IS IT POSSIBLE TO BEAT THE WORLD’S STRONGEST STOCK MARKET?

Our Comgest Growth America Fund is one of the few actively managed funds that have succeeded in outpacing the S&P 500 index. This concentrated Fund is comprised of carefully selected, Quality Growth companies that are predominantly headquartered or operating in the world's largest economy.

In the US market, success is contingent upon understanding that not all growth is created equal. Consequently, our portfolio management team focuses on seeking a range of small-, mid- and large-cap companies in a variety of sectors that are driving and benefiting from growth in the US economy. Given the fast-changing US market, our European perspective enables us to filter out the short-term hype and maintain a clear vision for our long-term investment strategy.

We cultivate long-term sustainable growth by seeking:

-

All-weather performers: companies that provide critical services, such as healthcare and software

-

Efficiency: “productivity enhancers”, i.e., companies offering better products at lower cost using fewer resources

-

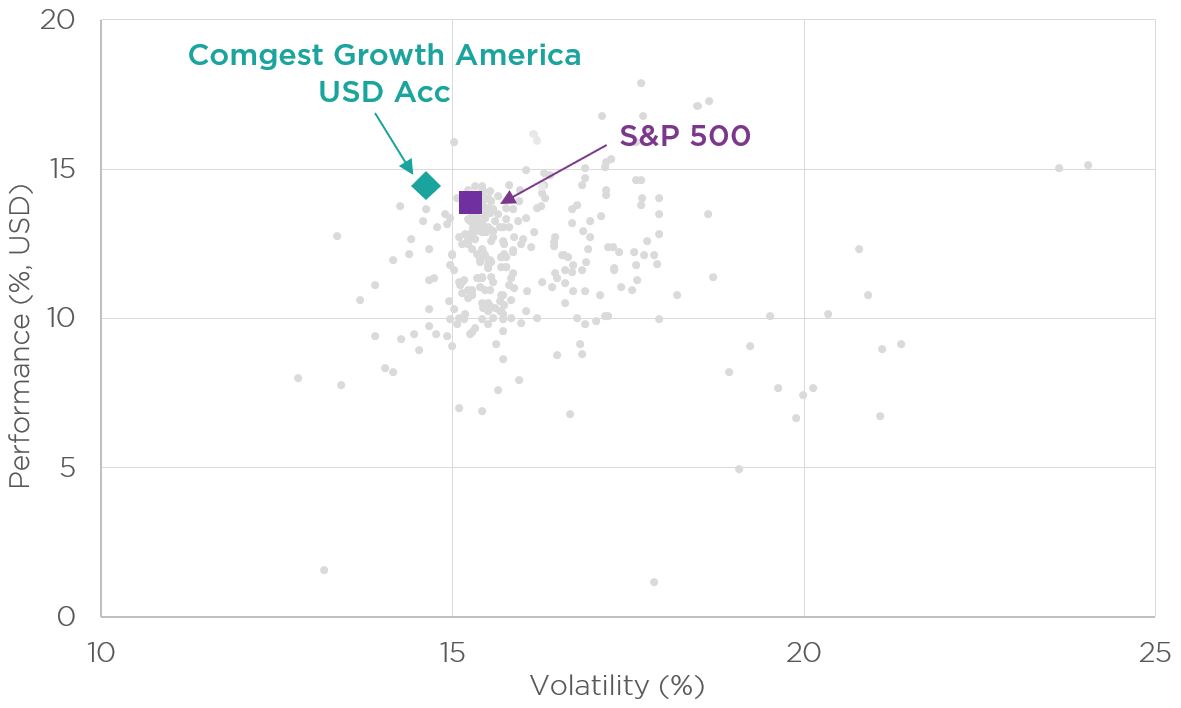

Resiliency: companies with 10% annualised total return, high visibility of growth and low volatility. As per the below chart, Morningstar ranks our fund’s risk-adjusted profile within the top 4% of our peer group

TOP 4% RISK-ADJUSTED RETURN PROFILE(1)

Past performance does not predict future returns. Source: Morningstar, Comgest; as of 30-Sept-2025. 1Morningstar categories: EAA FUND US large-cap growth (which is the Comgest Growth America Fund’s Morningstar category), EAA FUND US large-cap value and EAA FUND US large-cap blend; as measured by the Sharpe ratio, which is the ranking of the metric annual return divided by annual volatility.

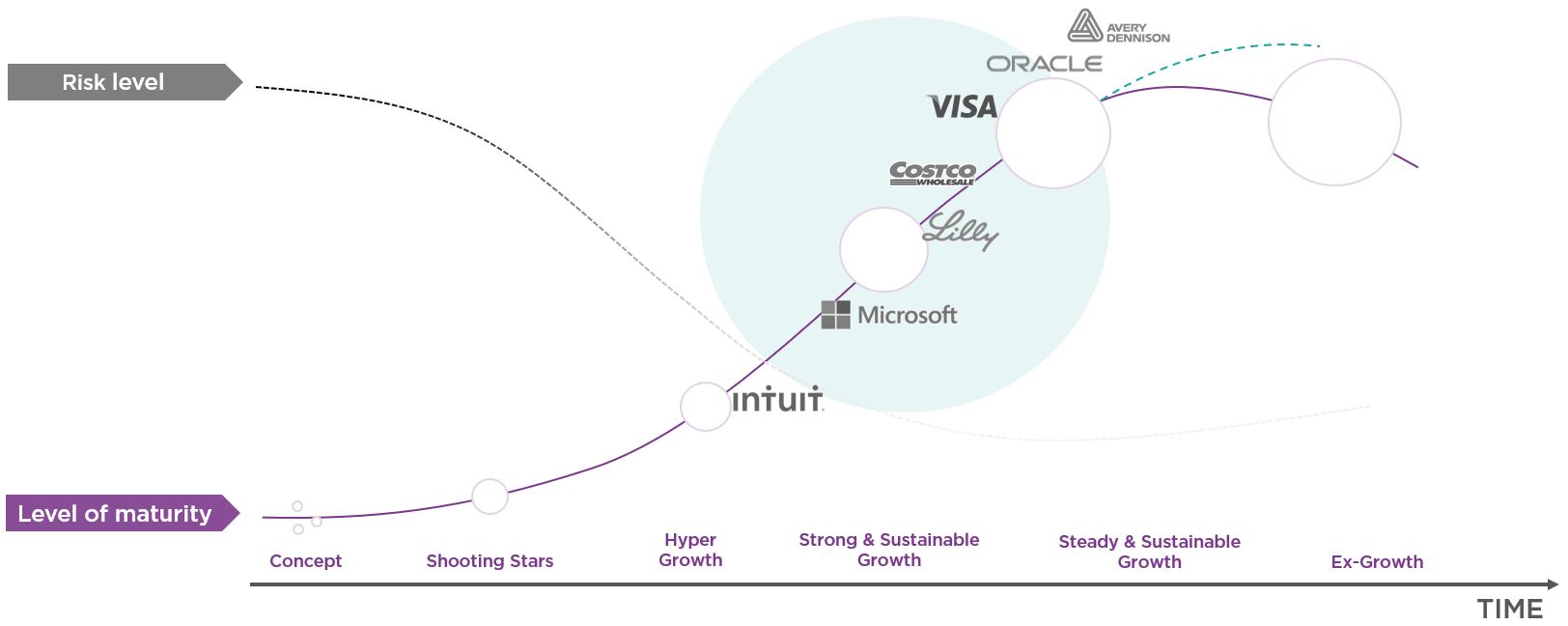

PATIENCE IS KEY TO CREATING VALUE

As long-term investors, we seek out companies that we believe have predictable and sustainable earnings growth. The Comgest Growth America fund is a high conviction portfolio that aims to generate above-average growth for an extended period of time.

The size of the bubbles corresponds to the size of the companies. For illustrative purposes only. The securities discussed above are provided for information only, are subject to change and are not a recommendation to buy or sell the securities. The securities discussed herein may not be held in the portfolio at the time you view this webpage.

Our investment team builds positions in what we believe are outstanding quality growth companies with long track records. We focus on:

MAIN RISKS

This fund has the following core inherent risks (non-exhaustive list):

- Investing involves risk including possible loss of principal

- The value of all investments and the income derived therefrom can decrease as well as increase

- There is no assurance that the investment objective will be achieved

THE COMGEST EDGE

Our success comes from our unwavering commitment to quality. For over 35 years, our investment philosophy has remained the same – regardless of external factors such as geopolitics, election outcomes, monetary policy or inflation rates. We believe in our proven strategy of investing in long-term, Quality Growth companies. In our experience, this approach has consistently reduced volatility and fuelled the growth of our Comgest Growth America Fund.

From our headquarters in Paris, we analyse US equities through a European lens. For many American companies, their local market is not their main segment of business growth. Global markets, especially Europe, can often offer faster growing opportunities for US companies. Given its mature markets and a large consumer demographic, Europe is a natural first choice for companies with global ambitions.

Comgest’s investment team enjoys the advantage of being centrally headquartered in Paris, straddling time zones and the continental divide of the US and other global markets. We can collaborate in real time with global colleagues spanning the US, Europe and Asia. By operating outside the US, our team can filter out short-term market noise and maintain a steadfast focus on our long-term investment strategy on-the-ground in the US, Europe and Asia.

COMGEST US EQUITIES INVESTMENT TEAM

With an average industry experience of 13 years*, we take a team approach to investing.

Our Experts:

-

Louis Citroën

Analyst / PM

-

Christophe Nagy

Analyst / PM

-

Justin Streeter

Analyst / PM

-

Rémi Adam

Analyst / PM

-

Christian de Roualle

Analyst / PM

-

Francesco Manfredini

Analyst / PM

-

Daihao Peng

Analyst

ESG

-

Liudmila Strakodonskaya

ESG Analyst

*As of 1-Oct-2025.

Interview

19-mei-2025

Quality Insights: 6 questions with Louis Citroën, Analyst/PM, US Equities

In this video, Portfolio Manager Louis Citroën explores the intricacies of the US economy and highlights its attractiveness for investors. He illustrates how our portfolio aims to achieve long-term growth by focusing on quality growth companies that tend to thrive regardless of market cycles, trends or geopolitical developments.

Louis Citroën kwam in 2019 in dienst bij Comgest, hij is analist en portefeuillebeheerder gespecialiseerd in Amerikaanse aandelen.

Louis is medebeheerder van de Amerikaanse aandelenstrategie en draagt sterk bij aan het genereren van ideeën door research te doen naar Amerikaanse bedrijven binnen een breed scala aan sectoren. Voordat Louis bij Comgest kwam, werkte hij gedurende vijf jaar bij Arete Research in Londen als aandelenanalist binnen de telecom- en mediasector. Daarvoor, vanaf 2011, werkte hij als Small Cap Equity Analyst bij Financière de l'Echiquier. Hij begon zijn carrière in 2009 als managementconsultant bij Oliver Wyman in Parijs.

Louis heeft een Master in Management van ESCP Europe Business School (Frankrijk, VK, Duitsland) en is CFA® certificaathouder.

Discover our Comgest Growth America fund

Comgest Growth America

Find out detailed information on our fund

Why Run When You Can Walk?

From top-tier research facilities to a business-friendly culture, the US possesses a compelling blend of qualities that make its companies appealing to investors

Contact Details

Louise Hofland

Marketing & Communications

Tel: +31 (0) 6 414 90236

E-mail: lhofland@comgest.com

Lodewijk van der Kroft

Investor Relations Manager

Tel: +31 6 51 58 75 59

E-mail: lvanderkroft@comgest.com

Arno Norro

Investor Relations Manager

Tel: +32 493 29 67 95

E-mail: anorro@comgest.com