier network to ensure that they receive excellent service. In a similar manner to Obic, we believe that Keyence’s culture has been heavily influenced by the consistent vision, style and values of its founder, which has been carefully maintained over decades.

Aside from a strong culture, we believe that Keyence’s sales efficiency, focus on operating profit and a solutions-first approach to customer relationships has enabled the company to grow consistently. Keyence’s unique sales approach, which relies upon a network of engineers rather than sales representatives or middle managers, has established a reliable domestic customer base.

The company’s sole metric – operating profit – has encouraged a cautious approach to spending, which has been successful in delivering sustainable growth over time, including a five-fold increase in returns to minority shareholders since the company’s inception. Keyence also does not see itself as a manufacturer of a product, but as a customer solutions company. The company’s engineers cater to their customers’ needs and offer tailored solutions.

AIMING TO REAP THE REWARDS OF LONG-TERM RETURNS

In our view, Japan’s value stocks are cyclical, lack visibility and – like fully-grown plants – will likely fade soon. We favour companies with deep-rooted competitive advantages making them capable of growing their earnings over the long term.

As the interest rate gap between the United States and Japan narrows, we believe that Japan’s market will normalise, which will favour long-term growth companies rather than short-term value stocks. Despite Japan’s value market rally over the past three years, we remain convinced that quality growth companies – those with significant longevity, visible growth, healthy free cash flow, high barriers to entry, and strong corporate culture – are better positioned for the long term.

From digitisation to addressing the needs of an ageing workforce, we believe that the companies in our Comgest Japan Equities strategy are well-positioned to potentially benefit from such long-term growth trends. In our experience, Japanese family- and founder-owned companies such as Obic and Keyence, are examples of undervalued stocks that are resilient and have company-specific growth drivers which can lead to consistent, long-term earnings growth. These are the types of quality growth companies that we believe have the potential to drive Japan’s future economic growth.

Japanese companies are typically under-researched by analysts compared to their counterparts in United States and Europe. This is evident in Japan’s value rally and the lack of attention being paid to the quality growth companies capable of delivering sustainable earnings growth that we know exist below the surface. In our view, many of these quality growth companies are historically undervalued. As we continue to nurture our Comgest Japan Equities strategy by patiently building positions in leading domestic and global companies, we hope to benefit from the promising long-term growth trends emerging from Japan’s new golden era.

Main Risks

- Investing involves risk including possible loss of principal.

- The value of all investments and the income derived therefrom can decrease as well as increase.

- Changes in exchange rates can negatively impact both the value of your investment and the level of income received.

- Comgest portfolios invest in limited number of securities and may therefore entail higher risks than those which hold a very broad spread of investments.

REFERENCES

1 Hyatt, Diccon. Here's How Much Central Banks Around the World Are Raising Interest Rates, Investopedia, 23-Mar-2023.↩︎

2 As of June 2024, SMID-caps comprise between 25-35% of Comgest’s Japanese equity strategy.↩︎

3 Normalisation refers to adjusting monetary policies, such as raising interest rates, to reduce inflation.↩︎

4 Saito, Jun. “Promoting Investment and Overcoming Deflation | Japan Center for Economic Research.” Japan Center for Economic Research, December 20, 2023.↩︎

5 Porter, Moeko, and Naoya Nishimura. “Have Corporate Reforms in Japan Unlocked Shareholder Value?” MSCI, March 14, 2024.↩︎

6 Asaf, Eduardo, Igor Carvalho, Acha Leke, Francesco Malatesta, and Jose Tellechea. The secrets of outperforming family-owned businesses: How they create value—and how you can become one. McKinsey & Company, November 28, 2023.↩︎

7 Source: OBIC Shares and Shareholders Information↩︎

8 Source: OBIC Financial Results Presentation for the Fiscal Year Ended March 31,2024↩︎

9 Comments made to OBIC’s Investor Relations staff to Comgest.↩︎

10 Source: Keyence, Financial Times↩︎

FOR PROFESSIONAL INVESTORS ONLY

Representative account information

The representative accounts discussed are managed in accordance with their relevant Composite since the Composite’s inception. The representative accounts are open-ended investment vehicles with the longest track record within their respective Composite. The performance results discussed reflect the performance achieved by the representative accounts. Accordingly, the performance results may be similar to the respective composite results, but the figures are not identical and are not being presented as such. The results are not indicative of the future performance of the representative account or other accounts and/or products described herein. Account performance will vary based upon the inception date of the account, restrictions on the account, and other factors, and may not equal the performance of the representative accounts presented herein.

Comgest claims compliance with the Global Investment Performance Standards (GIPS®). To receive GIPS-compliant performance information for the firm’s strategies and products please contact info@comgest.com. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Important Information

This document has been prepared for professional/qualified investors only and may only be used by these investors.

Not investment advice

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. It is incomplete without the oral briefing provided by Comgest representatives.

Not an investment recommendation

No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

Not investment research

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication

(a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Performance disclaimer

Past performance is not a reliable indicator of future results. Forward looking statements, data or forecasts may not be realised. This letter contains certain forward-looking statements, opinions and projections that are based on the assumptions and judgments of Comgest and the Strategy with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Comgest or the Strategy. Other events which were not taken into account in formulating such projections, targets or estimates may occur and may significantly affect the returns or performance of any Strategy managed by Comgest. Because of the significant uncertainties inherent in these assumptions and judgments, you should not place undue reliance on these forward-looking statements, nor should you regard the inclusion of these statements as a representation by Comgest that the Strategy will achieve any strategy, objectives or other plans. For the avoidance of doubt, any such forward looking statements, opinions and/or assumptions.

Trademark and index disclaimer

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners. The TOPIX Index Value and the TOPIX Marks are subject to the proprietary rights owned by JPX Market Innovation & Research, Inc. or affiliates of JPX Market Innovation & Research, Inc. (hereinafter collectively referred to as "JPX") and JPX owns all rights and know-how relating to TOPIX such as calculation, publication and use of the TOPIX Index Value and relating to the TOPIX Marks. S&P Dow Jones Indices LLC ("SPDJI"). S&P is a registered trademark of S&P Global ("S&P"); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones"). These trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Comgest. Comgest's fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones and S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in the fund nor do they have any liability for any errors, omissions, or interruptions of the index. MSCI data may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages (www.mscibarra.com).

Information provided subject to change without notice

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

Restrictions on use of information

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest's prior written consent.

Limitation of Liability

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Legal entity disclosure

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Its registered office is at 46 St. Stephen's Green, Dublin 2, Ireland.

Comgest Italia is the Italian branch of Comgest Asset Management International Limited, enrolled in the Milan Companies Register with no. MI-2587566 and in the CONSOB register with no. 191. Its registered office is at Via Del Vecchio Politecnico 9, 20121, Milan, Italy.

Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission.

Comgest Asset Management Japan Ltd. is regulated by the Financial Service Agency of Japan (registered with Kanto Local Finance Bureau (No. Kinsho1696)).

Comgest US L.L.C is registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Comgest Singapore Pte Ltd, is a Licensed Fund Management Company & Exempt Financial Advisor (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

The investment professionals listed in this document are employed either by Comgest S.A., Comgest Asset Management International Limited, Comgest Far East Limited, Comgest Asset Management Japan Ltd. or Comgest Singapore Pte. Ltd.

For UK only:

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

For Hong Kong only:

This advertisement has not been reviewed by the Securities and Futures Commission of Hong Kong.

For Singapore only:

This advertisement has not been reviewed by the Monetary Authority of Singapore.

For Australia only:

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).