You are visiting United Kingdom

If this is incorrect,

27-Oct-2025

With around 5,000 listed companies and an average of 400 IPOs each year since 2020, the US equity market offers abundant opportunities—but also hidden risks. At Comgest, our quality growth investment approach acts as a compass, guiding us toward companies built to stand the test of time, with enduring competitive advantages, such as brand strength, pricing power and a proven ability to innovate. In a market where innovation accelerates and competition never sleeps, quality remains our north star.

Driven by this approach, our US Investment team seeks out businesses that drive productivity—offering more efficient solutions and helping customers save time or cost—as well as resilient “all-weather performers” delivering essential services like healthcare and software. In our view, such companies may be better positioned to sustain long-term growth across varying market conditions and macroeconomic headwinds.

Within the forest of US equities, the evergreen companies we seek have the durability to compound growth over decades. Drawing on over 15 years of experience, we focus on businesses with deep roots: significant longevity, visible growth, healthy free cash flow, high barriers to entry and strong corporate culture. The US innovation ecosystem— where world-class research institutions intersect with a risk-taking entrepreneurial culture—provides fertile ground for research and development that fosters renewal and durability.

Oracle exemplifies this spirit of innovation. For over 50 years, Oracle has provided essential resource planning solutions while transforming from a traditional database model into one of the largest cloud enterprise planning providers through strategic acquisitions and rising AI demand. As of September 2025, Oracle’s cloud infrastructure as a service (IaaS) business recorded quarterly backlog sales increase of US$315 billion, driven by major contracts with OpenAI, Meta, AMD and Nvidia.1Furthermore, Oracle’s Q1 FY/2026 press release reported cloud revenue (IaaS + SaaS) of US$7.2 billion, up 28% year-on-year.2

Based on our research, Oracle’s differentiated cloud architecture serves as a competitive advantage over its peers by enabling better deployment and lower costs. We also believe that the company’s five-decade legacy as a database provider reinforces its expertise in securely managing critical enterprise data. These advantages, coupled with Oracle’s strategic vision and disciplined execution, position the company as a compelling example of the qualities we seek in a long-term investment—driving sustainable growth in revenue, earnings and scale.

For today’s market leaders, longevity and adaptability remain common threads. Both Oracle and Netflix—still led or influenced by their founders—have navigated multiple business cycles and evolving technologies, tapping vast total addressable markets (TAMs).

Investor enthusiasm has recently focused on AI-related stocks, particularly the “Magnificent Seven,” which accounted for over 30% of the S&P 500’s market capitalisation as of September 2025.3 While our US Equity strategy maintains some exposure, our investment approach is not confined to any single sector or benchmark.

In our view, video-streaming service Netflix illustrates how deep competitive advantages can leverage technology to strengthen its core product offerings. While not a major AI model developer, Netflix integrates AI tools to enhance user experience and production efficiency—a pragmatic approach to innovation that supports long-term productivity rather than short-term hype.

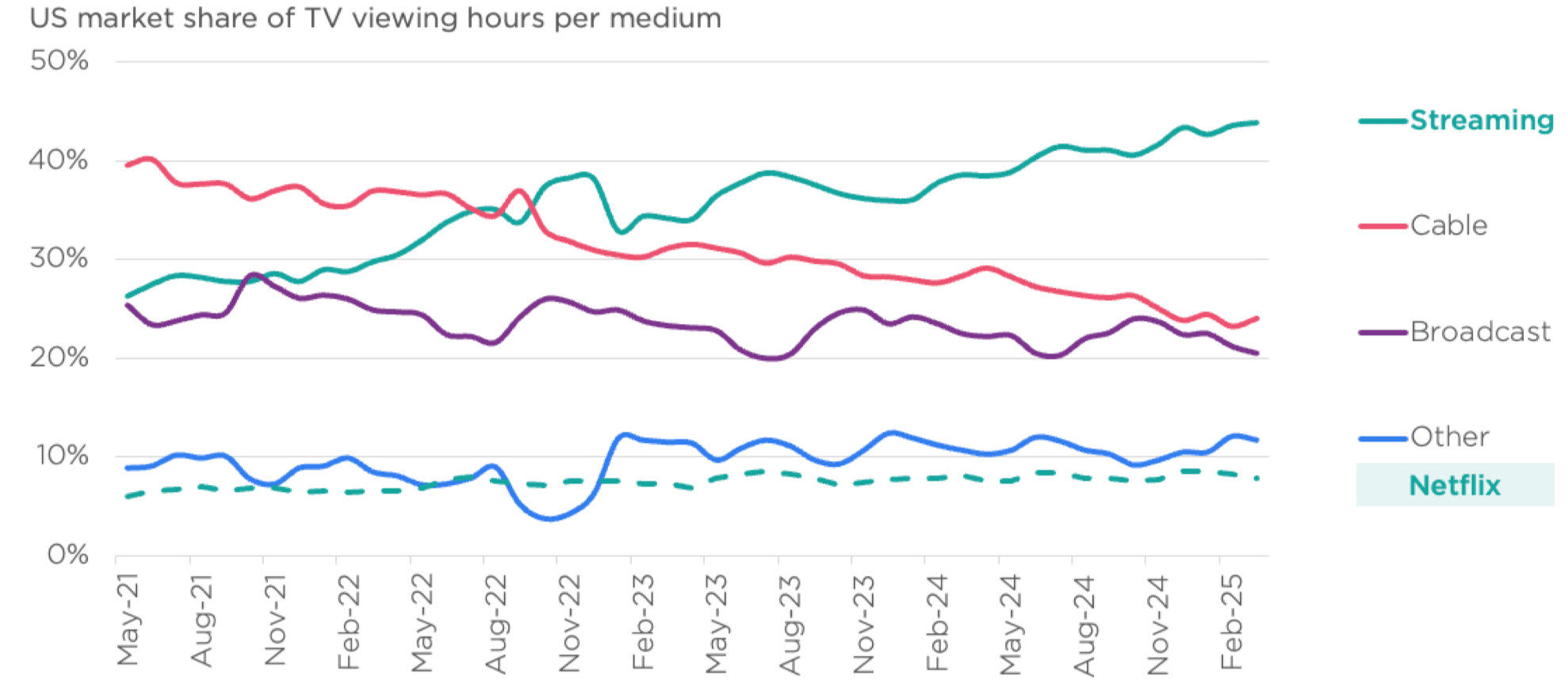

Source: Neilsen, as of 01-Aug-2025.

As consumers continue shifting from traditional cable packages to streaming, we believe that Netflix remains well positioned to capture this growing share of the market. As of August 2025, streaming accounted for nearly 50% of US TV viewing hours, while cable and broadcast fell to around 20% (see Figure 1).

Beyond its diverse catalogue, Netflix is among the most cost-efficient platforms— subscribers pay about $0.20 per hour of viewing, versus roughly $0.61 per hour for cable4, and $0.50–$0.80 for premium streaming services such as HBO Max and Amazon Prime Video5. In that sense, Netflix acts as a “productivity enhancer”, offering more value for less cost.6

At Comgest, we look for companies with long reinvestment runways— those able to deploy profits effectively to reinforce their competitive advantages and expand their share of structurally growing markets. For Netflix, this is evident in content spending, with amortization expenses around 39% of revenues in 2024.7 As long-term investors, we view this reinvestment as a virtuous circle—deepening advantages and strengthening subscriber loyalty by delivering fresh and engaging content.

Just as Netflix continues to innovate, we apply the same long-term lens to companies that are well-positioned to benefit from certain structural themes. We take a patient, team-based approach to identifying high-quality growth companies. Rather than chase trends, we pitch our tents, assess carefully and focus on the long term.

Companies like Ferguson, a specialised distributor of plumbing, HVAC, industrial, fire and water solutions, demonstrates the type of diversified, well-positioned businesses we seek. As a pure domestic player, Ferguson benefits from long-term trends in US infrastructure and building activities.

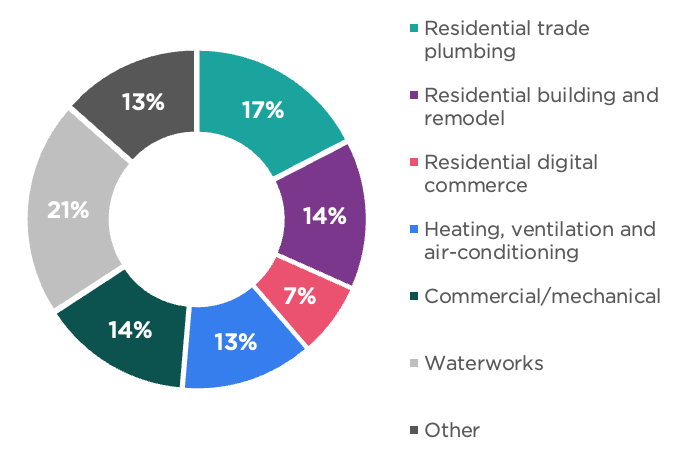

Source: Ferguson, Comgest as of 31-May-2025

Serving residential and non-residential sectors in both new construction and maintenance projects, Ferguson has a presence in eight end-markets. Its nationwide footprint—95% of the company's customers are located within 60 miles of a retail branch, import centre or warehouse—offers a competitive edge due to proximity and service in a fragmented industry.8

Our strength lies in collaboration and shared conviction— debate-driven discussions that challenge assumptions and refine ideas.

We look beyond the noise to find companies with strong moats, sustainable earnings growth, robust free cash flow, and enduing corporate cultures. Four decades of experience have taught us that quality compounds—and these fundamentals, not short-term trends, drive lasting value.

While some holdings like Oracle benefit directly from AI, our investment style also uncovers quality growth in less obvious sectors such as construction and plumbing. In a constantly evolving market, our compass remains steady, guiding us towards enduring quality—wherever it grows.

1 Comgest research note, 26-Sep-2025↩︎

2 Currency: USD. Source: Oracle Announces Fiscal Year 2026 First Quarter Financial Results (Press Release), Oracle Corporation, 9-Sep-2025.↩︎

3 CordCutting.com, “Subscribers pay 61 cents per hour of cable but only 20 cents per hour of Netflix,” and Reelgood.com analysis based on Netflix’s standard plan ($9.99/month) and estimated viewing hours, 2023.↩︎

4 CordCutting.com, “Subscribers pay 61 cents per hour of cable but only 20 cents per hour of Netflix,” and Reelgood.com analysis based on Netflix’s standard plan ($9.99/month) and estimated viewing hours, 2023. 5 ↩︎

5 Pricing estimates for HBO Max and Amazon Prime Video based on publicly available subscription data and average viewing-hour assumptions (HBO Max official pricing; Tom’s Guide, “What streaming costs in 2025: the price of Netflix, Disney Plus, Max and more” 2025).↩︎

6 These figures above are provided for illustrative purposes only, rely on publicly available data and assume methodologies cited by third-party sources. They were not verified or furnished by the companies mentioned and may vary depending on subscription plan, usage and regional pricing.↩︎

7 Netflix, Inc., Form 10-K for the Fiscal Year Ended December 31, 2024 (Washington, D.C.: U.S. Securities and Exchange Commission, filed January 27, 2025). ↩︎

8 Ferguson plc, Annual Report on Form 10-K for the Fiscal Year Ended July 31, 2024, filed September 25, 2024 (Washington, D.C.: U.S. Securities and Exchange Commission). ↩︎

This document has been prepared solely for professional/qualified investors and may be used only by such persons.

This commentary is for informational purposes only and does not constitute investment advice or a solicitation to buy or sell any security. It does not take into account any investor’s specific investment objectives, strategies, tax status, or investment horizon, and should be read in conjunction with an oral briefing provided by Comgest representatives.

Any discussion of specific companies does not constitute a recommendation to buy or sell any particular security or investment. The companies mentioned do not represent all past investments, and it should not be assumed that any discussed investments were or will be profitable.

Comgest does not provide tax or legal advice to its clients, and all investors should consult their own tax or legal advisors regarding any potential investment.

The information contained in this communication does not constitute ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with MiFID II. This means that (a) it has not been prepared in accordance with the legal requirements designed to promote the independence of investment research, and (b) it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance is not a reliable indicator of future results. Forward-looking statements, data or forecasts are based on assumptions and judgments by Comgest and the Strategy regarding future economic and market conditions, which are inherently uncertain and beyond the control of Comgest or the Strategy. Actual outcomes may differ materially, and unforeseen events may significantly affect performance.

Accordingly, no reliance should be placed on such statements as a guarantee that the Strategy will achieve its objectives or plans.

Product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners.

S&P Dow Jones Indices LLC ("SPDJI"). S&P is a registered trademark of S&P Global ("S&P"); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones"). These trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Comgest. Comgest's fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones and S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in the fund nor do they have any liability for any errors, omissions, or interruptions of the index.

All opinions and estimates constitute our judgment as of the date of this commentary and are subject to change without notice. The portfolio holdings referenced herein may not be held at the time you receive this publication and are subject to change without notice.

Comgest S.A. is regulated by the Autorité des Marchés Financiers (AMF). Comgest Asset Management International Limited is regulated by the Central Bank of Ireland and the U.S. Securities and Exchange Commission (SEC). Comgest US LLC is regulated by the SEC. Registration as an investment adviser with the SEC does not imply a certain level of skill or training. Comgest Asset Management Japan Ltd. is regulated by the Financial Services Agency of Japan (registered with the Kanto Local Finance Bureau, No. Kinsho 1696). Comgest Far East Limited is regulated by the Hong Kong Securities and Futures Commission. Comgest Singapore Pte. Ltd. is a Licensed Fund Management Company and Exempt Financial Adviser (for Institutional and Accredited Investors) regulated by the Monetary Authority of Singapore.

This commentary has not been approved under section 21 of the Financial Services and Markets Act 2000 (FSMA) by an person authorised. It is directed only at investment professionals as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (the FPO). Investments are available only to to such persons, and any related agreement will be made solely with them. Persons who are not investment professionals should not rely or act upon this commentary. Recipients must observe all applicable restrictions and must not publish, distribute or share this commentary in whole or in part.