Investment letters

US Equities: Why run when you can walk?

Comgest US Equities Investment Team - 13-Aug-2024

From top-tier research facilities to a business-friendly culture, the US possesses a compelling blend of qualities that make its companies appealing to investors. These advantages can be seen in the rising number of new US business applications, which surged from 3.5 million in 2019 to a record 5.5 million in 2023, according to the US Census Bureau.1

US equity investors all suffer from information overload. The growing number of companies they can invest in grows every year, each vying for capital and with many promising to be the next big thing. In the fast-changing US market, Comgest chooses to walk a consistent path to growth, passing by the short-term hype with a steadfast focus on our long-term investment strategy. Our Comgest US Equities strategy seeks durable brands with proven track records of above-average double-digit earnings growth, strong environmental, social and governance (ESG) credentials and experienced leadership teams. After all, why run to a potentially fleeting opportunity, when you can walk towards enduring quality growth?

Rather than rushing to our next investment opportunity, we prefer to take a deliberate approach in identifying quality growth companies in the U.S.

We pursue established quality companies – those with significant longevity, visible growth, healthy free cash flow, high barriers to entry, and strong corporate culture. Our US investment team also looks for “productivity enhancers,” which offer better products at lower cost, use fewer resources and are “all-weather performers” that provide critical services to consumers, including healthcare and software. In our view, such essential companies are well placed to achieve the sustainable growth that we seek as long-term investors.

DOING MORE WITH LESS

As the largest economy in the world, the US offers many flavours of growth for investors to explore. In our bottom-up research process, we actively look for companies that exhibit appealing profitability and growth profiles. The companies with high-quality products at lower cost tend to pass on their success to clients, creating sustainable cycles of profitability.

Source: Costco, Shutterstock, Comgest as of March 31, 2024. The data on the positions held are provided for informational purposes only, are subject to change and constitute neither a recommendation to buy nor a recommendation to sell the values displayed. The securities presented in this document may not be held in the portfolio at the time of receipt of this presentation.

Costco, the bulk-purchase discount retailer, is a prime example. Customers pay an annual membership fee (ranging from $60-$120) for access to Costco’s warehouse stores.2 This low-cost structure underpins razor-thin gross margins, which enables the company to sell high quality goods below the manufacturer’s minimum price. This low-cost structure attracts new members, which drives store-wide sales – as seen by the continuing rise in net sales worldwide. By increasing sales, Costco can then negotiate with manufacturers for even lower prices – ultimately leading to more members. Costco’s negotiations with suppliers benefit from a strong foundation of trust. Costco buys products directly from their suppliers – without intermediaries – which enables the company to enforce rigorous quality and sustainability standards.

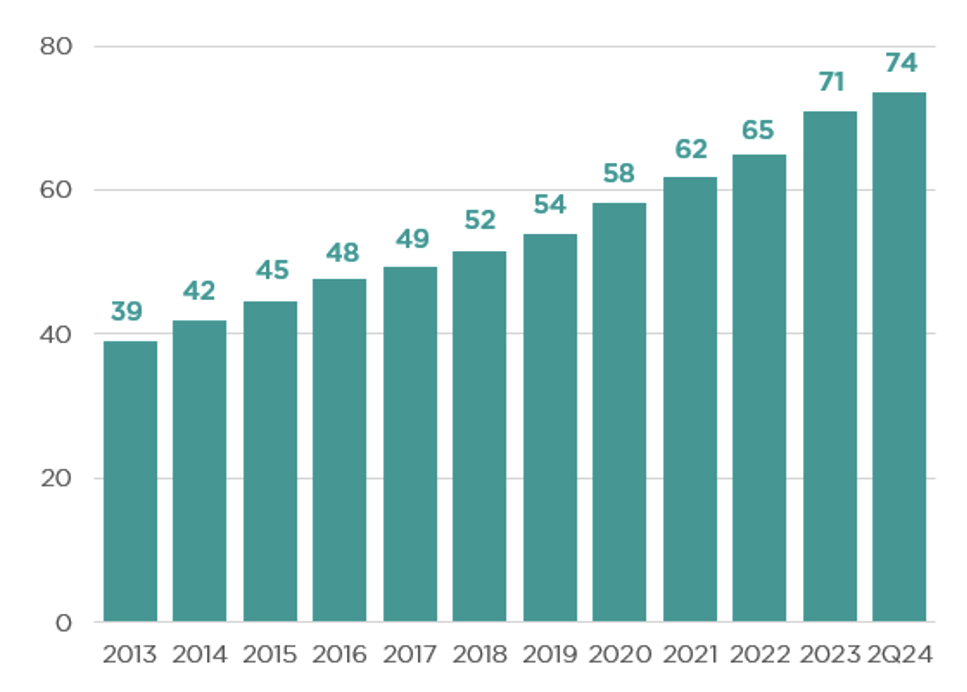

We view this “virtuous cycle”, which involves the company sharing financial gains with customers, as an extremely sustainable business model. Over the past decade, Costco’s total members have grown from 40 million in 2013 to 75 million as of last quarter.3 The company’s culture is exceptional, too. Costco typically pays its employees much more than their traditional rivals and offers additional benefits, including health insurance coverage. Happy employees also help profits: these benefits have resulted in low employee turnover (less than 8%), which has saved Costco the expense of having to train new employees.4

COME RAIN OR COME SHINE

The American culture of innovation enables companies to invest heavily in research and development (R&D) and design solutions to pressing problems. From medicine to software services, we believe that such non-discretionary companies are well positioned for long-term consumer demand. These companies experience consistent consumer demand, unlike discretionary stocks, which are vulnerable to economic cycles. In our view, innovative companies that solve complex consumer problems are more likely to build resilience and achieve sustainable growth.

Source: Gartner, Oracle, Comgest as of March 31, 2024. The data on the positions held are provided for informational purposes only, are subject to change and constitute neither a recommendation to buy nor a recommendation to sell the values displayed. The securities presented in this document may not be held in the portfolio at the time of receipt of this presentation.

One such company, Oracle, is a cloud services and database management company that has provided businesses with resource planning solutions for nearly five decades. Once perceived as a “mature company” due to its dominance in selling relationship database systems, Oracle’s rapid growth in cloud infrastructure and enterprise resource planning software markets has been largely overlooked by investors. Over the years, the company has patiently added new business facets, becoming one of the largest cloud enterprise resource planning providers in the world.

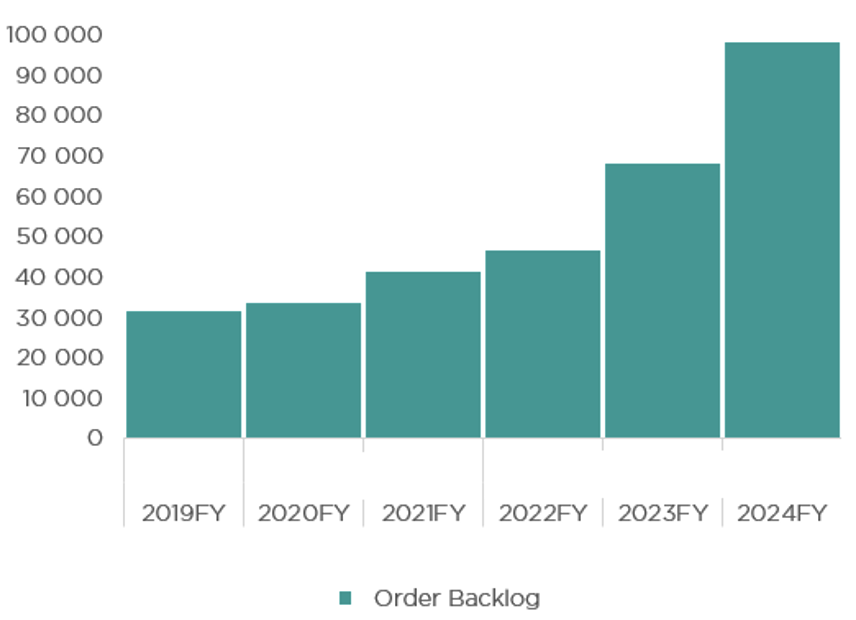

With the rise of artificial intelligence (AI), the company’s sales backlog for cloud services has grown from about 30 billion in 2019 to a projected 98 billion this year.5 To meet this growing demand, the company has expanded its use of renewable energy. Today, 80% of the company’s back-end infrastructure is powered by renewable energy and is expected to be fully renewable by 2025.6 Likewise, the company has sought to minimise electronic waste and explore energy and water efficiency solutions.

All-weather performers tend to leverage their R&D lead over competitors, pivoting into adjacent markets when the time is right. Over the course of 2020-2022, the company’s R&D-to-sales ratio was 16.8% compared to the industry average of 7.7%.7 With solid foundations, Oracle is a highly cash-generative legacy business that is accelerating its growth to meet modern client demands.

A FUTURE CHAMPION?

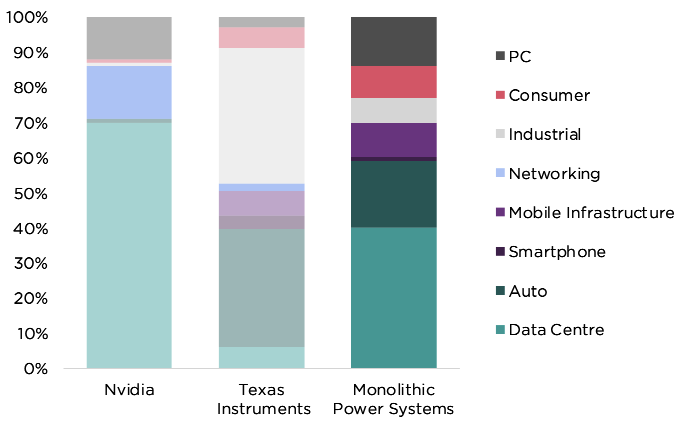

We prefer a concentrated portfolio of long-term holdings in our Comgest US equity strategy. We are always searching for new opportunities that align with our rigorous quality growth standards. We aim to invest in the companies designed to meet future challenges. One such example is Monolithic Power Systems (MPS), an electronics company specialising in semiconductors, which has consistently achieved faster growth compared to peers in the power management integrated circuit market.

Based in Kirkland, Washington, MPS provides its high-end power management semiconductors across a broad range of end markets, including data centres, automotive suppliers, computing companies, and industrial applications. MPS products are essential for managing the flow of electrical currents within integrated circuits. Founded over two decades ago, the company has leveraged its proprietary packaging technology to create smaller, energy-efficient chips which are key for AI applications.

Source: BofA, Comgest, as of June 2024. Data on positions held are provided for information purposes only, are subject to change and constitute neither a recommendation to buy nor a recommendation to sell the values displayed. The securities presented in this document may not be held in the portfolio at the time of receipt of this presentation. Any projections or estimated data are for informational purposes only and are not guaranteed.

MPS is also a crucial supplier to major technology companies, including Nvidia and Google, as well as automotive leaders, such as Tesla and Mercedes. As evidenced by the company’s return on invested capital, which increased from 27% in 2019 to over 50% in 2022,8 they are building an innovation lead over competitors. In our view, MPS shares many of the same characteristics as other all-weather performers given its diverse end markets, client base, steady share gains, and high returns.

SLOW AND STEADY WINS THE RACE

When seeking to maximise your investment opportunity for the long haul, it’s best to pace yourself. This is why Comgest prefers to walk – with a patient and conviction-driven approach that enables us to identify resilient companies capable of compounding growth over time.

Looking at the US market, we favour companies with sustainable earnings growth. Being bottom-up stock selectors, we aren’t bound by sectors, benchmarks or trends (such as the Magnificent Seven). With nearly 40 years of experience in quality growth investing around the world, we believe that company-specific growth drivers are the best indicators of a company’s long-term success. For Comgest, companies such as Costco, Oracle and MPS not only demonstrate these fundamentals, but also resilience, regardless of market conditions.

MAIN RISKS

- Investing involves risk including possible loss of principal.

- The value of all investments and the income derived therefrom can decrease as well as increase.

- Changes in exchange rates can negatively impact both the value of your investment and the level of income received.

- Comgest portfolios invest in limited number of securities and may therefore entail higher risks than those which hold a very broad spread of investments.

REFERENCES

- United States Census Bureau. “Business and Industry.” United States Census Bureau. Accessed June 24, 2024. https://www.census.gov/econ/currentdata/?programCode=BFS&startYear=2023&endYear=2024&categories%5B%5D=TOTAL&dataType=BA_BA&geoLevel=US&adjusted=1¬Adjusted=1&errorData=0.↩︎

- Costco website: “Welcome to Costco Customer Service,” accessed June 24, 2024.↩︎

- Source: Costco, Q1 2024 earnings call, Comgest↩︎

- Ton, Zeynep. Lessons from Costco on Sustainable Growth, Harvard Business Review, 13-Mar-2024.↩︎

- Source: Gartner, Oracle, Comgest; as of 31-Mar-2024.↩︎

- Source: Oracle, Oracle Commits to Powering Its Global Operations with Renewable Energy by 2025, June 23, 2021.↩︎

- Source: Factset/Comgest, 2020-2022↩︎

- Source: Morgan Stanley, World Semiconductor Trade Statistics, Comgest; as of 31-Mar-2024.↩︎

IMPORTANT INFORMATION

This document has been prepared for professional/qualified investors only and may only be used by these investors.

This material is not intended for the US market.

Not investment advice

This commentary is for information purposes only and it does not constitute investment advice. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon.

Not an investment recommendation No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular security/ investment. The companies discussed do not represent all past investments. It should not be assumed that any of the investments discussed were or will be profitable, or that recommendations or decisions made in the future will be profitable. Comgest does not provide tax or legal advice to its clients and all investors are strongly urged to consult their own tax or legal advisors concerning any potential investment.

Not investment research

The information contained in this communication is not an ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MIFID II. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Performance disclaimer

Past performance is not a reliable indicator of future results. Forward looking statements, data or forecasts may not be realised.

Trademark and index disclaimer Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners. S&P Dow Jones Indices LLC (“SPDJI”). S&P is a registered trademark of S&P Global (“S&P”); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). These trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Comgest. Comgest’s fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones and S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in the fund nor do they have any liability for any errors, omissions, or interruptions of the index.

MSCI data may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information.

MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.mscibarra.com).

Information provided subject to change without notice All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

Restrictions on use of information This commentary and the information herein may not be reproduced (in whole or in part), republished, distributed, transmitted, displayed, or otherwise exploited in any manner by third parties without Comgest’s prior written consent.

Limitation of Liability

Certain information contained in this commentary has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. No liability is accepted by Comgest in relation to the accuracy or completeness of the information.

Legal entity disclosure

Comgest S.A is a portfolio management company regulated by the Autorité des Marchés Financiers and whose registered office is at 17, square Edouard VII, 75009 Paris.

Comgest Asset Management International Limited is an investment firm regulated by the Central Bank of Ireland and registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Its registered office is at 46 St. Stephen’s Green, Dublin 2, Ireland.

Comgest Italia is the Italian branch of Comgest Asset Management International Limited, enrolled in the Milan Companies Register with no. MI-2587566 and in the CONSOB register with no. 191. Its registered office is at Via Del Vecchio Politecnico 9, 20121, Milan, Italy.

Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission. Comgest Asset Management Japan Ltd. is regulated by the Financial Service Agency of Japan (registered with Kanto Local Finance Bureau (No. Kinsho1696)).

Comgest US L.L.C is registered as an Investment Adviser with the U.S. Securities and Exchange Commission. Comgest Singapore Pte Ltd, is a Licensed Fund Management Company & Exempt Financial Advisor (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

The investment professionals listed in this document are employed either by Comgest S.A., Comgest Asset Management International Limited, Comgest Far East Limited, Comgest Asset Management Japan Ltd. or Comgest Singapore Pte. Ltd.

For UK only:

This commentary is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA) by a person authorised under FSMA. This commentary is being communicated only to persons who are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). The Investments are available only to investment professionals, and any invitation, offer or agreement to purchase will be engaged in only with investment professionals. Any person who is not an investment professional should not rely or act on this commentary or any of its contents. Persons in possession of this document are required to inform themselves of any relevant restrictions. No part of this commentary should be published, distributed or otherwise made available in whole or in part to any other person.

For Hong Kong only:

This advertisement has not been reviewed by the Securities and Futures Commission of Hong Kong.

For Singapore only:

This advertisement has not been reviewed by the Monetary Authority of Singapore.

For Australia only:

Comgest Far East Limited is regulated by the Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. Comgest Far East Limited is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).

Comgest Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore under Singaporean laws, which differ from Australian laws. Comgest Singapore Pte. Ltd. is exempt from the requirement to hold an Australian financial services licence under the Australian Corporations Act in respect of the financial services that it provides. This commentary is directed at “wholesale clients” only and is not intended for, or to be relied upon by, “retail investors” (as defined in the Australian Corporations Act).