White papers

SEEKING THE FOUNTAIN OF YOUTH : LINDY'S LAW & QUALITY GROWTH INVESTING

ARCHIVED - 01-Mar-2023

KEY TAKEAWAYS

- The natural process of ageing is engraved in investors' mindsets, but companies do not age as we do

- Lindy’s Law explains an anti-ageing process for companies — the longer they last, the longer they are to last — which also describes the life of "marathon runners", the bedrock of returns we generate for our clients

- Investment in young companies and disruptive technologies, on the other hand, bears a high risk of failure

On May 17, 1993, Princeton astrophysicist Richard Gott compiled a list of all the then-current Broadway and off-Broadway shows and noted when each had first opened in New York’s famous theatre district.1He then predicted, “how long each show would run, based solely on how long it had been running already”.2Ultimately, Gott was proven right – with an accuracy of 95%.3He has thus illustrated his theory that everything we observe at “random” is likely to be in the middle of its lifetime.

Statisticians and mathematicians have a name for non-perishables whose life expectancy – seems to get longer with age: Lindy’s Law

Aside from Broadway shows, Gott’s theory has been applied to philosophical ideas related to politics, religion and even the fate of humanity, as well as non-perishable items such as art, technology and everyday inventions. Take books, for instance. The publishing industry has a golden rule that if a book has been in circulation and selling successfully for a decade, it will continue in the same vein for at least another decade. If a book is successful for another 10 years, that would raise its publication outlook to 20 more years. Economist Benjamin Graham’s books about investing, Security Analysis and The Intelligent Investor, were published in 1934 and 1948, respectively, and remain foundational readings.

If we relate this to long-term quality growth investors such as Comgest, our clients and prospective clients assess the potential sustainability of our investment results by tracking past performance. A longer track record is more appreciated by prospective clients than a shorter one. The sustainability of a track record can be viewed as proportional to its past – be it successful or unsuccessful. This is why we find that a long-term investment track record is so critical in our fast-moving investment industry. That is the reason why institutional investors tend to avoid putting capital in investment vehicles with track records of less than five years.

Even though time brings a greater appreciation of portfolio track records, people sometimes view this via a short-term lens. Why? Organic life, such as humanity, obviously has a finite lifespan. No matter how healthy our way of life may be or whatever progress mankind may make, human life expectancy remains limited. This sense of finality is so engraved in our mindsets that we tend to believe everything on earth ages as we do. But this assumption is wrong.

There's even a name, coined by statisticians and mathematicians, for non- perishables whose life expectancy – unlike that of humans – seems to get longer with age: Lindy’s Law.4

LINDY’S LAW AND GROWTH INVESTING

Applying Lindy’s Law to our industry implies that certain companies could have a long future because of their lengthy history. As long-term quality growth investors, this theory helps us to assess a company’s longevity and growth duration.

Companies – unlike people, milk or chicken – do not have a finite expiration date. Many operate well beyond the lives of their founders, executives and employees, while others do not. It is a Darwinian process: the longer a company operates, the greater its chances of surviving well into the future. Perhaps the greatest example of a business ageing in line with Lindy’s Law is Kongo-Gumi, the world’s longest continuously operating company, which for 14 centuries specialised in building Japanese Buddhist temples until it was acquired by another company.5

Lindy’s Law in action: Kongo-Gumi, a Japanese company specialising in Buddhist temples operated continuously for 14 centuries

Other examples include brands that have remained popular such as L’Oréal for more than 100 years in the beauty industry or Microsoft for close to 50 years in the IT industry. Both companies continue to be competitive and dominate their markets. We would say they are ageing in line with Lindy’s Law, i.e., backwards and thriving. We call these companies “marathon runners” because they grow consistently over very long time periods. They are the types of companies that we are continually seeking at Comgest.

In contrast, most of the investment industry tends to be enthralled by young companies, disruptive technologies or the next “big thing”. The ARK Innovation Exchange Traded Fund (ETF)6 is an example that rose to fame in 2020 during the Covid-19 pandemic. Its net asset value more than quadrupled between March 2020 and February 2021 thanks to investment in technologies such as “genomic sequencing, adaptive robotics, energy storage, artificial intelligence (AI), and blockchain”.7However, by February 2022, the ARK Innovation ETF had lost all of its gains – after just one year.

The rise and fall of the ARK Innovation ETF suggests that investing in young companies lacking a long and successful past can be a very painful exercise. Many of those companies might not have a long future exactly because they haven’t had a long history. It might be that disruptive technologies or the next “big thing” just fail, or because an established player grabs the new market opportunity. The success of Microsoft in the SaaS and Cloud markets, for example, is the result of the “winner takes all” rule describing a virtuous circle where an already successful and big company becomes even bigger and stronger. That is quintessential to Lindy’s Law.

LINDY’S LAW: A CHALLENGE TO TRADITIONAL FINANCIAL THEORY

Lindy’s Law can seem at odds with financial theory, which states that the competitive advantage period (CAP) – during which a company generates returns on investment that exceed its cost of capital – is limited.8

Many investors believe in mean reversion in the life of a stock which is foundational for the investment industry. Investors refer to it as the investor clock. The investor clock steers the tireless efforts of many market participants to search for promising investments and take profit in stocks held usually for a rather short period of time before profits as well as the share price are expected to fall again.

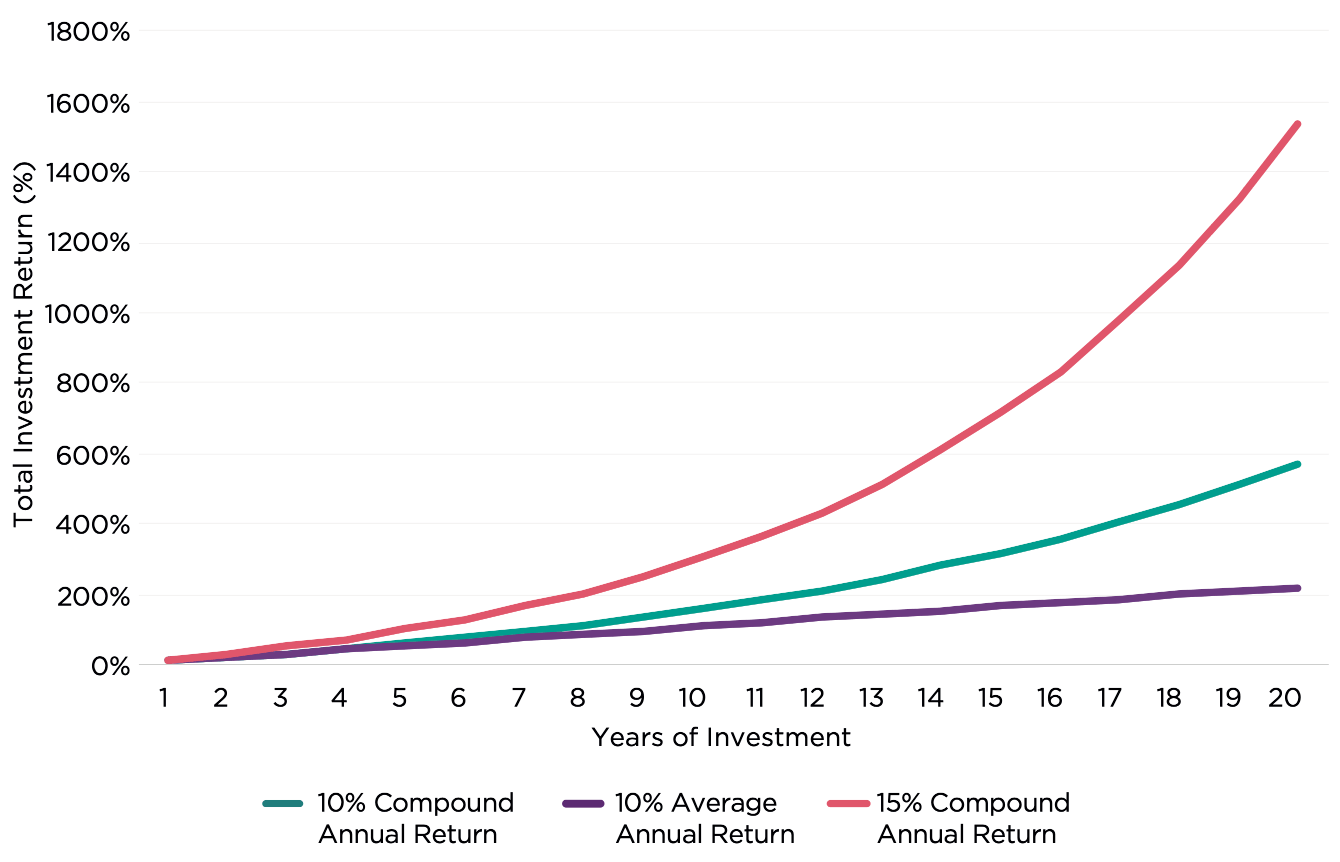

The information is presented for illustrative purposes only. All investments involve risk including the loss of principal. Source: Comgest; The compound return is the rate of return, usually expressed as a percentage, that represents the cumulative effect that a series of gains or losses has on an original amount of capital over a period of time. Compound returns are usually expressed in annual terms, meaning that the percentage number that is reported represents the annualised rate at which capital has compounded over time.

Source: Medium; Merrill Lynch (2021).Yet mean reversion, CAP theory or the investor clock sometimes tremendously fail to predict the future of a company. For the past 40 years L’Oréal’s earnings per share has grown by 11% per annum and their dividends by 14%.9Today, the company appears stronger than ever after establishing successful US- and China-based businesses as well as their growing e-commerce solutions. Compared to its foundation in 1909 when it was a single-product French hair colour company run by Eugène Schüller, a young chemist who invented and sold his innovative dyes to Parisian hair dressers, L’Oréal is now a global beauty brand powerhouse.

Marathon runners such as L’Oréal illustrate that financial theory and popular investment beliefs can significantly diverge when it comes to a company’s growth trajectory. According to Lindy’s Law, L’Oréal’s 114 years of historical experience should sustain their growth for many more decades in the future.

Nevertheless, it’s a stretch to assert that every long-standing company will be successful in the future simply due to their history. Likewise, we also cannot make an assumption that every young company will fail because of a lack of a successful track record. Such views are clearly too simplistic, narrow-minded and static interpretations of Lindy’s Law. Even Richard Gott’s forecast was only 95% accurate.

Occasionally, an outlier – like Microsoft – comes along. Founded in 1974, the rise of the company’s fortunes occurred in tandem with the decline of tech giant IBM, founded in 1911. Once the biggest IT company with an established and highly successful past, IBM started to struggle in the late 1980s and 1990s as it failed to innovate and adjust to the personal computer (PC) revolution – powered by its much younger competitor, Microsoft’s Windows operating system and office software.

To capture dynamic and sustainable long-term growth, Comgest seeks the right balance of marathon runners and established small- and mid-cap companies

Comgest remains cautious about participating in the IPOs of young and unproven companies, which often raise money to compete with larger peers. Their inexperience and the lack of track record makes it difficult to determine how sustainable their business is likely to be in the future and, therefore, to make a 5-year projection with a high degree of confidence.

We are rather trying to find the right balance of marathon runners and established small- and mid-cap companies to capture dynamic and sustainable long-term growth.

Our portfolio cannot, however, just rely on evidence of a great past. Marathon runners can sometimes fall off a cliff, as was the case of Tesco in the UK in the 2010s and, as dicussed above, IBM in the 1990s. This is a key issue for our long-term quality growth approach, as explored in our 2028 white paper, “When growth stalls: anticipating a growth investor's greatest challenge”.10Using Tesco as an example, this white paper illustrates how long-term growth investors like Comgest can spot certain red flags that could indicate a future growth stall of ‘marathon runners’ in order to sell out before it is too late.

For growth investors, Lindy’s Law establishes a link between the length of a company’s track record and the potential duration of future growth. It validates the tremendous value of long and consistent growth track records of marathon runners for growth investors, which could be underestimated by the short-termism of equity markets. At Comgest, we study these histories in detail to build on our own 20- and 30-year track records as an investor in L’Oréal and Microsoft and to project the next 5 years with a high degree of confidence.

LINDY’S LAW AND THE POWER OF COMPOUNDING

A main source of alpha for Comgest’s portfolios is the compounding effect of outstanding businesses that grow strong over a long time period. As a growth investor, time generally plays in our favour if we manage to successfully identify and invest in the right companies for the long term. This is the bedrock of the returns we generate for our clients.11

Figure 2 illustrates the benefit of compounding by comparing a hypothetical 10% and 15% compound return over 20 years with an average return of 10% p.a. over the same time period. The difference between the pink and green lines, which represent the compound returns, and the purple line, which depicts the average return, demonstrates the compounding effect.

Companies can perpetuate growth compounding by: 1) gaining market share in existing markets; 2) by investing in new geographic regions, innovation, new products or distribution channels; or 3) by expanding into adjacent markets. Investments of this kind, whether achieved through organic growth or acquisition, are successful when they increase the strength of a company, thus extending their life expectancy and growth. This is how companies become marathoners.

COMGEST’S COMPOUNDERS EQUITY STRATEGIES: THE EPITOME OF LINDY’S LAW FOR QUALITY GROWTH INVESTING

Within Comgest’s product range, we believe that our “Compounders” strategies are thoroughly aligned with principles of Lindy’s Law. The portfolios are exclusively dedicated to “marathon runners”. For these strategies, we search for the highest-quality companies with the longest duration of growth.

The information is presented for illustrative purposes only. All investments involve risk including the loss of principal. Source: Comgest; The compound return is the rate of return, usually expressed as a percentage, that represents the cumulative effect that a series of gains or losses has on an original amount of capital over a period of time. Compound returns are usually expressed in annual terms, meaning that the percentage number that is reported represents the annualised rate at which capital has compounded over time.

Compared to our traditional quality growth portfolios, our Compounders strategies are even more focused on the durability of growth over time rather than the absolute level of growth. For example, unlike our traditional large-cap strategies, our marathon runners are not expected to generate at least 10% annual EPS growth over our 5-year forecasting period. However, they must offer strong visibility on how they will pursue their growth path well beyond the 5-year forecasting period.

Consequently, between the time factor and stock holding period, the compounding effect becomes even more important to the return equation for our Compounders strategies versus our other Comgest quality growth strategies. This is evidenced by the very low turnover ratio of our “Compounders” strategies.

Launched three years ago, the Pan Europe Compounders Equities Strategy (“Pan Europe Compounders”)12was our inaugural “Compounders” strategy. As of end December 2022, the portfolio’s turnover ratio stands at 6% since inception – below that of our traditional European strategies.13Over the same period, our Pan Europe Large Cap Equities Strategy and Pan Europe Europe Smaller Companies Equities Strategy had a turnover ratio of 10% and 21%, respectively.14

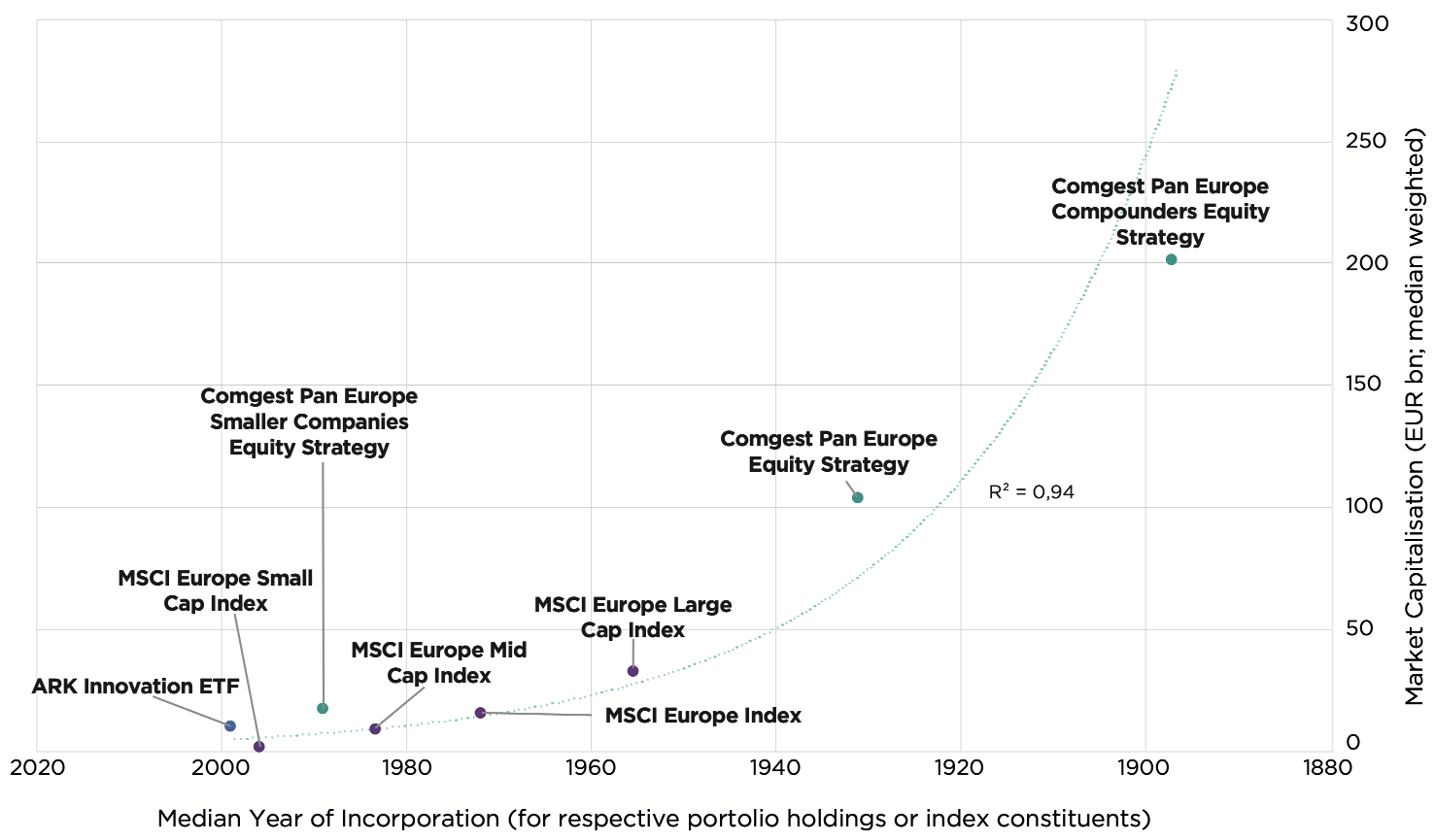

A simple way of assessing the significance of Lindy’s Law to our Pan Europe Compounders portfolio is to position the aggregate age and market capitalisation of its holdings to comparative benchmarks, our traditional large and SMID strategies as well as a portfolio almost entirely dedicated to young companies, i.e., the ARK Innovation ETF. The Pan Europe Compounders portfolio holdings have a median age of 113 years versus 22 years for the companies in the ARK Innovation ETF.

The older the company and the longer its growth track record, the higher its sales, cash flows and profits should be. This follows the “winner takes all” scenario and the power of compounding. Ultimately, marathon runners should combine their maturity with comparatively high market capitalisation.

Figure 3 shows the median year of incorporation and median market capitalisation of Comgest’s Pan Europe Compounders portfolio holdings against various comparative benchmarks. The chart establishes a clear link between median age and market cap. Comgest’s Pan Europe Compounders portfolio is positioned to maximise this compounding effect in the upper right hand part of the chart.

Past performance does not predict future returns. Source: Comgest / FactSet financial da/ta and analytics, unless otherwise stated. Data as of 31-Mar-2023 expressed in EUR. The Comgest Equity portfolios referenced in figure 5 refer to the following: Comgest’s Pan Europe Large Cap Equities Representative Account and Pan Europe Large Cap Compounders Equities Representative Account, which are pooled investment vehicles that have been managed in accordance with their respective Composites discussed since inception of each Composite. Please refer to the important information section for more details on the representative accounts, their selection methodology and where to receive a GIPS report of the Composites. The MSCI Europe Large Cap, MSCI Europe Mid Cap and MSCI Europe Small Cap indices are used for comparative purposes only. ARK Innovation ETF is an actively managed Exchange Traded Fund (ETF) that seeks long-term growth of capital by investing under normal circumstances primarily (at least 65% of its assets) in domestic and foreign equity securities of companies that are relevant to the ARK Innovation ETF investment theme of disruptive innovation.

The litmus test for Lindy’s Law is to estimate the future growth duration of our Compounders’ portfolio companies. Will the portfolio holdings of the Comgest’s Pan Europe Compounders prosper for the next 113 years15? This is a question a mathematician would try to answer based on Lindy’s Law.

Past performance does not predict future returns. Source: Comgest / FactSet financial data and analytics, unless otherwise stated. Data as of 31-Mar-2023 expressed in EUR. The Comgest Equity portfolios referenced in figure 5 refer to the following: Comgest’s Pan Europe Large Cap Equities Representative Account and Pan Europe Large Cap Compounders Equities Representative Account, which are pooled investment vehicles that have been managed in accordance with their respective Composites discussed since inception of each Composite. Please refer to the important information section for more details on the representative accounts, their selection methodology and where to receive a GIPS report of the Composites.

Comgest is a long-term investor, but when it comes to our Compounders product range – we strive to be very long-term investors. However, we don’t need to, and certainly can’t, make projections for the next 113 years. But we can build on the 113 years of track record that those companies offer us to project the next 5-10 years of growth with a very high degree of confidence.

In our view, Comgest’s Compounders strategies could be considered the most quintessential examples of Lindy’s Law among all of our quality growth strategies. Comgest’s Compounders portfolios combine older, established companies with long-duration growth track records and outlooks to maximise the power of compounding.

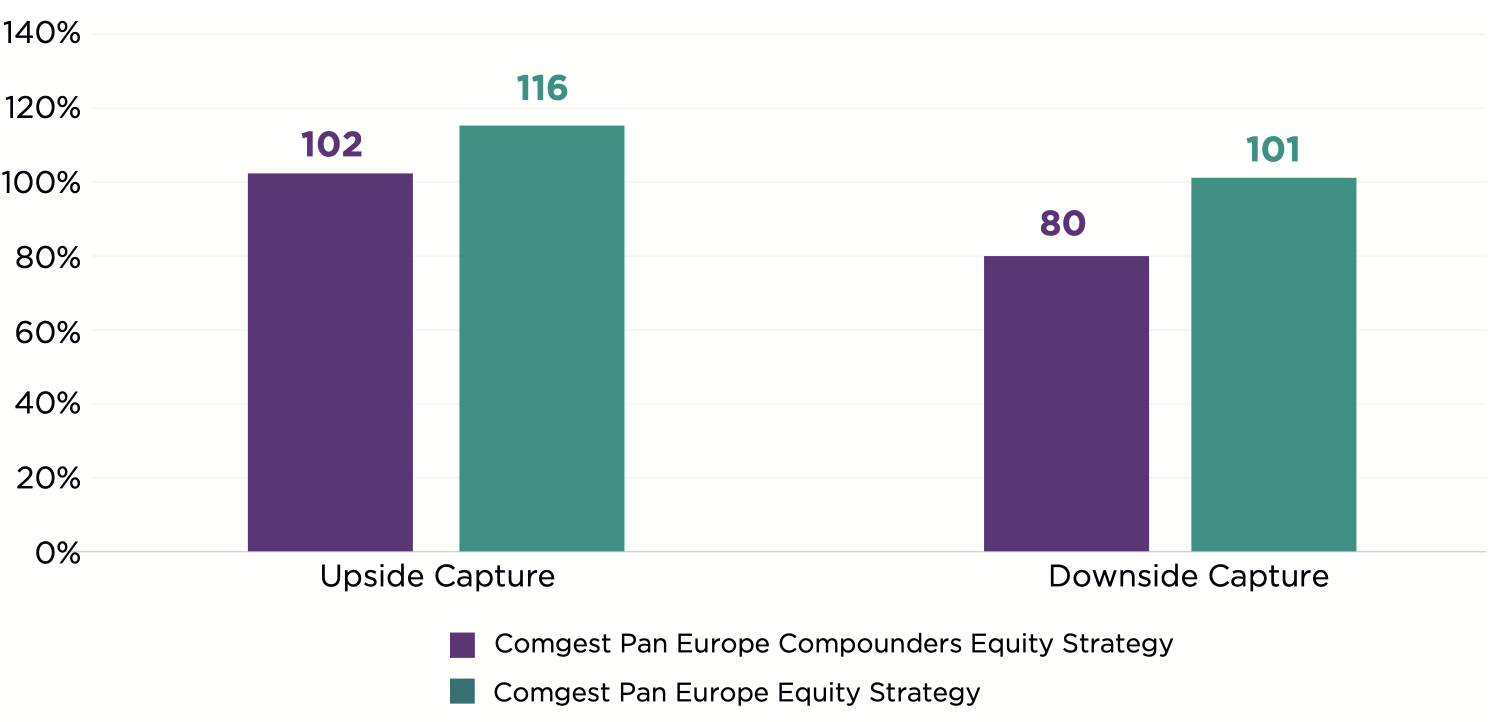

Companies that are an average of 113 years old have gone through many crises and recessions. As a result, they have developed an arsenal of weapons that allow them to grow even in tough economic times. That yields a highly defensive growth investment approach that has resulted in a very low downside capture of 80% for our original Pan Europe Compounders Strategy since the onset of the Covid pandemic, as shown in figure 4.

CONCLUSION

The natural process of ageing is so engraved in our mindsets that we tend to believe everything ages as we do. In contrast, Lindy’s Law describes how some companies are “anti-ageing” – developing greater strength and life expectancy as they become older. For Comgest, this law effectively describes the life cycle of the marathon runners in which we invest. These companies are the bedrock for the compounding benefit captured in all our quality growth portfolios.

Comgest’s Compounders strategies, such as our Pan Europe Compounders, are entirely dedicated to marathon runners and have proven to be a very defensive growth investment for our clients since their inception.

MAIN RISKS

The following are the main risks relevant to the strategies discussed in this paper:

- Investing involves risk including possible loss of principal

- The value of all investments and the income derived therefrom can decrease as well as increase

- Changes in exchange rates can negatively impact both the value of your investment and the level of income received

- The portfolio invests in a limited number of securities and may therefore entail higher risks than those which hold a very broad spread of investments

References

1 Ferris, Timothy. How to Predict Everything, The New Yorker, 12-Jul-99.

2 Parrish, Shane. The Copernican Principle: How To Predict Everything, Farnam Street, May 2019.

3 J. Richard Gott III, A grim reckoning, New Scientist, 15-Nov-1997. Gott applies the Copernican Principle to the fate of humanity.

4 Eliazar, Iddo. Lindy’s Law, Physica A: Statistical Mechanics and its Applications; 15-Nov-2017; Vol. 486: 797-805. Lindy’s Law (or the “Lindy effect”) comes from a 1964 New Republic article about New York comedians that met up every night at Lindy’s Deli to discuss their shows. The author hypothesized that the longer a show had been running, the longer its run was expected to continue in the future.

5 Kongo-Gumi Co., Ltd., part of Takamatsu Construction Group.

6 ARK Innovation ETF is an actively managed Exchange Traded Fund (ETF) that seeks long-term growth of capital by investing under normal circumstances primarily (at least 65% of its assets) in domestic and foreign equity securities of companies that are relevant to the ARK Innovation ETF investment theme of disruptive innovation.

7 Source: Twitter account of ARK Innovation ETF fund manager Cathie Wood, May 12, 2022.

8 Economic theory suggests that competitive forces will drive returns down to the cost of capital over time. CAP is hence finite and very often shown to last only a few years in textbook examples.

9 Company results, as of 31-Dec-22.

10 Wittet, Alistair. “When growth stalls: anticipating a growth investor's greatest challenge,” Comgest, June 2018. (To access this paper, please click our website link to select your country entry and then visit “Our Thinking/White Papers”).

11 This is unlike the non-growth or value investor. Time works against the non-growth or value investor because, without growth, returns converge towards the discount rate over long periods or the time value of money.

12 Pan Europe Large Cap Compounders Equities Strategy refers to the representative account of the Pan Europe Large Cap Compounders (Core Composite) Composite, managed in accordance with the Composite since inception of the Composite. Please refer to the important information section for more details on the representative account, its selection methodology and where to receive the GIPS compliant presentation of the composite.

13 Inception date: 23-Dec-2019.

14 The Comgest Equity portfolios refer to the following representative accounts: Comgest’s Pan Europe Large Cap Equities and Pan Europe Smaller Companies Equities, which are pooled investment vehicles that have been managed in accordance with their respective Composites discussed since inception of each Composite. Please refer to the important information section for more details on the representative accounts, their selection methodology and where to receive a GIPS report of the Composites.

15 The average year of incorporation of Comgest’s Pan Europe Compounders portfolio holdings is 1910.

IMPORTANT INFORMATION

Data as of 31 March 2023, unless stated otherwise.

This document has been prepared for professional/qualified investors only and may only be used by these investors.

Representative account information

The representative accounts discussed are managed in accordance with their relevant Composite since the Composite’s inception. The representative accounts are open-ended investment vehicles with the longest track record within their respective Composite. The performance results discussed reflect the performance achieved by the representative accounts. Accordingly, the performance results may be similar to the respective composite results, but the figures are not identical and are not being presented as such. The results are not indicative of the future performance of the representative account or other accounts and/or products described herein. Account performance will vary based upon the inception date of the account, restrictions on the account, and other factors, and may not equal the performance of the representative accounts presented herein.

Comgest claims compliance with the Global Investment Performance Standards (GIPS®). To receive GIPS-compliant performance information for the firm’s strategies and products please contact info@comgest.com. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Not investment advice

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. It is incomplete without the oral briefing provided by Comgest representatives.

Not an investment recommendation

No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable.

Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

Not investment research

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Performance disclaimer

Past performance does not predict future returns. Forward looking statements, data or forecasts may not be realised. The index used is for comparative purposes only and the portfolio discussed does not seek to replicate the index.

Information provided subject to change without notice.

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

Restrictions on use of information

This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest's prior written consent.

Limitation of Liability

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Trademark and index disclaimer

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners.

MSCI data may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information.

MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information.

Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.mscibarra.com).

GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Legal entity disclosure

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities Exchange Commission. Its registered office is at 46 St. Stephen's Green, Dublin 2, Ireland.

For UK only:

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

For Hong Kong only:

This advertisement has not been reviewed by the Securities and Futures Commission of Hong Kong.

For Singapore only:

This advertisement has not been reviewed by the Monetary Authority of Singapore.

For Australia only:

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).