Investment letters

GLOBAL EQUITIES: CULTIVATING A BALANCED GARDEN OF GROWTH

Comgest's Global Equities Team - 10-Dec-2025

KEY TAKEAWAYS

- The artificial intelligence (AI) boom has reshaped global equity markets, concentrating the MSCI AC World Index (ACWI) in a handful of US tech giants.

- As long-term investors, we prioritise growing portfolios rooted in diverse growth drivers, ensuring resilience beyond the AI.

- Comgest’s unconstrained approach spotlights quality growth regardless of sector or geography.

A BROAD SPECTRUM OF GROWTH

Rapid advancements in AI have led to unprecedented levels of concentration across global equity markets. As of October 2025, nine of the top 10 largest year-to-date contributors to the MSCI AC World Index were AI-linked companies.1Yet beneath the surface, investors are growing increasingly concerned about diversification and earnings durability of these leading stocks.2

Although several encouraging indicators suggest that the AI momentum could continue—including increased investment in datacentres, growing demand for computing power and expanding applications—potential headwinds remain. Signs of overcapacity, reduced funding, slower implementation and technological setbacks could quickly temper the current AI enthusiasm.3

At Comgest, we recognise the pitfalls associated with concentration risk. Like any well-tended garden, our portfolios thrive on diversification and draw strength from a mix of structural growth drivers. Rather than only planting our portfolio with AI stocks, we seek to cultivate resilience through other sectors such as healthcare, critical data, consumer products and industrial gases. This balanced approach underpins our Global Equity strategy and aims to deliver consistent returns over the long run.

When it comes to AI, our research tends to focus on the “enablers”, such as Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest chipmaker and a vital link in the AI supply chain. We typically avoid areas where the long-term winners are difficult to discern due to rapid innovation or constant disruption, such as AI models and chatbots.

In our garden of quality growth, we aim to plant companies rooted in lasting competitive advantages, strong earnings trajectories and experienced leadership. We believe this diversity is key to weathering volatility and delivering consistent long-term returns.

TURNING DATA INTO DIRECTION

While artificial intelligence and the Magnificent Seven4continue to dominate headlines, we see compelling opportunities for quality growth in other technology leaders outside this narrow focus. Software providers like Intuit offer critical tools for payroll management, tax preparation and accounting.

AI’s rapid advance has made high-quality data indispensable. Flawed datasets can trigger AI hallucinations, which could result in costly errors. By leveraging decades of proprietary data and trusted customer relationships, Intuit is positioned to deliver tangible productivity gains for small businesses, such as automated invoicing and real-time strategy recommendations.

The company is best known for TurboTax, its tax and financial software, which has become a primary filing tool for US retail and professional users. On the final day of the 2024 US tax season, Intuit processed 500 million user requests and 11 million transactions per second. In our view, this is a strong reflection of the company’s scale and reach.5

While Intuit is not an AI infrastructure provider, its deep reservoirs of data hold a distinct advantage in the current AI boom. Unlike software startups, Intuit benefits from decades of refined data and long-standing customer relationships. From our perspective, these advantages are formidable barriers to entry in an increasingly competitive market.

BLOSSOMING DIGITAL PAYMENTS

As with past technological revolutions, the mass adoption of AI has the potential reshape industries, displace incumbents and challenge established processes. At Comgest, our Global Equity team typically seeks companies that are resilient to change and well-positioned to harness the tailwinds of innovation.

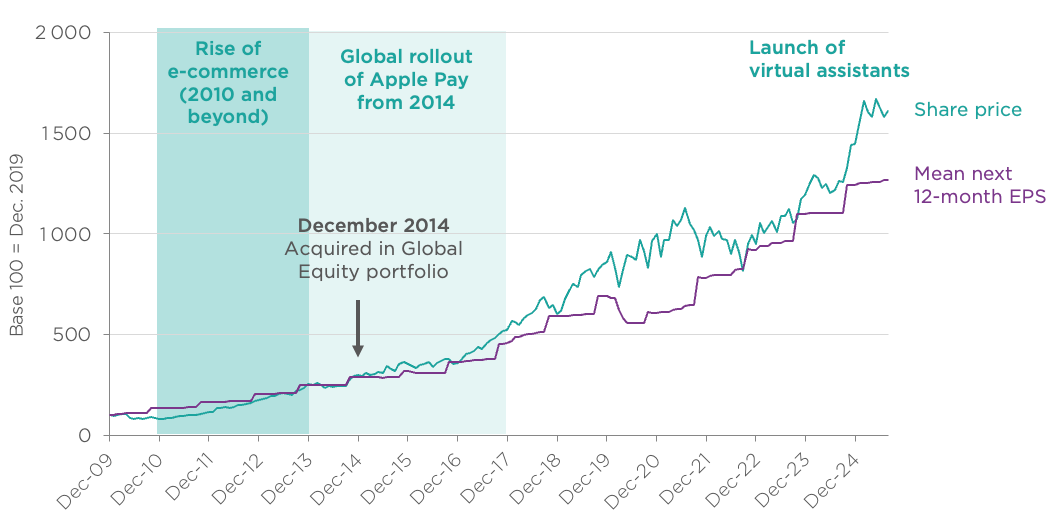

Visa, the American payments company, has demonstrated this time and again. Over the past decade, it has adapted to shifts such as the rise of e-commerce and Apple Pay, all while remaining the invisible infrastructure powering global transactions (as shown in Figure 1). In 2024, Visa processed 234 billion transactions with a cash volume of US$16 trillion, underscoring the scale and strength of its network.6From our perspective, that scale acts as a formidable barrier to competition.

Source: Comgest, Factset. Data as of 31-Aug-2025 expressed in USD. The security discussed herein may not be held in the portfolio at the time you read this material. The security discussed is provided for informational purposes only, is subject to change and do not constitute a recommendation to buy or sell the security. Past performance does not predict future returns.

Today, Visa faces a new challenge: AI-powered virtual assistants capable of executing purchases autonomously—from clothes to holidays.7In response, the company launched Visa Intelligence Commerce, a product designed to ensure secure and trusted payments in this emerging landscape.8Visa’s ability to adapt to each new payment revolution exemplifies the spirit of innovation that defines our portfolio holdings.

HARVESTING HEALTH

Healthcare is a key area of structural growth, one that we believe offers clarity through the fog surrounding today’s markets. Despite headwinds from tariffs and trade restrictions, we continue to identify quality growth companies across the sector. Our diversified holdings span medical equipment, animal health and pharmaceuticals—businesses driven by essential demand rather than short-term trends.

Swiss-based Lonza illustrates the long-term attributes we seek in healthcare companies. From its origins as a hydroelectric power station in the Alps, Lonza has evolved into a leader in outsourced pharmaceutical manufacturing. The company produces vaccines, capsules and health ingredients for many of the world’s largest drug companies—including Moderna, which partnered with Lonza to manufacture its pioneering mRNA Covid-19 vaccine.9

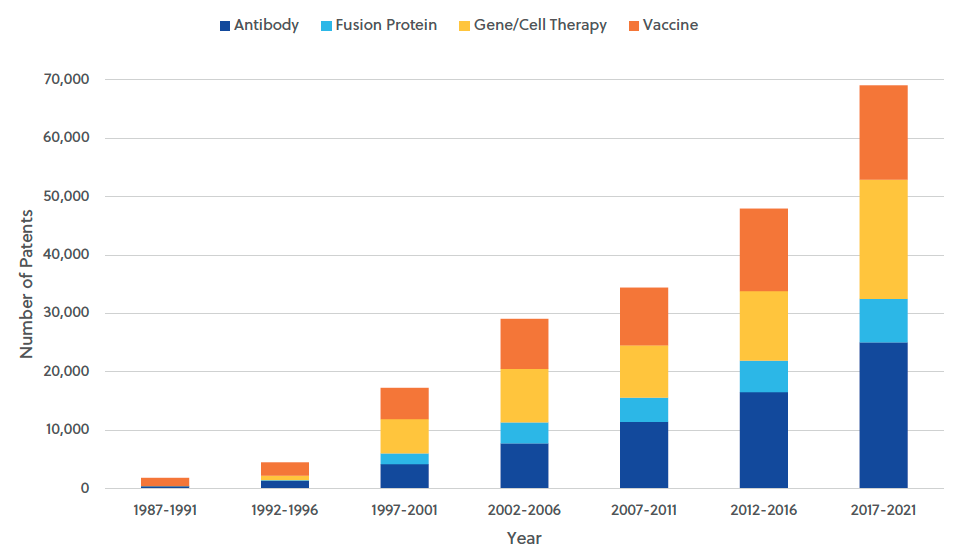

In recent years, Lonza has also emerged as a key player in biologics— therapies derived from living organisms such as proteins and genes.10These treatments are more complex and cost-intensive to produce than conventional drugs due to their highly specialised manufacturing process.

Source: The Rise of Biologics: Emerging Trends and Opportunities, American Chemical Society, 2023.

The biologics market, one of the fastest-growing therapeutic categories (as seen in Figure 2), is projected to reach US$567.7 billion by 2027—which represents a 9.2% growth rate since 2021.11As of July, Lonza reported a 39.3% year-to-date increase in integrated biologics sales, reflecting its strong positioning in this expanding market.12

With a Swiss heritage and extensive US presence—including facilities in California and Maryland— Lonza has successfully navigated shifting regulatory and geopolitical pressures.13Supported by 30 production sites across five continents and a volume-driven growth model, the company’s scale and operational depth provide stability and visibility through changing market conditions.14

MANY PLANTS, ONE GARDEN

While we recognise the transformative potential of AI, we believe that there are enduring opportunities that extend well beyond the most visible. In our view, true resilience lies in diversification and a deep understanding of structural growth drivers across sectors.

Our Global Equities strategy is built on decades of experience and a consistent focus on fundamentals. From chipmaker TSMC to software provider Intuit, payment leader Visa and healthcare manufacturer Lonza, these are kinds of businesses with strong competitive advantages and sustainable earnings growth that define our portfolios. By looking through the short-term haze and remaining grounded in our quality growth principles, we aim to deliver lasting value for our clients across all market cycles.

The following are the main risks relevant to the fund discussed in this presentation:

- Investing involves risk including possible loss of principal.

- The value of all investments and the income derived therefrom can decrease as well as increase.

- Changes in exchange rates can negatively impact both the value of your investment and the level of income received.

- Emerging markets may be more volatile and less liquid than more developed markets and therefore may involve greater risks.

- Comgest portfolios invest in limited number of securities and may therefore entail higher risks than those which hold a very broad spread of investments.

REFERENCES

1 “MSCI ACWI Index Factsheet - September 2025.” MSCI, Sept-30-2025.↩︎

2 Martin, Katie. “Bubble-Talk Is Breaking out Everywhere.” Financial Times, Oct-22-2025.↩︎

3 Lawder, David. “AI Investment Boom May Lead to Bust, but Not Likely Systemic Crisis, IMF Chief Economist Says .” Reuters, Oct-14-2025↩︎

4 Alphabet, Amazon, Apple, Broadcom, Meta Platforms, Microsoft, and NVIDIA.↩︎

5 Huber, Tori. “How Intuit Transformed Tax Filing Experiences for Millions of Consumers with AI/Genai This Tax Season.” Intuit Blog, 30-Jul-2024.↩︎

7 “AI Shopping Assistants: A Guide.” Salesforce. Accessed Oct-23-2025.↩︎

8 “Enabling AI Agents to Buy Securely and Seamlessly.” Visa. Accessed Oct-23-2025.↩︎

9 “Lonza and Moderna Announce Further Collaboration For Drug Substance Manufacturing of COVID-19Vaccine Moderna in the Netherlands.” Lonza, Jun-2-2021.↩︎

10 “What Are Biologics?” Cleveland Clinic Medical, Sept-10-2025.↩︎

11 “The Rise of Biologics: Emerging Trends and Opportunities.” Chemical Abstracts Service (CAS), American Chemical Society, 2023.↩︎

13 Le Poidevin, Olivia, and Cecile Mantovani. “Swiss Pharma Companies Eye Follow up to Pfizer-US PricingDeal, Business Lobby Says.” Reuters, Oct-1-2025.↩︎

FOR PROFESSIONAL INVESTORS ONLY

Important Information

This document has been prepared solely for professional/qualified investors and may be used only by such persons.

Not investment advice

This commentary is for informational purposes only and does not constitute investment advice or a solicitation to buy or sell any security. It does not take into account any investor’s specific investment objectives, strategies, tax status, or investment horizon, and should be read in conjunction with an oral briefing provided by Comgest representatives.

Not an investment recommendation

Any discussion of specific companies does not constitute a recommendation to buy or sell any particular security or investment. The companies mentioned do not represent all past investments, and it should not be assumed that any discussed investments were or will be profitable.

Comgest does not provide tax or legal advice to its clients, and all investors should consult their own tax or legal advisors regarding any potential investment.

Not investment research

The information contained in this communication does not constitute ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MiFID II. This means that (a) it has not been prepared in accordance with the legal requirements designed to promote the independence of investment research, and (b) it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Performance disclaimer

Past performance is not a reliable indicator of future results. Forward-looking statements, data or forecasts are based on assumptions and judgments by Comgest and the Strategy regarding future economic and market conditions, which are inherently uncertain and beyond the control of Comgest or the Strategy. Actual outcomes may differ materially, and unforeseen events may significantly affect performance.

Accordingly, no reliance should be placed on such statements as a guarantee that the Strategy will achieve its objectives or plans.

Trademark and index disclaimer

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners.

S&P Dow Jones Indices LLC ("SPDJI"). S&P is a registered trademark of S&P Global ("S&P"); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones"). These trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Comgest. Comgest's fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones and S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in the fund nor do they have any liability for any errors, omissions, or interruptions of the index.

Information provided subject to change without notice

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

Restrictions on use of information

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest's prior written consent.

Limitation of Liability

Certain information contained in this commentary has been obtained from sources believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Comgest accepts no liability for any errors or omissions in the information provided.

Legal entity disclosure

Comgest S.A. is regulated by the Autorité des Marchés Financiers (AMF). Comgest Asset Management International Limited is regulated by the Central Bank of Ireland and the U.S. Securities and Exchange Commission (SEC). Comgest US LLC is regulated by the SEC. Comgest Asset Management Japan Ltd. is regulated by the Financial Services Agency of Japan (registered with the Kanto Local Finance Bureau, No.

Kinsho 1696). Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission. Comgest Singapore Pte. Ltd. is a Licensed Fund Management Company and Exempt Financial Adviser (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

For UK only:

This commentary has not been approved under section 21 of the Financial Services and Markets Act 2000 (FSMA) by an person authorised. It is directed only at investment professionals as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). Investments are available only to to such persons, and any related agreement will be made solely with them. Persons who are not investment professionals should not rely or act upon this commentary. Recipients must observe all applicable restrictions and must not publish, distribute or share this commentary in whole or in part.