Investment Letters

Onze beleggingsexperts delen de diepte-analyses die zij hebben gedaan voor de Comgest-strategieën

GLOBAL EQUITIES: CULTIVATING A BALANCED GARDEN OF GROWTH

The AI boom has concentrated global equity markets in a few US tech giants, but as long-term investors Comgest focuses on building resilient, diversified portfolios through an unconstrained approach that targets quality growth across sectors and geographies.

QUALITY GROWTH: OUR COMPASS THROUGH UNCERTAINTY

As the US equity market continues to evolve, Comgest remains focused on companies with enduring quality and discipline—like Oracle and Netflix—that support long-term growth. In this investment letter, our US Equities investment team explains how our collaborative, bottom-up approach targets resilient businesses with competitive advantages that compound value over time.

Artificial Intelligence: with great power comes great responsibility

Digitalisation, cloud computing, and AI are driving global data centre expansion. Big tech companies need more computing power for their AI services, increasing data centre infrastructure and environmental impact. In this investment letter, Comgest ESG Analyst Liudmila Strakondonskaya emphasises the need for effective governance and decision-making to balance AI growth with ESG considerations.

Equities: Why Valuation Alone Won’t Drive Long-Term Success

Is a stock at 12x earnings really a bargain? Not necessarily. In this thought-provoking piece, Comgest CIO and Portfolio Manager Franz Weis challenges the conventional wisdom around valuation metrics. He explains why long-term success comes from quality growth and earnings visibility — not chasing cheap-looking stocks. Discover how avoiding the “value trap” is central to Comgest’s Quality Growth investment philosophy.

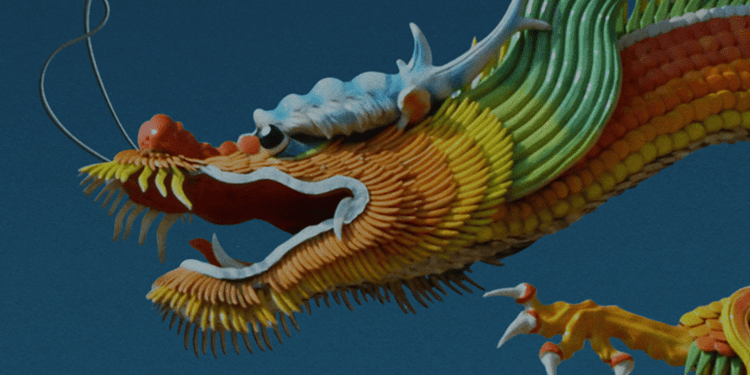

GLOBAL EQUITIES: AI’s gold rush: Unearthing the nuggets of Quality Growth

Over the past two years, the AI "Gold Rush" has led to the MSCI World Index becoming concentrated in just a handful of AI-related stocks. In this investment letter, Comgest’s Global Equity team explains why we typically focus on AI infrastructure companies with high barriers to entry and strong pricing power, while avoiding early-stage AI models and software due to intense competition and potential commoditisation.

Hermès: Behind the Seams

Investors often focus on tangible assets like inventory and machinery, but human capital—employee knowledge, skills, and experience—is oftentimes undervalued. French leather goods company Hermès exemplifies how human capital is the quiet force behind long-term success.