"Seeking the fountain of youth: Lindy's law and quality growth investing”

Albert Einstein once described compounding as the eighth wonder of the world. The longer the investment horizon, the greater its effect. This also applies to equity returns when high-quality companies grow sustainably over the long term. As a Quality Growth investor, our approach has been guided for decades by the belief that time can work in an investor’s favour. When analysing quality companies for inclusion in our Comgest Compounders equity strategies, we seek:

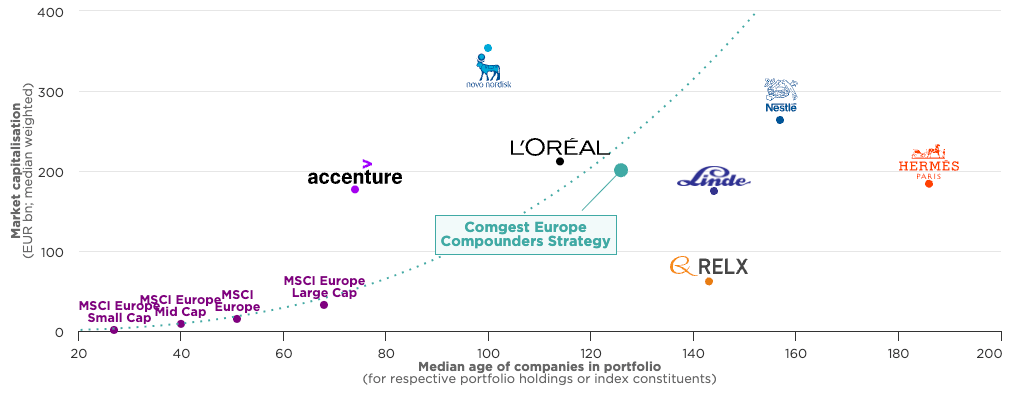

Our three Comgest Compounders equity strategies − Europe, Global and Japan − are all high conviction, low-turnover strategies that aim to deliver above-average returns at below-average risk. The types of companies we consider for inclusion in our Compounders’ strategies all demonstrate visibility, consistency and longevity of growth. These companies are typically industry leaders and/or dominant global players. Despite the passage of time, these companies are still achieving earnings growth by increasing their share of existing markets or venturing into new regions. Their growth is often fuelled by significant investment in R&D, innovation, product, sales channels or by expanding into adjacent segments. When successful, such investments − organic or through acquisition − enhance a company’s strength and market position. As a result, they continue to grow and extend their life expectancy. The impact of this effect increases exponentially over time, making it an important source of returns and much more difficult for competitors to replicate. We believe that time therefore favours Quality Growth investors – provided they identify the right companies, at the right time and invest in them for the long term. The principle of Lindy’s Law proposes that companies that have been successful for a long time are the ones with the best chance of building on that success well into the future. We call these companies ‘marathon runners’.

To invest successfully, investors must not simply rely on a great track record. Instead, they must carefully observe what has driven the long-term growth trend of the company and whether it is sustainable. We also believe that the strength of a company's ESG credentials is important in sustaining growth and lowering their risk profile. After all, not every Quality Growth company will be successful, just as not every young company will fail. "Marathon runners" only become apparent after they have survived and thrived through many crises and recessions. Only then will they have developed a comprehensive arsenal of strategies to not only grow when market conditions are good, but also survive the tough times. For Comgest, it is therefore vitally important when constructing a Compounders equity strategy to continually assess our long-term investment thesis for each company.

Past performance does not predict future returns.

Source: Comgest / FactSet financial data and analytics, unless otherwise stated. Data as of 31-Mar-2023 expressed in EUR. The MSCI Europe Large Cap, MSCI Europe Mid Cap and MSCI Europe Small Cap indices are used for comparative purposes only and the strategies do not seek to replicate the indices.

This strategy has the following core inherent risks (non-exhaustive list):

William Bohn

Analyst / PM

Quentin Borie

Analyst

Denis Callioni

Analyst / PM

Eva Fornadi

Analyst / PM

James Hanford

Analyst / PM

Mehdi Huet

Analyst

Bassel Choughari

Analyst / PM

Connor Middleton

Analyst

Mark Schumann

Analyst / PM

Franz Weis

CIO - PM

Petra Daroczi

ESG Analyst / PM

AVERAGE INDUSTRY EXPERIENCE IS 15 YEARS

Interested in knowing more about investing in our European, Global or Japanese Compounders equity strategies? Click below to discover which strategy is right for you.

Thorben Pollitaras, Mba

MANAGING DIRECTOR OF COMGEST DEUTSCHLAND GMBH

+49 211 44 03 87 – 22

Maximilian Neupert, Cfa

INVESTOR RELATIONS MANAGER DEUTSCHLAND

+49 211 44 03 87 – 26

Angela Dickel-Makhoul

MARKETING & INVESTOR SERVICES

+49 211 44 03 87 – 10